Get the free Form 41A720-S35. Schedule KRA - Tax Credit computation Schedule for a KRA Project of...

Show details

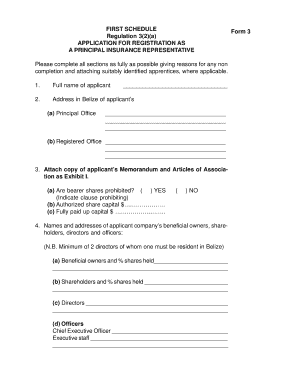

SCHEDULE ERA For taxable year ended *1300010250* 41A720-S35 (10-13) Commonwealth of Kentucky DEPARTMENT OF REVENUE ?? Attach to Form 720. Yr. MRS 154.34-010 to 120 Names of Corporation Federal Identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 41a720-s35 schedule kra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 41a720-s35 schedule kra form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 41a720-s35 schedule kra online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 41a720-s35 schedule kra. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out form 41a720-s35 schedule kra

How to fill out form 41a720-s35 schedule kra:

01

Obtain the form: You can download form 41a720-s35 schedule kra from the appropriate government websites, or you may receive it from your tax advisor or the tax department.

02

Fill in personal information: Provide your name, address, and taxpayer identification number at the top of the form, ensuring that all information is accurate and up-to-date.

03

Provide relevant financial details: This form is typically used to report specific types of income or deductions. Fill out the appropriate sections that pertain to your situation, making sure to include accurate figures and provide supporting documents if required.

04

Double-check for accuracy: Review the completed form for any errors or omissions. It is vital to ensure that all information provided is correct and matches your records.

05

Sign and date the form: Once you have reviewed and confirmed the accuracy of the information provided, sign and date the form before submitting it to the relevant tax authorities.

Who needs form 41a720-s35 schedule kra:

01

Taxpayers with specific income or deductions: Form 41a720-s35 schedule kra is typically required for taxpayers who have certain types of income or deductions that need to be reported separately. These may include rental income, capital gains, or certain investment-related deductions.

02

Individuals with complex financial situations: If your financial affairs are more intricate, such as owning multiple properties or having various investment holdings, you may need to complete form 41a720-s35 schedule kra to provide a comprehensive report of your income and deductions.

03

Those instructed by the tax authorities or tax advisors: In some cases, you may be instructed by the tax authorities or your tax advisor to complete form 41a720-s35 schedule kra. This could be due to a specific tax audit, investigation, or request for additional information related to your financial affairs. It is essential to follow such instructions to remain compliant with tax regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 41a720-s35 schedule kra?

Form 41a720-s35 schedule kra is a specific schedule used for reporting certain information to the Kenya Revenue Authority (KRA).

Who is required to file form 41a720-s35 schedule kra?

Entities or individuals with specific tax obligations as determined by KRA are required to file form 41a720-s35 schedule kra.

How to fill out form 41a720-s35 schedule kra?

Form 41a720-s35 schedule kra should be filled out according to the instructions provided by KRA, ensuring all required information is accurately reported.

What is the purpose of form 41a720-s35 schedule kra?

The purpose of form 41a720-s35 schedule kra is to gather specific information from taxpayers to aid in the enforcement of tax laws and regulations.

What information must be reported on form 41a720-s35 schedule kra?

Form 41a720-s35 schedule kra may require various information such as income details, expenses, deductions, and other relevant tax-related information.

When is the deadline to file form 41a720-s35 schedule kra in 2023?

The deadline to file form 41a720-s35 schedule kra in 2023 is typically determined by KRA and announced in advance.

What is the penalty for the late filing of form 41a720-s35 schedule kra?

The penalty for late filing of form 41a720-s35 schedule kra may include fines or interest charges, as determined by KRA's policies.

How can I manage my form 41a720-s35 schedule kra directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your form 41a720-s35 schedule kra and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the form 41a720-s35 schedule kra in Gmail?

Create your eSignature using pdfFiller and then eSign your form 41a720-s35 schedule kra immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete form 41a720-s35 schedule kra on an Android device?

Use the pdfFiller mobile app and complete your form 41a720-s35 schedule kra and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your form 41a720-s35 schedule kra online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.