Get the free We have audited the accompanying financial statements of the Logan-Hocking County Di...

Show details

LOGAN-HOCKING COUNTY DISTRICT LIBRARY HOCKING COUNTY REGULAR AUDIT FOR THE YEARS ENDED DECEMBER 31, 2008 2007 LOGAN-HOCKING COUNTY DISTRICT LIBRARY HOCKING COUNTY TABLE OF CONTENTS TITLE PAGE Cover

We are not affiliated with any brand or entity on this form

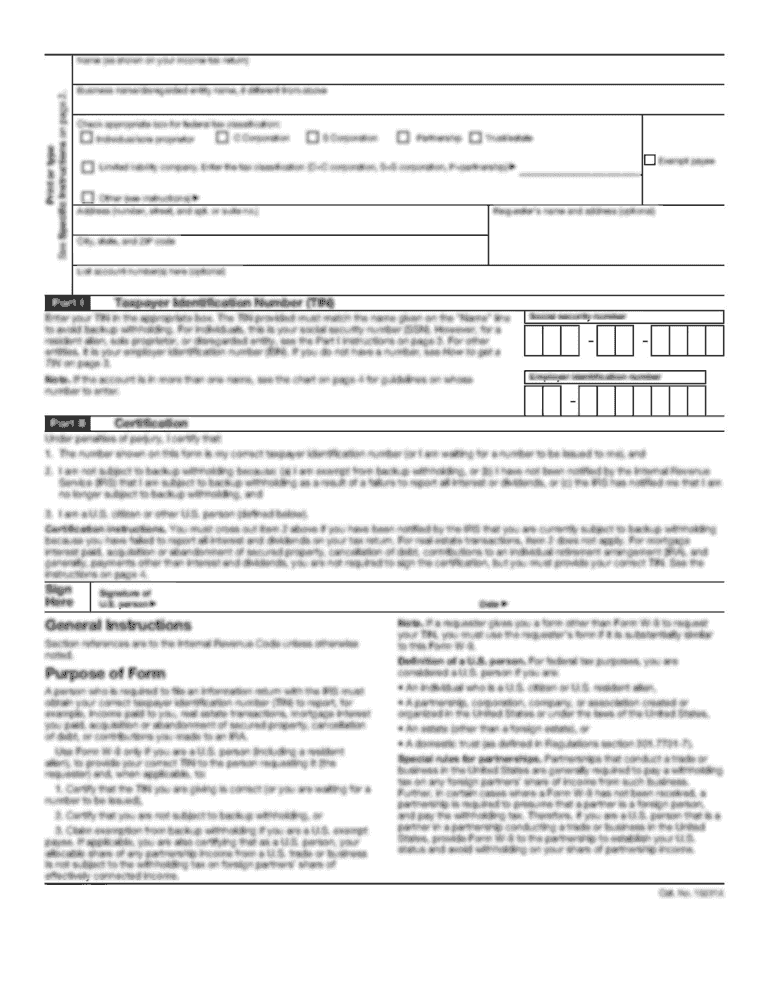

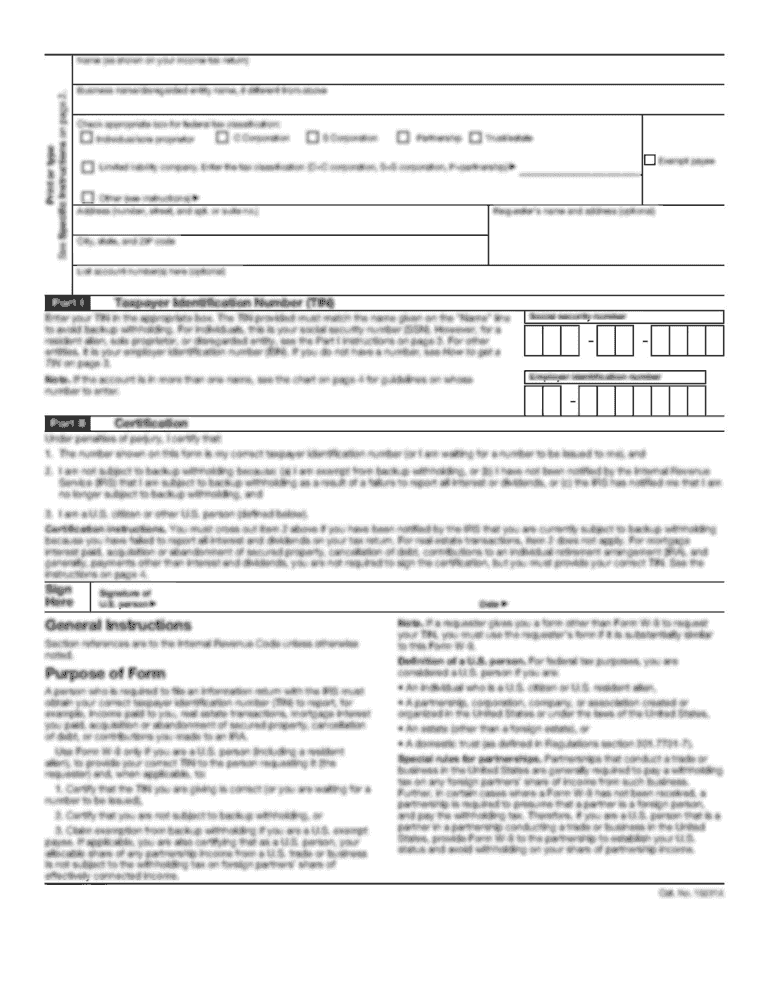

Get, Create, Make and Sign

Edit your we have audited form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your we have audited form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit we have audited form online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit we have audited form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out we have audited form

How to fill out we have audited form:

01

Begin by obtaining the we have audited form from the appropriate source. This could be a government agency, an auditing firm, or any other organization that requires this form.

02

Read the instructions carefully to understand the purpose and requirements of the form. Make sure you have all the necessary information and documentation before proceeding.

03

Fill in the personal details section of the form, such as your name, address, contact information, and any other required information. Provide accurate and up-to-date information to ensure the form is properly completed.

04

Next, provide the relevant information regarding the audit that has been conducted. This may include the date of the audit, the name of the auditors or auditing firm, the scope and objective of the audit, and any findings or observations made during the audit.

05

If applicable, include any recommendations or actions taken as a result of the audit. This could involve implementing changes, improving processes, or addressing any issues identified during the audit.

06

Review the form thoroughly for any errors or missing information. Ensure that all sections have been completed correctly and that all required fields have been filled in.

07

Sign and date the form to indicate your confirmation and acceptance of the information provided.

Who needs we have audited form:

01

Organizations or individuals who have performed an audit of their financial statements or processes and need to provide evidence or documentation of the audit.

02

Businesses or government entities that require audits to meet regulatory or compliance requirements.

03

Auditing firms or professionals who have conducted audits on behalf of clients and need to provide a formal record of the audit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is we have audited form?

The 'we have audited form' refers to a document that shows that a particular entity's financial statements have been audited by a certified public accountant (CPA). It provides assurance to stakeholders that the financial information provided is accurate and compliant with relevant accounting standards.

