Get the free Form W-8BEN Formul rio W-8BEN (Rev

Show details

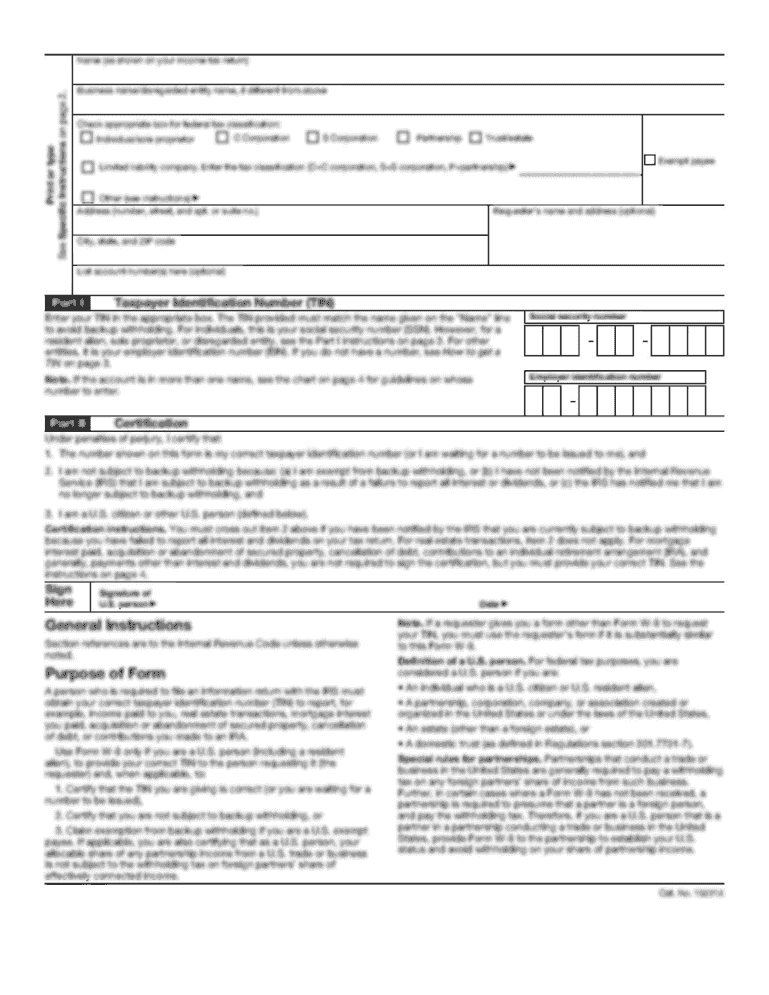

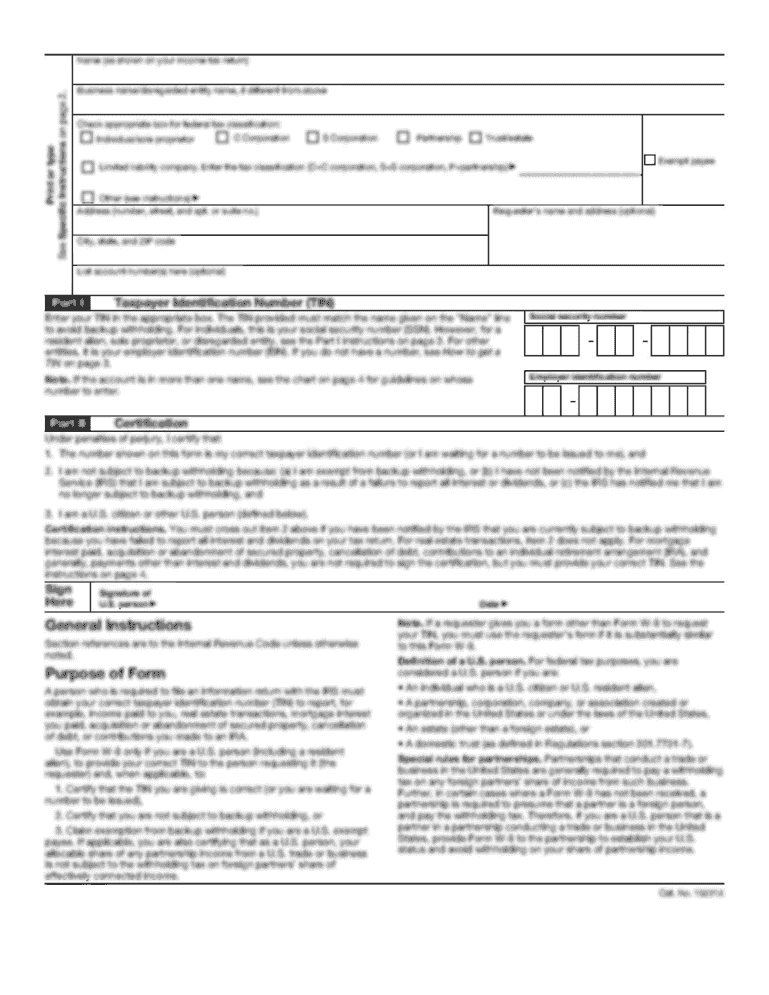

Form W-8BEN Formal Rio W-8BEN (Rev. February 2014) Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) / Declare o de Benefice Rio Effective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-8ben formul rio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-8ben formul rio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-8ben formul rio online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form w-8ben formul rio. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form w-8ben formul rio

How to fill out form W-8BEN Formulário:

01

Start by providing your personal information. This includes your full name, residential address, country of citizenship, and taxpayer identification number (if applicable).

02

Indicate the type of beneficial owner you are. This could be an individual, corporation, trust, etc. Provide any necessary details or documentation to support your classification.

03

Specify your foreign tax identifying number, if applicable. Some countries have their own tax identification system, so check if you need to provide this information.

04

Determine if you are claiming a tax treaty benefit. If so, provide the necessary details and attach any required documentation to support your claim.

05

Mention any limitations on benefits under the applicable tax treaty, if applicable. This could include any specific provisions that restrict or modify the tax benefits you are claiming.

06

Sign and date the form. Make sure to provide your capacity in which you are signing (e.g., individual, officer of the corporation, trustee, etc.) and indicate if you are signing as an agent.

Who needs form W-8BEN Formulário:

01

Non-U.S. individuals or entities who are receiving income from U.S. sources may need to fill out form W-8BEN. This includes individuals who are not U.S. citizens or residents, as well as foreign corporations, partnerships, trusts, and other types of entities.

02

Individuals or entities who are eligible for tax treaty benefits may also need to submit this form to claim those benefits and reduce their tax liability.

