Last updated on Feb 20, 2026

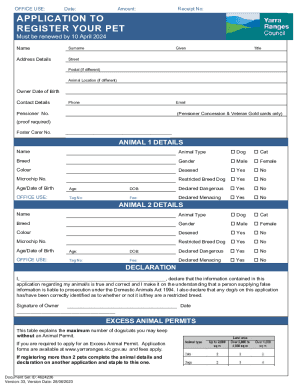

Get the free sample corporate tax return

Show details

Instruction This is a model letter. Adapt to fit your facts and circumstances. Date Name Company Address City State Zip Code Re Corporate Tax Return Dear Enclosed herewith please find the Year Corporation Franchise Tax Income Tax and Small Business Corporation Income Tax packet which was sent to me by the State Tax Commission as registered agent for the corporation. To insure the continued existence of the corporation you need to make sure that the appropriate forms are filed in a timely manner....If the appropriate forms are not filed the Secretary of State can administratively dissolve the corporation* Should you have any questions please do not hesitate to contact me.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample letter for corporate

A sample letter for corporate is a template used to draft formal correspondence within or from a corporation.

pdfFiller scores top ratings on review platforms

Finally got the job done with PDF Filler and wasting two nights trying other free PDF editors that don't really work. :-)

I was nervous about fulfilling a clients project but the PDFfiller helped me with getting the project done. Thank you!!!

I really like how easy this is! I don't have to print, sign, scan, and email anything! Woo-hoo! It would be nice to rotate pages.

HAVE ENJOYED THIS--WISH I HAD FOUND IT ALOT SOONER.

Just getting started and it's working very well for me.

needed to complete a 2011 W-3 for an old company. Easy to use and fill out

Who needs sample corporate tax return?

Explore how professionals across industries use pdfFiller.

Sample letter for corporate form

Filling out a sample letter for corporate forms is essential for ensuring compliance and professionalism in business communication. A well-crafted letter can streamline the process of submitting necessary documents, adhering to regulations, and facilitating clear exchanges of information.

What are the corporate form requirements?

Every corporation must comply with certain regulatory requirements when submitting corporate forms. This includes providing necessary documentation to ensure legal standing and operational compliance.

-

Different types of corporate forms vary by jurisdiction, but common examples include tax returns, annual reports, and business registration documents.

-

Submitting forms on time is crucial to avoid penalties, such as fines or legal complications that could detrimentally affect the business.

-

Stay informed about your jurisdiction's specific requirements, as they can vary widely. It’s essential to research state-specific guidelines.

How should a corporate letter be structured?

The structure of a corporate letter sets the tone for effective communication. Adhering to standard formats increases professionalism and reduces misunderstandings.

-

Always begin with a properly formatted date placed at the top for context and record-keeping.

-

Using the correct title and full name of the recipient is vital for respect and clarity.

-

Start with a clear and concise introduction that states the purpose of the letter, guiding the reader's understanding from the outset.

What are the components of a corporate letter?

Each section of a corporate letter serves a specific purpose, contributing to the clarity and professionalism of the communication.

-

This section relays essential information, such as tax details or corporate announcements, in a clear manner.

-

Sign off the letter with a professional closing remark, thanking the recipient or indicating next steps.

-

When including additional documents, clearly list them at the end of the letter to inform the recipient of what to expect.

What examples and templates are available for corporate letters?

Utilizing templates for corporate letters can save time and ensure consistent messaging across documents.

-

This template helps outline the specific details needed for tax submissions, making compliance straightforward.

-

Different examples can be tailored for specific situations, such as letters for established corporations versus startups.

-

Leverage pdfFiller's features to create and modify letter templates to meet your specific needs and branding.

What are best practices for crafting business communication?

Effective business communication hinges on clarity and professionalism. Adhering to best practices can greatly enhance the impression your correspondence leaves.

-

Maintain formality in your language to reflect the seriousness of business processes.

-

Avoid jargon and long-winded sentences that could confuse readers; keep it straightforward.

-

Take the time to proofread your documents to ensure they are free of errors that could undermine credibility.

How can pdfFiller enhance document management for corporate letters?

pdfFiller provides a comprehensive platform for document management, aiding in the efficient crafting and management of corporate letters.

-

Users can easily upload corporate letters and edit them directly within the platform, streamlining the process.

-

Share documents with team members for collaborative editing and feedback, which enhances the quality of the final output.

-

Incorporate eSignatures for quick approvals, which is crucial in fast-paced business environments.

What compliance considerations should be kept in mind?

Compliance with regional requirements is essential in maintaining a corporation's legitimacy and operational standing. Understanding these requirements is vital.

-

Familiarize yourself with your region's compliance needs for corporate filings as these can greatly influence how forms are drafted and submitted.

-

Many businesses fail to keep meticulous records, leading to compliance issues; avoiding these pitfalls is critical.

-

Ensure that corporate records are maintained properly and in line with legal standards to support transparency and accountability.

How to fill out the sample corporate tax return

-

1.Go to pdfFiller's homepage and log in or create an account.

-

2.Search for 'sample letter for corporate' in the template library.

-

3.Select the appropriate sample letter template from the results.

-

4.Click on the template to open it in the editor.

-

5.Fill in the required fields such as the company name, recipient name, date, and any specific details relevant to your letter.

-

6.Review the text to customize the content according to your needs, ensuring clarity and professionalism.

-

7.Once all fields are filled, use the 'Save' option to store your completed letter.

-

8.If needed, you can print the letter directly from the platform or download it as a PDF for email.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.