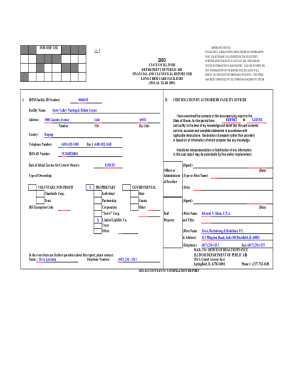

Get the free Statement of Revenues, Expenses and Changes in Fund Balances - auditor state oh

Show details

OHIO AIR QUALITY DEVELOPMENT AUTHORITY FRANKLIN COUNTY REGULAR AUDIT FOR THE YEAR ENDED DECEMBER 31, 2004, OHIO AIR QUALITY DEVELOPMENT AUTHORITY TABLE OF CONTENTS TITLE PAGE Independent Accountants

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your statement of revenues expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your statement of revenues expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit statement of revenues expenses online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit statement of revenues expenses. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

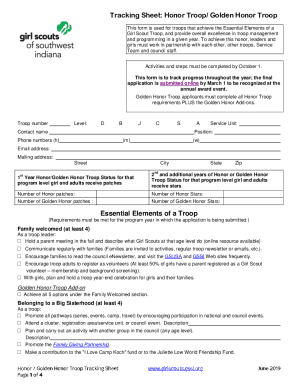

How to fill out statement of revenues expenses

How to fill out statement of revenues expenses:

01

Gather all relevant financial data: Start by collecting all the necessary financial information, including revenue and expense records for the specific period you are preparing the statement for.

02

Categorize revenues: Separate the revenue sources into appropriate categories. Common categories include sales revenue, service income, rental income, and interest income. Assign each revenue source to its respective category.

03

Calculate total revenue: Sum up all the revenues in each category to determine the total revenue for the period.

04

Categorize expenses: Similarly, categorize the expenses into appropriate categories such as cost of goods sold, marketing expenses, rent, utilities, and salaries. Assign each expense item to its respective category.

05

Calculate total expenses: Add up all the expenses in each category to determine the total expenses for the period.

06

Calculate net income: Subtract the total expenses from the total revenue to calculate the net income (or net loss). If the total revenue exceeds the total expenses, it represents a net income, whereas if the expenses surpass the revenue, it represents a net loss.

07

Include additional information: This could involve providing explanations for any significant changes in revenue or expenses from the previous period, or any other pertinent information that would aid in understanding the statement.

Who needs statement of revenues expenses:

01

Small business owners: Small business owners need a statement of revenues and expenses to understand their financial performance over a specific period. It helps in making informed decisions, assessing profitability, and planning for future growth.

02

Investors and stakeholders: Investors and stakeholders analyze the statement of revenues and expenses to evaluate the financial health and profitability of a company. It assists them in determining the potential return on investment and making investment decisions.

03

Government agencies and regulatory bodies: Government agencies and regulatory bodies require companies to submit a statement of revenues and expenses for compliance purposes. This helps in ensuring transparency, accuracy, and adherence to financial reporting standards.

04

Financial institutions: Lenders and banks often request a statement of revenues and expenses from businesses when assessing loan applications. It allows them to evaluate the borrower's repayment capacity and assess the risk involved.

05

Internal management: Internal management teams rely on the statement of revenues and expenses to track financial performance, identify areas of improvement, and make strategic decisions. It provides insights into revenue-generating activities and areas where expenses can be minimized.

Overall, the statement of revenues and expenses is a crucial financial document that benefits various stakeholders by providing a comprehensive overview of a company's financial performance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is statement of revenues expenses?

The statement of revenues expenses, also known as an income statement, is a financial document that summarizes the revenues, expenses, and net income or loss of a business entity over a specific period of time.

Who is required to file statement of revenues expenses?

Business entities, including corporations, partnerships, and sole proprietorships, are generally required to file a statement of revenues expenses as part of their financial reporting obligations. The specific requirements may vary based on the jurisdiction and legal structure of the entity.

How to fill out statement of revenues expenses?

To fill out a statement of revenues expenses, you need to compile information about the revenues earned and the expenses incurred during a specific period. The statement typically includes sections for revenue sources, such as sales or services, and expense categories, such as salaries, rent, and utilities. The net income or loss is calculated by subtracting the total expenses from the total revenues.

What is the purpose of statement of revenues expenses?

The purpose of a statement of revenues expenses is to provide an overview of the financial performance of a business during a specific period. It helps stakeholders, including investors, creditors, and management, assess the profitability, efficiency, and sustainability of the entity's operations.

What information must be reported on statement of revenues expenses?

A statement of revenues expenses typically includes information such as the total sales or revenue, cost of goods sold, gross profit, operating expenses, taxes, and net income or loss. It may also include additional details or notes to provide further insights into the financial results.

When is the deadline to file statement of revenues expenses in 2023?

The deadline to file a statement of revenues expenses in 2023 may vary depending on the jurisdiction and industry. It is advisable to consult the relevant regulations or seek professional advice to determine the specific deadline for a particular entity.

What is the penalty for the late filing of statement of revenues expenses?

The penalty for the late filing of a statement of revenues expenses can also vary based on the jurisdiction and applicable laws. Common penalties may include monetary fines, interest charges, and potential legal consequences. It is important to comply with the filing requirements to avoid any penalties or adverse consequences.

How can I edit statement of revenues expenses from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including statement of revenues expenses. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send statement of revenues expenses to be eSigned by others?

Once your statement of revenues expenses is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in statement of revenues expenses without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing statement of revenues expenses and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Fill out your statement of revenues expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.