Get the free K-608 - Maryland State Archives

Show details

Maryland Inventory of Historic Properties (MIP) Property Detail Report K-608 Todd's Furniture Store, Building 4 (Rear Building) Inventory Number: K-608 Property Name: Todd's Furniture Store, Building

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your k-608 - maryland state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your k-608 - maryland state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing k-608 - maryland state online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit k-608 - maryland state. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

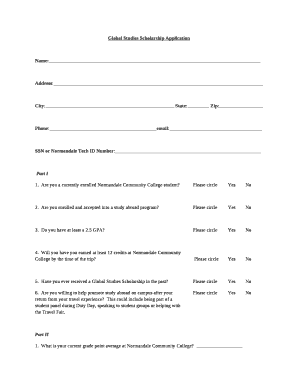

How to fill out k-608 - maryland state

How to fill out k-608 - Maryland state:

01

Start by obtaining the k-608 form from the Maryland State Department of Assessments and Taxation (SDAT) website or office. It is used for filing an annual personal property return for businesses.

02

Enter the basic information about your business at the top of the form, including the legal name, trade name, address, phone number, and federal employer identification number (EIN). Make sure to provide accurate and up-to-date information.

03

Report the cost of your personal property, including machinery, equipment, furniture, vehicles, and other assets used for business purposes. Include the original cost of each item and the total value of all personal property.

04

Specify any personal property exemptions that apply to your business. Maryland offers certain exemptions based on the type of property or business, such as goods in transit or machinery used for manufacturing.

05

Provide details about the personal property located in Maryland, including the description, quantity, cost, and year of acquisition for each item. You may also need to include supporting documentation or attachments if required.

06

Calculate the total assessed value of your personal property and indicate the corresponding personal property tax rate for your jurisdiction. The SDAT's website provides information on the specific tax rates for different areas within Maryland.

07

Sign and date the form to certify the accuracy of the information provided. If you have any questions or need assistance, contact the SDAT for guidance or consult a tax professional.

08

Submit the completed k-608 form to the Maryland SDAT by the specified deadline, along with any required payments. Failure to file or pay on time may result in penalties or interest charges.

Who needs k-608 - Maryland state:

01

Business owners operating in the state of Maryland who own tangible personal property used for business purposes.

02

Individuals or entities with a valid federal employer identification number (EIN) and a business operating in Maryland are required to file the k-608 form.

03

It is important for businesses of all sizes, from sole proprietors to corporations, to fulfill their personal property tax obligations and file a k-608 form annually with the Maryland SDAT.

Remember, it is always advisable to consult with a tax professional or the SDAT for specific instructions and guidance tailored to your business's unique circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is k-608 - maryland state?

K-608 form is a state tax form used in Maryland to report income from rental properties and other real estate.

Who is required to file k-608 - maryland state?

Individuals or businesses who earn income from rental properties or other real estate in Maryland are required to file K-608 form.

How to fill out k-608 - maryland state?

K-608 form can be filled out online or by mail. It requires information about rental income, expenses, and other related details.

What is the purpose of k-608 - maryland state?

The purpose of K-608 form is to report income from rental properties and other real estate to the state of Maryland for tax purposes.

What information must be reported on k-608 - maryland state?

Information such as rental income, expenses, depreciation, and other related details must be reported on K-608 form.

When is the deadline to file k-608 - maryland state in 2023?

The deadline to file K-608 form in 2023 is April 15th.

What is the penalty for the late filing of k-608 - maryland state?

The penalty for late filing of K-608 form in Maryland is $50 per month, up to a maximum of $500.

How do I edit k-608 - maryland state online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your k-608 - maryland state to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in k-608 - maryland state without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing k-608 - maryland state and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out k-608 - maryland state using my mobile device?

Use the pdfFiller mobile app to fill out and sign k-608 - maryland state on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your k-608 - maryland state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.