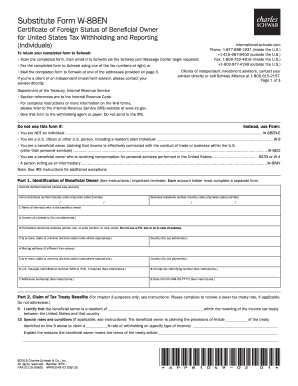

Get the free charles schwab w 8ben form

Get, Create, Make and Sign

How to edit charles schwab w 8ben online

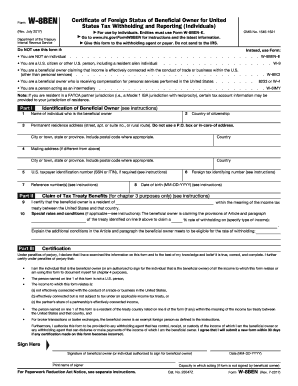

How to fill out charles schwab w 8ben

How to fill out Charles Schwab W-8BEN:

Who needs Charles Schwab W-8BEN:

Video instructions and help with filling out and completing charles schwab w 8ben

Instructions and Help about schwab w 8ben form online

As a battle of the brokers heats up Charles Schwab firing the latest salvo in the fight to attract and retain clients last week by announcing a move to fractional investing in Dave what does this mean for the ETF industry and will we see other rivals follow suit well, so I think yes to the last question first I think this is setting the new standard for brokerages in the space okay it's Commission free and fractional shares what does that do for ETF investors well obviously gives you a lot more flexibility right if there's an ETF out there with a hundred and fifty dollar price, and you only want a half a share well you'll now be able to do that it certainly makes managing a more balanced portfolio easier at smaller asset levels, but I think the interesting question is what does it change about the dynamics of the whole industry ETFs traditionally haven't had any presence in 401 k's because of the fractional share problem because you can't dollar-cost average your 200 out of your paycheck across ten ETFs it doesn't work now it could work, so I think it could open up that market the flip side is this is a big opening for so-called direct indexing folks that want to put together portfolios not of ethic's but of individual stocks that look like index investments that's where I'd expect quad to go next John do you carry a similar view I would push back a little in a sense that you know, so the mutual fund industry has been handling fractional shares for a while, so it's good that the ETF exosphere is now kind of catching up to that I do think that there's something about like younger millennial that want to buy a half a share at Google on Facebook right now if you have 100 you can basically buy one share of 87 of the Russell 3000 index, so you can get most you know the Russell 3000 index with you know what I happened to deal with fractional shares but look it's a net positive I would say overall, but I don't think it's going to purge more kind of younger millennial investors that long invest and buy half the share of Facebook yeah I don't I don't think that's what it's really about I don't I mean that's going to get a lot of headline risk into our headlines and certainly if you look at some competitors here like Robin Hood and acorns that's the market that they're they're focused on, so I can see why people are thinking about that, but I actually think the longer-term play here is for folks like Schwab and competitors to start running these massive portfolios of hundreds of stocks on a fractional share basis as part of their Robot advisor platform right it disinter mediate s-- the entire packaged product business, so I think this is early days I think it's very exciting, and I think it's very bullish for investors in general what about John's initial point about Millennials the younger generation investing differently perhaps active versus passive yes certainly that's true and if you look at you know Robin Hood you can go to Robin track and see what...

Fill charles schwab w8ben : Try Risk Free

People Also Ask about charles schwab w 8ben

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your charles schwab w 8ben online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.