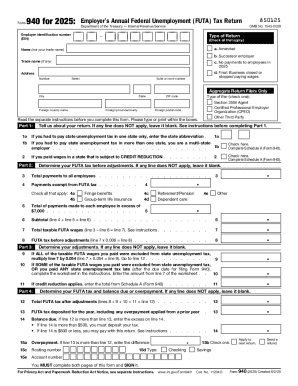

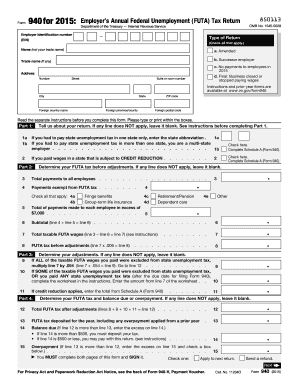

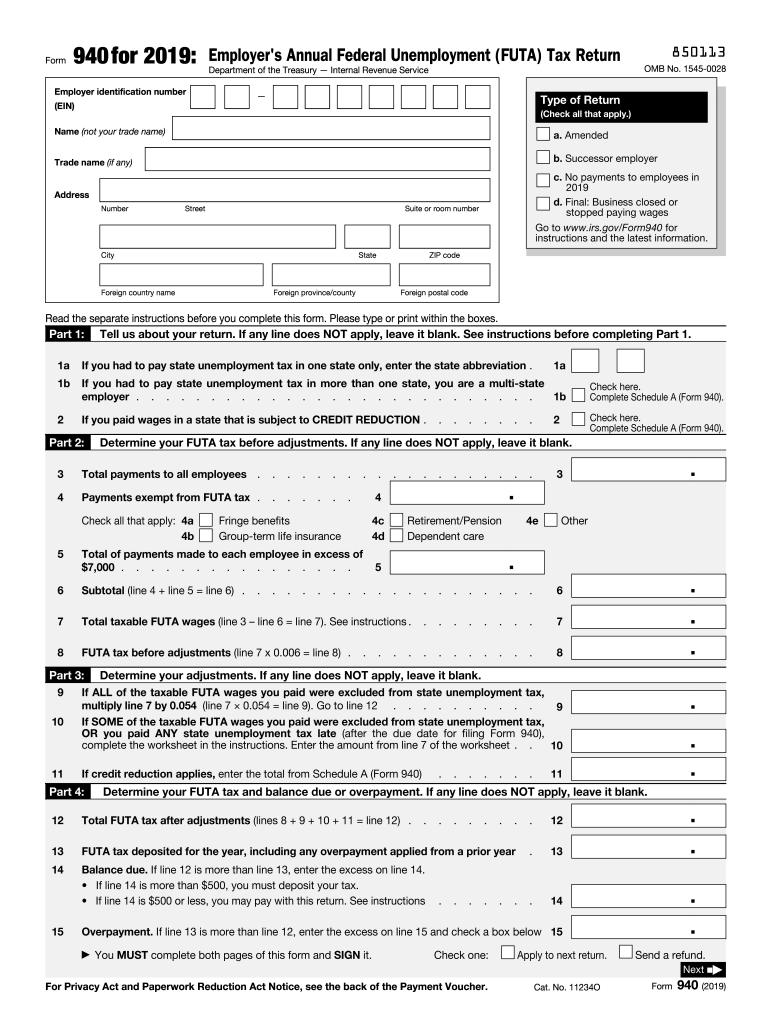

IRS 940 2019 free printable template

FAQ about IRS 940

What should I do if I realize there’s an error after filing my IRS 940?

If you discover a mistake after submitting your IRS 940, you will need to file an amended return using Form 940-X. This form allows you to make corrections to previous filings. Be sure to follow the specific instructions for corrections and maintain detailed records of any adjustments.

How can I verify if my IRS 940 has been processed?

To check the status of your filed IRS 940, you can utilize the IRS online tracking system if you filed electronically. For paper submissions, it may take longer, and you should wait at least 4-6 weeks before inquiring. Always have your details handy to provide information when checking the status.

What are common mistakes to avoid when filing IRS 940?

Common errors include incorrect taxpayer identification numbers, missing signatures, and discrepancies in wage and tax amounts. To avoid these pitfalls, double-check all entries and ensure that calculations are correct before submitting your IRS 940.

How does filing IRS 940 differ for nonresident employers?

Nonresident employers must comply with specific regulations when filing IRS 940, particularly concerning federal employment taxes. It's crucial to consult IRS guidelines or a tax professional, as there may be additional forms or considerations for foreign payees involved.

What should I do if I receive a notice related to my IRS 940?

If you receive a notice or letter from the IRS regarding your IRS 940, it is essential to read it carefully and understand the issue. Prepare the necessary documentation to respond appropriatelywithin the specified timeframe, and consider seeking assistance from a tax professional if needed.

See what our users say