Who is required to file we have audited form?

Entities that are required to file the 'we have audited form' are usually publicly traded companies, large corporations, and organizations that receive government funding. In some cases, lenders or investors may also require the submission of audited financial statements.

How to fill out we have audited form?

Filling out the 'we have audited form' involves providing detailed information about the audited financial statements, such as the financial period covered, the name of the auditor, and any significant findings or notes highlighted during the audit process. The form usually requires the signature of the authorized representative of the entity.

What is the purpose of we have audited form?

The purpose of the 'we have audited form' is to demonstrate the credibility and reliability of an entity's financial statements. It helps stakeholders, such as shareholders, investors, and regulatory authorities, make informed decisions based on accurate and audited financial information.

What information must be reported on we have audited form?

The 'we have audited form' typically requires the reporting of the audited financial statements, including the balance sheet, income statement, cash flow statement, and accompanying notes. It may also require the disclosure of significant accounting policies and any material events or transactions that may impact the financial statements.

When is the deadline to file we have audited form in 2023?

As the specific deadline may vary depending on the jurisdiction and reporting requirements, it is recommended to refer to the regulatory authority or relevant accounting standards for the exact deadline to file the 'we have audited form' in 2023.

What is the penalty for the late filing of we have audited form?

Penalties for the late filing of the 'we have audited form' also vary by jurisdiction and the specific regulations governing the entity. Typically, late filing may result in monetary fines, potential legal consequences, and damage to the entity's reputation. It is advisable to consult with legal and accounting professionals to understand the specific penalties applicable in a particular jurisdiction.

How do I modify my we have audited form in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign we have audited form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit we have audited form from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including we have audited form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit we have audited form online?

With pdfFiller, it's easy to make changes. Open your we have audited form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your we have audited form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.