Get the free North Carolina Sales Tax Report Squadron Worksheet - usps

Show details

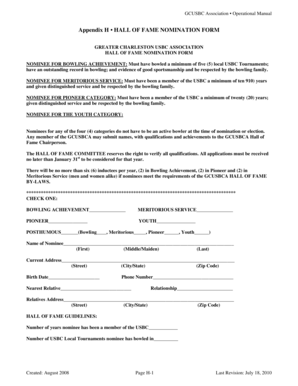

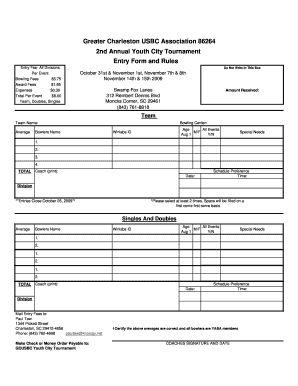

North Carolina Sales Tax Report Squadron Worksheet 6-Month Period beginning: Please read instructions before filling out form Squadron: Date County where purchased Page of Vendor Totals Porch Amt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your north carolina sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north carolina sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit north carolina sales tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit north carolina sales tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out north carolina sales tax

How to fill out North Carolina sales tax:

01

Gather necessary information: Before filling out the North Carolina sales tax form, gather all the required information such as your business name, employer identification number (EIN), and sales figures for the reporting period.

02

Determine the filing frequency: North Carolina sales tax returns can be filed monthly, quarterly, or annually. Determine your filing frequency based on your average monthly sales tax liability.

03

Access the relevant form: Visit the North Carolina Department of Revenue website and locate the appropriate sales tax form for your business type. The most commonly used form is the E-500, Sales and Use Tax Return.

04

Fill in your business information: Start by entering your business name, address, contact information, and your EIN on the top portion of the form. Double-check the accuracy of this information to avoid any processing errors.

05

Report your sales figures: In the designated sections of the form, report your total taxable sales, sales exempt from tax, and any other relevant sales information based on the specific instructions provided. Ensure to accurately calculate the sales tax owed for each category.

06

Calculate the amount due: Subtract any allowable deductions or exemptions from your total sales tax liability to determine the final amount of sales tax due. Do this for both state and local sales tax.

07

Make payment: Choose your preferred payment method to remit the sales tax amount due. North Carolina Department of Revenue accepts various payment methods, including electronic funds transfer, credit/debit card, or check.

08

Retain copies and file: Make copies of your completed sales tax return and any supporting documentation for your records. Submit the original form along with payment to the North Carolina Department of Revenue by the designated deadline based on your filing frequency.

Who needs North Carolina sales tax?

01

Businesses with physical presence: Any business that operates with a physical presence, such as a store, office, warehouse, or fulfillment center, within North Carolina is required to collect and remit sales tax, thus needing North Carolina sales tax.

02

Online sellers: Even if your business is not physically located in North Carolina, if you make sales to customers within the state, you may still be required to collect and remit North Carolina sales tax based on the economic nexus laws. These laws apply to online sellers who meet certain thresholds of sales or transactions into the state.

03

Out-of-state sellers: If you are an out-of-state seller who does not have a physical presence in North Carolina but meet the economic nexus requirements, you may be obligated to register for and collect North Carolina sales tax on sales made to customers within the state.

Note: It is important to consult with a tax professional or the North Carolina Department of Revenue to ensure compliance with the specific rules and regulations regarding North Carolina sales tax.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is north carolina sales tax?

North Carolina sales tax is currently set at 4.75%, with local rates also being applied.

Who is required to file north carolina sales tax?

Businesses selling tangible personal property and certain digital property in North Carolina are required to file North Carolina sales tax.

How to fill out north carolina sales tax?

North Carolina sales tax can be filled out online through the North Carolina Department of Revenue website or through paper forms.

What is the purpose of north carolina sales tax?

The purpose of North Carolina sales tax is to generate revenue for the state government to fund public services and projects.

What information must be reported on north carolina sales tax?

Information such as total sales, exempt sales, taxable sales, sales tax collected, and other relevant data must be reported on North Carolina sales tax forms.

When is the deadline to file north carolina sales tax in 2023?

The deadline to file North Carolina sales tax in 2023 is January 31, 2024.

What is the penalty for the late filing of north carolina sales tax?

The penalty for the late filing of North Carolina sales tax is 5% of the tax due per month up to a maximum of 25%.

How can I manage my north carolina sales tax directly from Gmail?

north carolina sales tax and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get north carolina sales tax?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific north carolina sales tax and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit north carolina sales tax in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your north carolina sales tax, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Fill out your north carolina sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.