03

Financial institutions and payers of U.S. income are required to obtain the W-8BEN form from non-U.S. individuals or entities to comply with tax withholding and reporting obligations.

Remember to consult the official instructions for form W-8BEN and seek professional advice if you have specific questions or complex tax situations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-8ben formul rio?

Form W-8BEN is a tax form used by non-resident aliens who receive income in the U.S. to declare their tax status.

Who is required to file form w-8ben formul rio?

Non-resident aliens who receive income in the U.S. are required to file Form W-8BEN.

How to fill out form w-8ben formul rio?

Form W-8BEN must be filled out with the individual's personal information, including name, address, and tax identification number.

What is the purpose of form w-8ben formul rio?

The purpose of Form W-8BEN is to certify that the individual is a non-resident alien for tax purposes and to claim any applicable tax treaty benefits.

What information must be reported on form w-8ben formul rio?

Form W-8BEN requires information about the individual's country of residence, tax identification number, and any tax treaty benefits being claimed.

When is the deadline to file form w-8ben formul rio in 2023?

The deadline to file Form W-8BEN in 2023 is typically by the date of payment of income, or when requested by the withholding agent.

What is the penalty for the late filing of form w-8ben formul rio?

The penalty for late filing of Form W-8BEN can vary depending on the specific circumstances, but it may include withholding of a higher tax rate or other penalties.

How do I complete form w-8ben formul rio online?

Filling out and eSigning form w-8ben formul rio is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I sign the form w-8ben formul rio electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your form w-8ben formul rio and you'll be done in minutes.

How can I edit form w-8ben formul rio on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form w-8ben formul rio, you can start right away.

Fill out your form w-8ben formul rio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.