Get the free public bank application form pdf

Show details

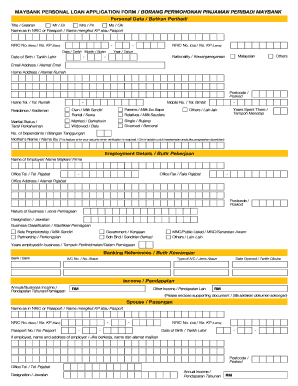

Application Form / Boring Permohonan

I WISH TO APPLY FOR / SAYS ING IN MEMO HON UNT UK:PLEASE COMPLETE APPLICATION FORM IN FULL. Type or print in BLOCK LETTERS throughout. I WISH TO APPLY (Tick where

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your public bank application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your public bank application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit public bank application form pdf online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit borang pinjaman perniagaan public bank form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

How to fill out public bank application form

How to fill out public bank application form:

01

Start by gathering all the necessary documents. This may include identification proof, address proof, income proof, and any other required documents specified by the bank.

02

Carefully read all the instructions given on the application form. Make sure you understand the requirements and any specific details needed.

03

Begin filling out the personal information section of the application form. This usually includes your full name, date of birth, gender, contact information, and occupation.

04

Provide accurate details regarding your address, including the full address with postal code and any additional information if required.

05

Fill in the financial information section, which may include your income details, employment status, and any existing bank accounts you hold.

06

If there are any joint account holders, provide their information as well. Ensure that all joint account holders sign the form where necessary.

07

Carefully review all the information you have entered in the form before submitting it. Make any necessary corrections or additions.

08

Sign the application form where required, attesting that all the information provided is true and accurate.

09

Attach any necessary documents and submit the completed application form to the designated branch or online portal of the public bank.

Who needs public bank application form:

01

Individuals who want to open a new bank account with the public bank will need to fill out the application form. This includes personal bank accounts, joint accounts, and business accounts.

02

Existing customers who want to apply for additional services or products offered by the public bank, such as credit cards, loans, or insurance, may also be required to fill out an application form specific to that service.

03

Individuals who want to update or modify their existing account details, such as change of address, change of contact information, or change of account type, may need to fill out an application form to facilitate these changes.

Fill public bank loan application form pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is public bank application form?

A public bank application form refers to the form that individuals or businesses need to fill out in order to apply for various banking services or products offered by a public bank. These forms typically include personal and financial information such as name, contact details, identification documents, employment details, income information, and the specific service or product being applied for. The application form may differ based on the type of service or product, such as account opening, loan application, credit card application, or investment account application.

Who is required to file public bank application form?

Anyone who wants to open a new account with a public bank is required to file an application form.

How to fill out public bank application form?

Filling out a public bank application form typically follows a standard process. Here are step-by-step instructions on how to complete it:

1. Read the instructions: Start by carefully reviewing the instructions provided with the application form. This will give you a clear understanding of what information is required and any specific guidelines to follow.

2. Personal information: Begin by providing your personal details such as your full name, address, phone number, and email address. Include any other requested information, such as your date of birth or social security number.

3. Employment and financial details: Provide details about your employment status, including your current occupation, employer's name, address, and contact information. You may also be required to enter your income details. If you have existing bank accounts, mention them as well.

4. Account type and services: Indicate the type of account you wish to open, such as savings, checking, or others. If there are specific services you require, such as internet banking, debit card, or ATM access, make sure to check the respective options.

5. Beneficiary details: If you wish to designate beneficiaries for the account, provide their names, addresses, and contact information. Also, specify the percentage or share of the account balance that each beneficiary should receive.

6. Signature and date: Sign and date the application form, confirming that the provided information is accurate and complete.

7. Supporting documents: Some application forms may require you to attach supporting documents such as photocopies of your identification documents (driver's license, passport, etc.), proof of address (utility bills, rental agreement), and proof of income (pay stubs, tax returns).

8. Review before submission: Before submitting the form, carefully go through each section to ensure all the necessary information has been provided and all required fields are completed.

9. Submitting the form: Follow the instructions to submit the form as directed by the bank. This may involve mailing the form to a specified address or submitting it in person at a bank branch.

Remember, different banks may have variations in their application forms. Make sure to read and follow the instructions specific to the bank you are applying to.

What is the purpose of public bank application form?

The purpose of a public bank application form is to collect essential information and documentation from individuals or entities seeking to establish a banking relationship with the public bank. The application form is designed to gather details such as personal or business information, identification documents, financial history, purpose of the account, and other relevant information needed to assess the applicant's eligibility for banking services. It serves as a formal request for opening a bank account and allows the bank to evaluate the applicant's suitability to comply with legal and regulatory requirements, assess risk factors, and determine the type of account and services that can be offered to the applicant. Ultimately, the application form helps facilitate the process of establishing a banking relationship between the applicant and the public bank.

What information must be reported on public bank application form?

The specific information required on a public bank application form may vary depending on the country and the specific bank, but typically, the following information is commonly requested:

1. Personal Information: Full name, date of birth, gender, nationality, and marital status.

2. Contact Information: Residential address, phone number, and email address.

3. Employment Details: Occupation, employer's name and address, length of employment, and annual income. If self-employed, information on the nature of the business may be required.

4. Financial Information: Details of existing bank accounts, loans, and credit cards held with other banks. Information on income sources, such as salary, investments, and rental income, may also be requested.

5. Identification Documents: Passport or national identification card number, issue and expiry date, and place of issuance. Documents may need to be provided as proof of identification.

6. Residential History: Details of previous addresses, including duration and rental/mortgage payment history.

7. References: Names and contact information of personal or professional references who can vouch for the applicant's character and creditworthiness.

8. Purpose of Account Opening: The purpose for which the account is being opened, such as personal savings, business transactions, investment, etc.

9. Consent and Declaration: A statement agreeing to comply with the bank's terms and conditions, verifying the accuracy of the provided information, and granting consent for the bank to verify the details provided.

It's important to note that this list may not be exhaustive and some additional information may be required based on the bank's specific policies and regulatory requirements.

What is the penalty for the late filing of public bank application form?

The penalty for the late filing of a public bank application form can vary depending on the specific bank and their policies. However, in most cases, a late filing may result in a delay in processing your application or even rejection. It is important to adhere to the specified deadlines provided by the bank to avoid any potential penalties or negative consequences.

How do I complete public bank application form pdf online?

Filling out and eSigning borang pinjaman perniagaan public bank form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit borang pinjaman public bank on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute borang permohonan public bank from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out public bank application form pdf on an Android device?

Complete your borang permohonan pembiayaan public bank form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your public bank application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Borang Pinjaman Public Bank is not the form you're looking for?Search for another form here.

Keywords relevant to borang pinjaman public bank form

Related to borang pembiayaan public bank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.