Get the free gateshead council tax support form

Show details

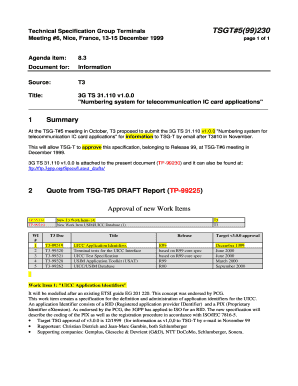

Council Tax Civic Center Regent Street Gates head NE8 1HH E-mail: council tax gates head.gov.UK www.gateshead.gov.uk/counciltax Tel: 0191 4333600 Report Benefit Fraud: 0191 4334646 Council Tax Disabled

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gateshead council tax support form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gateshead council tax support form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gateshead council tax support online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gateshead council tax refund form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out gateshead council tax support

How to fill out gateshead council tax support:

01

Gather all necessary documents such as proof of income, proof of residency, and any other required documents stated in the application form.

02

Read the instructions on the application form carefully, ensuring you understand all the requirements and eligibility criteria.

03

Fill out the application form accurately, providing all the requested information.

04

Double-check that all sections of the application form are complete and any required information or supporting documents are attached.

05

Submit the completed application form and supporting documents either by mail, in person, or online, following the instructions provided by gateshead council.

Who needs gateshead council tax support:

01

Individuals or households who are struggling to pay their council tax bill in Gateshead.

02

People with low income or on certain benefits who meet the eligibility criteria for council tax support.

03

Anyone who meets the specific requirements set by the gateshead council to qualify for council tax support.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gateshead council tax support?

Gateshead Council Tax Support is a scheme provided by the Gateshead Council in England to help people on low incomes or certain welfare benefits pay their council tax bill. It is designed to provide financial assistance to eligible individuals or households who may struggle to afford their council tax payments. The amount of support provided is based on factors such as income, household size, and specific circumstances.

Who is required to file gateshead council tax support?

Residents of Gateshead who are liable to pay council tax and meet certain criteria may be eligible to apply for Gateshead Council Tax Support. The specific criteria may vary, but typically include factors such as income, savings, age, and number of people in the household. It is advisable to contact the Gateshead Council directly or visit their official website for detailed information on eligibility and the application process.

How to fill out gateshead council tax support?

To fill out Gateshead Council Tax Support, follow the steps below:

1. Ensure that you have the necessary information: You will need your personal details, income and expenditure details, and information about any benefits or credits you receive.

2. Visit the Gateshead Council website: Go to the Gateshead Council website (www.gateshead.gov.uk) and search for "Council Tax Support." Look for a link or page that allows you to apply for Council Tax Support or complete an online application.

3. Start the application: Click on the link to start the application process. You may need to create an online account or log in if you already have one.

4. Fill in your personal details: Provide your name, address, contact details, and any other information required.

5. Enter your income details: Provide details about your income from all sources, including employment, self-employment, pensions, benefits, or any other income you may have. You may need to provide recent payslips, bank statements, or benefit award letters as proof.

6. Provide details about your expenditure: Enter information about your monthly outgoings, including rent/mortgage payments, utility bills, insurance, childcare costs, and any other essential expenses.

7. Declare any savings or capital: If you have any savings or capital, you will need to declare them. The amount of support you receive may be affected by the level of your savings.

8. Submit supporting documents: If required, upload scanned copies or provide photocopies of the necessary documents, such as proof of income, savings, or benefits.

9. Review and submit your application: Take the time to review all the information you've entered for accuracy. Once you're satisfied, submit your application.

10. Await a decision: After submitting your application, the council will review your details and make a decision regarding your eligibility and support amount. This process may take some time, so be patient.

Note: If you have any difficulties or need assistance while filling out the application, you can contact the Gateshead Council Tax Support team for guidance.

What is the purpose of gateshead council tax support?

The purpose of Gateshead Council Tax Support is to provide financial assistance to individuals and households who are on a low income and are struggling to pay their council tax bill. This support helps to ensure that everyone has access to essential local services while reducing the financial burden on those who have difficulty in meeting their council tax obligations. The council tax support scheme is designed to act as a safety net for those who need it most, contributing towards their council tax liability and helping them to manage their overall financial situation.

What information must be reported on gateshead council tax support?

When applying for Gateshead Council Tax Support, the following information may need to be reported:

1. Personal details: This includes your full name, date of birth, National Insurance number, and contact details (address, phone number, and email).

2. Household details: Information about everyone living in the property, including their names, ages, and relationship to you. This includes any children, partners, or other dependents.

3. Income details: Details of all sources of income for you and your household, such as wages, benefits, pensions, pensions, self-employment income, and rental income. You may need to provide recent payslips, benefit letters, or bank statements as evidence.

4. Employment details: If you or anyone in your household is employed, you will need to provide details of your employer, job title, working hours, and salary.

5. Benefits and allowances: Information about any benefits you or your household receive, such as Universal Credit, Jobseeker's Allowance, Income Support, Personal Independence Payment, or Carer's Allowance. This includes details of the latest award letters or benefit statements.

6. Savings and investments: Details of any savings, capital, or investments you or your household have, including bank statements or evidence of investment funds.

7. Expenditure details: Information about your regular expenses, such as rent/mortgage payments, council tax payments, utility bills, childcare costs, and any other regular outgoings.

8. Housing details: Details of your current housing situation, including the property type, number of rooms, and any adaptations or special requirements.

9. Previous Council Tax Support: If you have received Council Tax Support in the past or from a different local authority, you might need to provide details of your previous claims.

It is important to note that these requirements may vary, and it is best to contact Gateshead Council or visit their website for the most accurate and up-to-date information when applying for Council Tax Support.

When is the deadline to file gateshead council tax support in 2023?

As an AI, I do not have access to specific dates in the future, including the deadline for filing Gateshead council tax support in 2023. It is recommended to check the official website of Gateshead Council or contact their customer service for up-to-date information on deadlines and procedures for filing council tax support.

How can I modify gateshead council tax support without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your gateshead council tax refund form into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in gateshead council tax refund form?

The editing procedure is simple with pdfFiller. Open your gateshead council tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit gateshead council tax straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit gateshead council tax reduction form.

Fill out your gateshead council tax support online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gateshead Council Tax Refund Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.