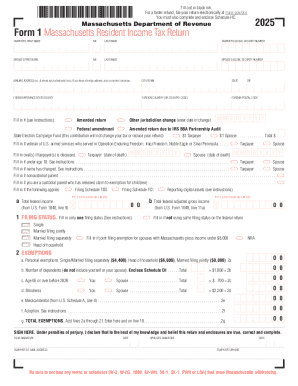

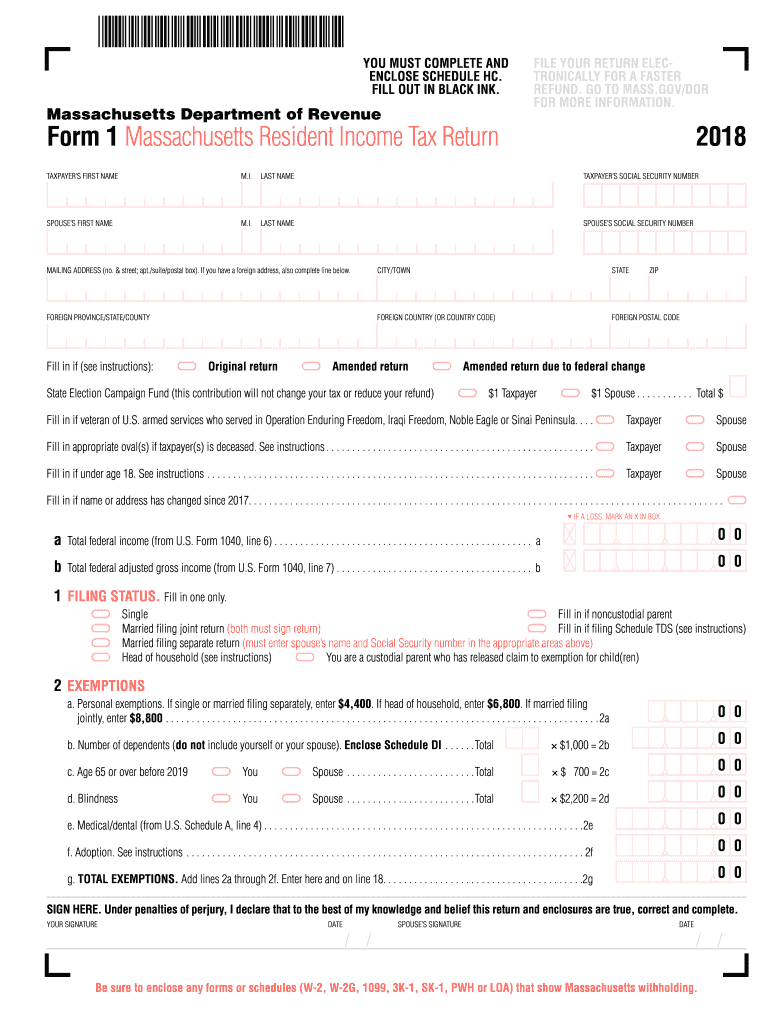

MA Form 1 2018 free printable template

FAQ about MA Form 1

What should I do if I realize I made a mistake after submitting the MA Form 1?

If you discover an error after filing your MA Form 1, you should submit an amended return as soon as possible. Clearly indicate that it is an amended form, and provide the correct information required. Correcting mistakes promptly can help avoid potential penalties or issues with your filing.

How can I verify if my MA Form 1 has been received and processed?

To verify the status of your MA Form 1, you can check online using the state’s tax portal or contact their customer service. Keep an eye out for any notifications regarding processing or rejection that may arise during the e-filing process, as these will help you address any issues quickly.

What common errors should I avoid when filing the MA Form 1?

When completing your MA Form 1, be sure to double-check your numerical entries, ensure all required fields are filled, and verify that your personal information is correct. Common mistakes often arise with incorrect calculations or overlooking signature requirements, which may lead to processing delays.

Are there specific requirements for e-signing the MA Form 1?

Yes, the MA Form 1 allows for electronic signatures, provided they meet the state's technical and legal standards. Ensure that any e-signature used complies with the relevant security measures to maintain the integrity of your submission.

What steps should I take if I receive a notice regarding my filed MA Form 1?

Upon receiving a notice related to your MA Form 1, carefully read the document to understand the issue presented. Gather any requested documentation, and respond to the tax authority promptly to clarify or contest the notice, ensuring that you address any concerns raised.

See what our users say