NIU UBIT Preliminary Questionnaire 2019-2024 free printable template

Show details

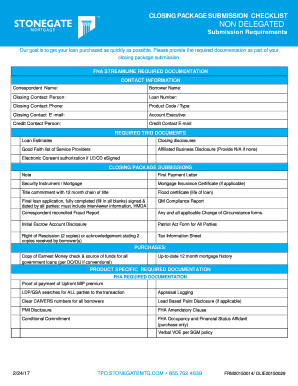

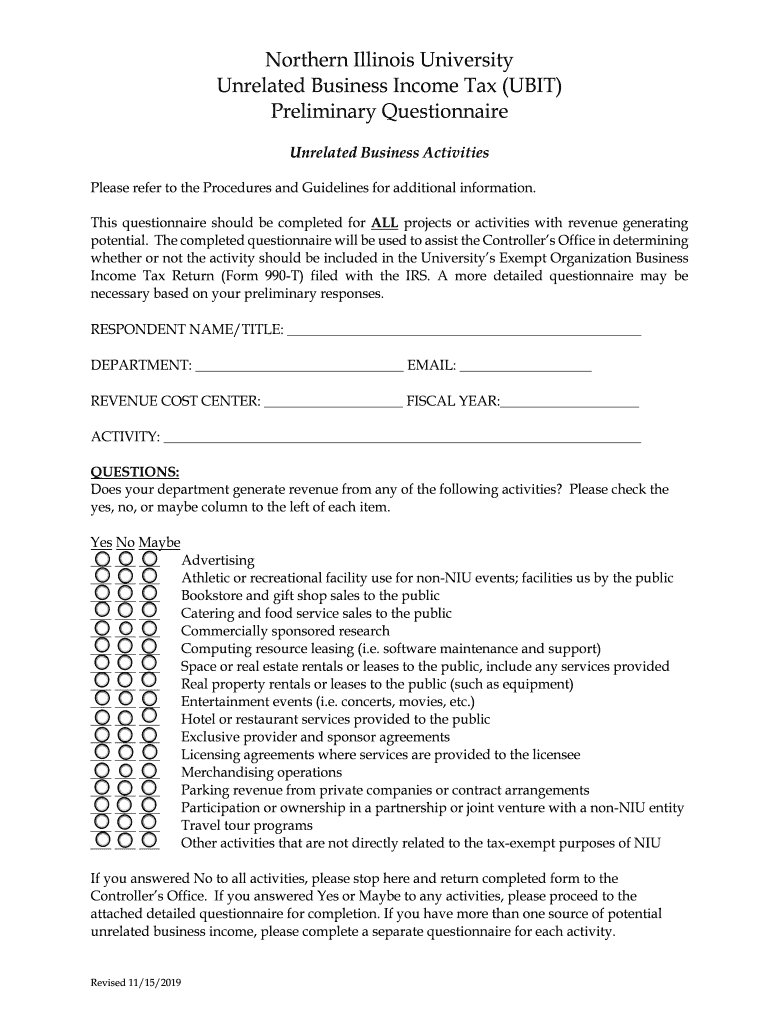

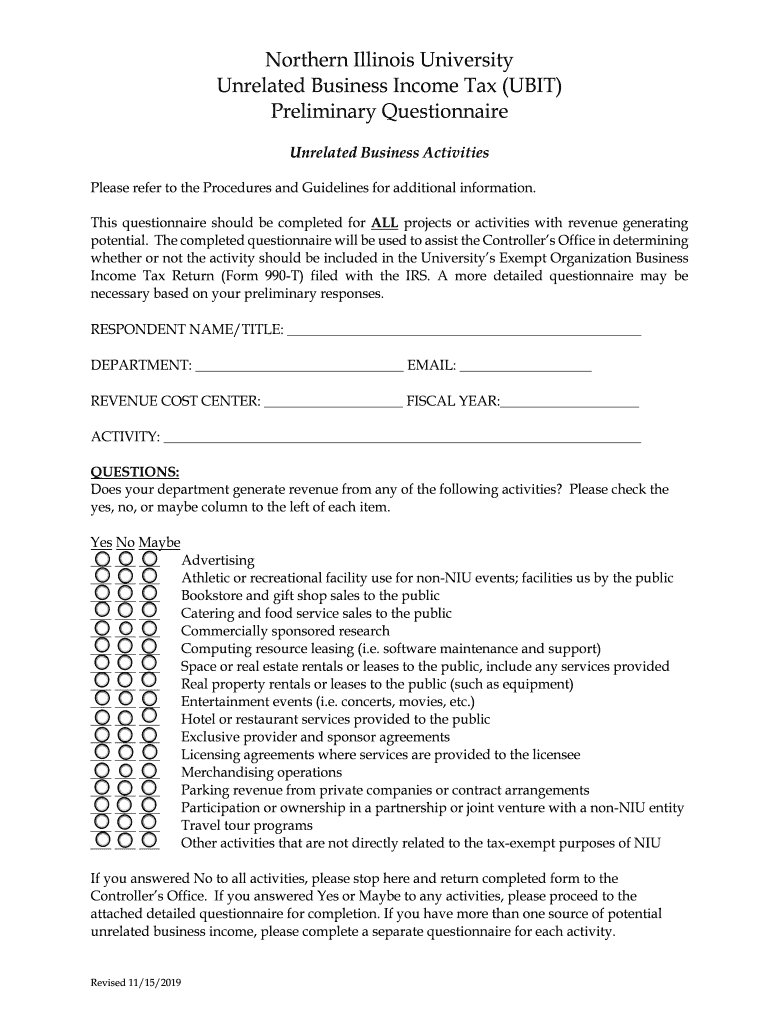

Northern Illinois University

Unrelated Business Income Tax (UNIT)

Preliminary Questionnaire

Unrelated Business Activities

Please refer to the Procedures and Guidelines for additional information.

This

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your unrelated business income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unrelated business income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unrelated business income tax online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit unrelated business income tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out unrelated business income tax

How to fill out unrelated business income tax

01

To fill out unrelated business income tax, follow the steps below:

02

Gather all necessary financial documents and records related to your unrelated business income.

03

Fill out Form 990-T, which is used to report unrelated business income.

04

Provide detailed information about the organization's unrelated business activities, including income, expenses, and any deductions.

05

Calculate the unrelated business taxable income (UBTI) by subtracting any allowed deductions from the gross unrelated business income.

06

Determine the tax rate that applies to your organization based on the UBTI.

07

Complete the appropriate schedules and attachments as required by the IRS.

08

Pay the calculated tax amount or request an extension if needed.

09

File the completed Form 990-T and any accompanying forms with the IRS by the due date.

10

Keep a copy of the filed tax return and supporting documentation for your records.

Who needs unrelated business income tax?

01

Any tax-exempt organization that engages in unrelated business activities needs to file unrelated business income tax (UBIT).

02

This includes organizations such as charities, foundations, associations, clubs, universities, and religious organizations.

03

If the organization generates income from activities that are not substantially related to its exempt purpose, it may be subject to UBIT.

04

However, certain exceptions and thresholds exist, so it's essential to consult the IRS guidelines or a tax professional to determine if your organization needs to file.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit unrelated business income tax online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your unrelated business income tax to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit unrelated business income tax on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing unrelated business income tax right away.

How do I fill out unrelated business income tax on an Android device?

Complete your unrelated business income tax and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your unrelated business income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.