Get the free Form 990-PF Return of Private Foundation - Foundation Center

Show details

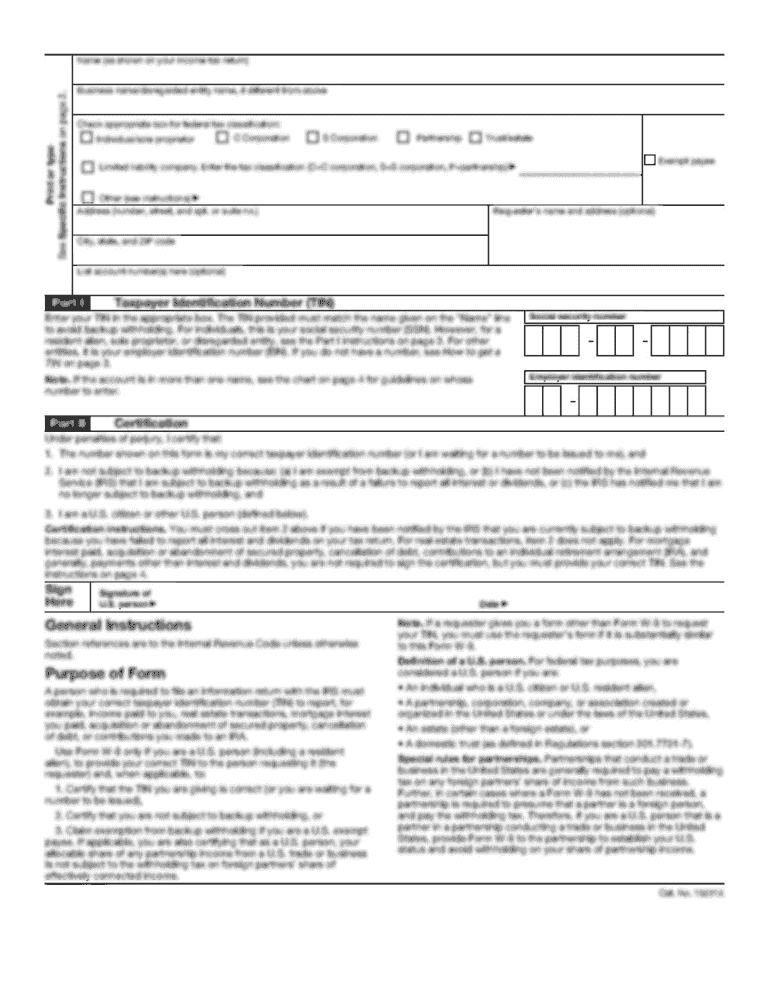

R 41 Return of Private Foundation 990-PF Form or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation Department. oftheTreasury Internal Revenue Service (77) OMB No 1545-0052,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 990-pf return of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990-pf return of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 990-pf return of online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 990-pf return of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out form 990-pf return of

How to fill out form 990-pf return of:

01

Gather all necessary information: before filling out form 990-pf return of, collect all required documents such as financial records, receipts, and other relevant documentation.

02

Fill out the identifying information: provide the name, address, and employer identification number (EIN) of the private foundation. Include the tax year for which the return is being filed.

03

Complete Part I: in this section, provide details about the foundation's activities, mission, and any changes that have occurred during the tax year.

04

Fill out Part II: report the foundation's assets, including cash, investments, and property. Provide detailed information about each asset category.

05

Complete Part III: report the foundation's income, including contributions, grants, and investment income. Provide detailed information about each source of income.

06

Fill out Part IV: report the foundation's various expenses, such as grants and charitable distributions, administrative expenses, and program service expenses. Provide detailed information about each expense category.

07

Complete Part V: report any liabilities or indebtedness of the foundation.

08

Fill out Part VI: report information about disqualified persons, such as substantial contributors and foundation managers.

09

Complete Part VII: report information about the foundation's investments, including details about any excess business holdings or jeopardizing investments.

10

Fill out the Schedule A: report information about the foundation's public charity status, including tests to determine whether the foundation is a public charity.

11

Complete the Schedule B: report information about contributors to the foundation, including their identifying details and contributions amounts.

12

Fill out any other necessary schedules and attachments: depending on the foundation's activities and financial situation, additional schedules and attachments may be required.

13

Sign and date the form: ensure that the form 990-pf return of is signed by an authorized officer of the foundation and dated.

14

Keep a copy of the completed form: make sure to retain a copy of the filled-out form 990-pf return of for your records.

Who needs form 990-pf return of:

01

Private Foundations: form 990-pf return of is specifically for private foundations. Private foundations are typically organized as non-profit organizations and have a charitable purpose.

02

Organizations with significant assets: form 990-pf return of is required for organizations with significant assets, as it provides information about the foundation's financial activities and ensures compliance with tax regulations.

03

Organizations with income from investments: foundations that generate income from investments, such as stocks, bonds, or real estate, are required to file form 990-pf return of to report their investment activities.

04

Organizations receiving contributions and making grants: foundations that receive contributions from donors and make grants or charitable distributions are required to file form 990-pf return of to report these activities and maintain transparency.

05

Organizations seeking tax-exempt status: foundations that are seeking tax-exempt status should file form 990-pf return of as part of the application process to demonstrate their compliance with tax regulations and provide financial information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 990-pf return of?

Form 990-PF is the return of private foundation or section 4947(a)(1) nonexempt charitable trust treated as a private foundation.

Who is required to file form 990-pf return of?

Private foundations and section 4947(a)(1) nonexempt charitable trusts must file Form 990-PF.

How to fill out form 990-pf return of?

Form 990-PF must be filled out accurately with all required financial information regarding the foundation’s activities.

What is the purpose of form 990-pf return of?

The purpose of Form 990-PF is to provide the IRS and the public with information about the private foundation's finances and activities.

What information must be reported on form 990-pf return of?

Form 990-PF requires information on the foundation's income, expenses, grants, investments, and other financial activities.

When is the deadline to file form 990-pf return of in 2023?

The deadline to file Form 990-PF for tax year 2023 is May 15, 2024.

What is the penalty for the late filing of form 990-pf return of?

The penalty for late filing of Form 990-PF is $20 per day, up to a maximum of $10,000 or 5% of the foundation's gross receipts, whichever is less.

How can I manage my form 990-pf return of directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 990-pf return of and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit form 990-pf return of from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form 990-pf return of, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find form 990-pf return of?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific form 990-pf return of and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Fill out your form 990-pf return of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.