WI Form CV-424 2019-2026 free printable template

Show details

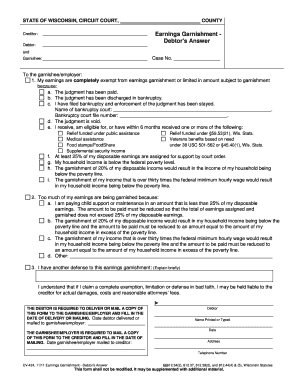

STATE OF WISCONSIN, CIRCUIT COURT, COUNTYCreditor:Earnings Garnishment Debtors AnswerDebtor: and Garnishee:Case No. To the garnishee/employer: 1. My earnings are completely exempt from earnings garnishment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cv 424 form

Edit your 502028388 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin debtors answer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debtors answer online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit wisconsin 424 earnings form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI Form CV-424 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out debtor answer form

How to fill out WI Form CV-424

01

Obtain the WI Form CV-424 from the official Wisconsin court website or local clerk's office.

02

Fill in the case caption at the top of the form, including the name of the court and the parties involved.

03

Provide your contact information, including your name, address, and phone number, in the designated fields.

04

Indicate the type of request you are making by checking the appropriate box.

05

Clearly explain the reason for your request in the provided space, using concise and clear language.

06

If necessary, attach any additional documents that support your request.

07

Review the form for accuracy and completeness before signing it.

08

Sign and date the form in the designated area.

09

Submit the completed form to the court clerk's office in person or via mail, following any specific submission guidelines.

Who needs WI Form CV-424?

01

Individuals involved in a legal proceeding in Wisconsin who need to request a change or seek relief related to a court order or decree.

02

Parties seeking to modify a custody arrangement or child support order.

03

Anyone who wishes to respond to a specific court action that requires the use of this form.

Fill

wisconsin court garnishment

: Try Risk Free

People Also Ask about debtor answer

How long does a garnishment last in VA?

A garnishment is good for 30, 60, 90 or 180 days, at the choice of the judgment-creditor. The garnished money is under the control of the court until the garnishment period is over.

How do I get out of a garnishment in Ohio?

Request a Court-Appointed Trustee Under Ohio law, you may be able to avoid wage garnishment if you enter into a trusteeship. Trusteeships can stop wage garnishment and prevent creditors from harassing you for payment. A trusteeship requires that you pay a percentage of your earnings to your court-appointed trustee.

How do I stop a wage garnishment after it starts in Ohio?

With your demand letter or notice, you will get a form titled “Payment to Avoid Garnishment.” Complete the form and return it to the creditor within 15 days and you can make periodic payments without having to go through the formal garnishment process.

What is an order of garnishment in Ohio?

This order of garnishment of personal earnings is a continuous order that generally requires you to withhold a specified amount, calculated each pay period at the statutory percentage, of the judgment debtor's personal disposable earnings during each pay period, as determined in ance with the "INTERIM REPORT AND

How do I write an objection letter for wage garnishment?

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

How do I respond to a garnishment summons in Virginia?

In Virginia, you have 21 days to file an answer, or respond to the lawsuit, if it's filed in a circuit court. If the suit is filed in a district court, you need to show up at the time on your summons prepared to prove your case. If you fail to answer or appear as directed, a default judgment may be entered against you.

What is the answer of garnishee in Ohio?

A garnishee is liable to the judgment creditor for all money, property, and credits, other than personal earnings, of the judgment debtor in the garnishee's possession or under the garnishee's control or for all personal earnings due from the garnishee to the judgment debtor, whichever is applicable, at the time the

What are the garnishment rules in Ohio?

The total amount garnished cannot be more than 25% of the employee's monthly disposable earnings. Exemptions from garnishment, including, but not limited to, worker's compensation, unemployment compensation, disability payments, OWF payments, or child support or spousal support, and most pensions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the cv424 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign WI Form CV-424 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit WI Form CV-424 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign WI Form CV-424 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete WI Form CV-424 on an Android device?

Use the pdfFiller mobile app to complete your WI Form CV-424 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is WI Form CV-424?

WI Form CV-424 is a tax form used in Wisconsin for reporting certain tax credits, specifically the credit for income taxes paid to other states.

Who is required to file WI Form CV-424?

Individuals who have paid income taxes to another state and are claiming a tax credit on their Wisconsin tax return must file WI Form CV-424.

How to fill out WI Form CV-424?

To fill out WI Form CV-424, taxpayers must gather their income tax information from the other state, provide details on taxes paid, and complete the form with accurate calculations before submitting it with their Wisconsin tax return.

What is the purpose of WI Form CV-424?

The purpose of WI Form CV-424 is to allow Wisconsin residents to claim a tax credit for income taxes that they have paid to other states, ensuring they are not taxed twice on the same income.

What information must be reported on WI Form CV-424?

WI Form CV-424 requires taxpayers to report their personal information, details of the other state's income tax return, the amounts of taxes paid, and any other relevant credits or deductions associated with the income in question.

Fill out your WI Form CV-424 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI Form CV-424 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.