Get the free Term Life Insurance - Protection For A Period of TimeNew ...

Show details

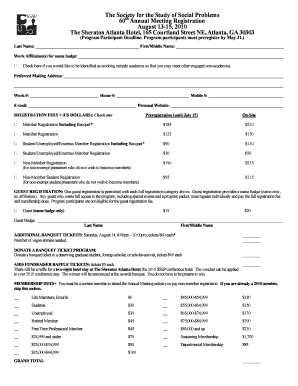

Individual & Family Life Insurance (Policy #32871G) Annual Option to Increase Life Insurance Coverage Form The Annual Increase Option (AIO) period (September 30 October 25, 2019) is your opportunity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your term life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term life insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit term life insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out term life insurance

How to fill out term life insurance

01

Start by gathering all necessary documents and information, including your personal identification, financial details, and health history.

02

Research and compare different term life insurance policies from various insurance providers to find the best coverage and rates that suit your needs.

03

Once you have chosen a suitable policy, complete the application form accurately and truthfully, providing all requested information.

04

Disclose any relevant medical conditions or lifestyle habits that may impact your eligibility or premium rates.

05

Review the policy terms and conditions, including coverage duration, death benefits, and any optional riders or add-ons.

06

Calculate the desired coverage amount based on your financial obligations and future expenses, such as mortgage payments, education costs, and other debts.

07

Consider seeking advice from a licensed insurance agent or financial advisor to ensure you make an informed decision.

08

Submit the completed application with any required supporting documents, such as medical records or financial statements.

09

Await underwriting process, which involves evaluation of your application, medical examination (if required), and assessment of risk factors.

10

Once approved, review the policy again to ensure accuracy and notify your beneficiaries of your decision to purchase term life insurance.

Who needs term life insurance?

01

Term life insurance is typically suitable for individuals who have dependents or financial responsibilities that they want to protect in the event of their death.

02

Breadwinners: Individuals who are the primary income earners for their families can benefit from term life insurance as it can provide a financial safety net for their loved ones.

03

Parents: Parents who want to ensure their children's educational expenses or any outstanding debts are covered in case of their untimely demise may consider term life insurance.

04

Homeowners: Homeowners with mortgages or other substantial debts can use term life insurance to protect their family from being burdened with those financial obligations.

05

Business Owners: Business owners who have business partners or outstanding business loans may find term life insurance helpful to ensure the survival of their business.

06

Individuals with financial dependents: If you have anyone who relies on your income, such as aging parents or siblings, term life insurance can provide financial support for them.

07

It's important to assess your specific financial situation and goals before deciding if term life insurance is necessary for you.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my term life insurance in Gmail?

term life insurance and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find term life insurance?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific term life insurance and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for the term life insurance in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your term life insurance in minutes.

Fill out your term life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.