AU MR9B 2015 free printable template

Show details

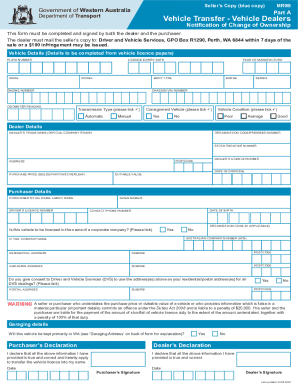

Seller s Copy (green copy) MR9B Part A Vehicle Transfer Vehicle Dealers Notification of Change of Ownership This form must be completed and signed by both the dealer and the purchaser. The dealer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mr9b 2015 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mr9b 2015 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mr9b online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mr9b form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

AU MR9B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out mr9b 2015 form

How to fill out mr9b?

01

Start by gathering all necessary information and documents such as personal details, income statements, and tax-related documents.

02

Carefully read the instructions provided with the mr9b form to ensure you understand all the requirements and sections.

03

Begin filling out the form by entering your personal information accurately, including your name, address, and contact details.

04

Proceed by providing the necessary financial information, such as income details, deductions, and any other required information.

05

Double-check all the information you have entered to avoid any errors or inconsistencies. Make sure to review the form thoroughly before submitting it.

06

Once you have completed filling out the mr9b form, sign and date it as required.

Who needs mr9b?

01

Individuals who need to report and declare their annual income to the relevant tax authorities.

02

Employees who have multiple sources of income and need to report each of them separately.

03

Individuals who are self-employed or have their own businesses and need to report their business income.

04

Anyone who has received any type of income that is subject to taxes and needs to provide accurate information to the tax authorities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mr9b?

There is no specific information available about "mr9b." It is possible that it could be a personal identifier, a product code, a computer program, or a code name used in various contexts. Without more context or information, it is difficult to determine its specific meaning.

How to fill out mr9b?

Form MR9B is used to report income and expenses for the rental of personal property. Here's a step-by-step guide on how to fill out this form:

1. Start by entering the name, address, and tax identification number (TIN) of the taxpayer at the top of the form.

2. In Part I, you will need to provide a description of the property being rented, such as furniture, equipment, or vehicles. Write down the description and the total number of properties rented during the tax year.

3. In Part II, you will report the income received from the rental activity. List the gross receipts from the rental of personal property in the appropriate boxes.

4. If you have any expenses related to renting the personal property, report them in Part III. This may include expenses such as repairs, maintenance, advertising, or insurance. List each expense category and the corresponding amount in the appropriate boxes.

5. Calculate the total income and expenses in Part IV by adding up the amounts from Part II and Part III.

6. If any adjustments need to be made to the total income and expenses, provide the details in Part V. This could include removing non-taxable income or disallowed expenses.

7. Calculate the net rental income by subtracting the total expenses from the total income in Part VI.

8. If you have any additional information or explanations related to the rental activity, write them down in Part VII.

9. Finally, sign and date the form at the bottom.

Remember to keep a copy of the filled-out MR9B form for your records.

What is the purpose of mr9b?

I could not find any specific information about "mr9b." It is possible that you are referring to a product or term that is not widely known or recognized. Can you please provide more context or clarify your question so that I can assist you better?

What information must be reported on mr9b?

The MR9B is a tax form used in the United Kingdom to report certain payments made to individuals who are not employees, such as directors, consultants, or freelancers. The information that must be reported on MR9B includes:

1. The name and address of the person or company to whom the payment was made.

2. The national insurance number or unique taxpayer reference (UTR) of the recipient, if available.

3. The date the payment was made.

4. The total amount of the payment made during the tax year.

5. Any deductions or expenses that were made in relation to the payment.

6. Any tax that has been withheld or paid on the payment, such as through the Construction Industry Scheme (CIS) or PAYE.

7. The reason for the payment, such as consultancy services or director's fees.

8. The nature of the work or services provided, if applicable.

It is important to accurately report the information on the MR9B form to ensure compliance with tax regulations and avoid penalties.

What is the penalty for the late filing of mr9b?

The MR9B is a form related to the filing of the UK Annual Return and Annual Accounts for companies. If a company fails to file MR9B (Annual Return) on time, there may be penalties imposed by Companies House, the UK's registrar of companies. The penalty for the late filing of MR9B can vary depending on the length of the delay:

1. Up to 1 month late: £150 penalty

2. 1 to 3 months late: £375 penalty

3. 3 to 6 months late: £750 penalty

4. More than 6 months late: £1,500 penalty

These penalties can accumulate over time, so the longer the delay, the higher the penalty. Additionally, failure to file the MR9B can also result in the company being struck off the register and dissolved, making it important to file the form on time.

How do I modify my mr9b in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your mr9b form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute mr9b form online?

pdfFiller has made it easy to fill out and sign mr9b. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in vehicle transfer papers?

With pdfFiller, it's easy to make changes. Open your mr9b in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your mr9b 2015 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

mr9b Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.