Get the free Petty Cash Expense Reimbursement Form. - mta

Show details

PETTY CASH EXPENSE REIMBURSEMENT ONLY TO BE USED FOR AMOUNTS LESS THAN $50.00 Name Date Submitted Department Telephone No. DETAILS OF EXPENSES FINANCIAL SERVICES Reimbursement will only be made for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your petty cash expense reimbursement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petty cash expense reimbursement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petty cash expense reimbursement online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit petty cash expense reimbursement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out petty cash expense reimbursement

How to Fill Out Petty Cash Expense Reimbursement:

01

Obtain the reimbursement form: Begin by requesting the petty cash expense reimbursement form from your organization's finance department or designated person in charge. This form will serve as your documentation for requesting reimbursement for any authorized expenses paid out of the petty cash fund.

02

Gather necessary information: Before filling out the reimbursement form, make sure to gather all the relevant information. This typically includes the date of the expenditure, a detailed description of the expense, the amount spent, the category or purpose of the expense, and any supporting documentation like receipts or invoices.

03

Complete the reimbursement form: Using a clear and legible handwriting, fill out the reimbursement form accurately. Start by providing your personal information, including your name, employee or identification number, contact details, and any other required personal details.

04

Specify the expenditure details: In the reimbursement form, include all the necessary information regarding the expenses. Write down the date of the expenditure, the description of the expense (e.g., office supplies, transportation, meals), and the amount spent. Ensure that the information provided is accurate and matches any supporting documentation.

05

Attach supporting documentation: To validate your expenses and facilitate the reimbursement process, attach any required supporting documentation. This may include original receipts or invoices, which should be properly labeled and organized for easy reference. Make sure the receipts are clear and legible, as illegible or faded receipts may hinder the reimbursement process.

06

Seek approval if necessary: Depending on your organization's policy, you may be required to seek approval from a supervisor or manager for certain expenses. If this is the case, ensure that the necessary signatures or approvals are obtained before submitting the reimbursement form.

07

Submit the reimbursement form: Once you have completed the reimbursement form and gathered all necessary documentation, submit the form to the relevant person or department responsible for processing petty cash reimbursements. Follow any specific submission procedures or deadlines outlined by your organization to avoid any delays in receiving your reimbursement.

Who Needs Petty Cash Expense Reimbursement:

01

Employees: Petty cash expense reimbursement is primarily needed by employees who have access to the petty cash fund and incur authorized expenses on behalf of the organization. These employees could include office administrators, department heads, or any staff members entrusted with managing minor cash disbursements.

02

Small Businesses: Small businesses often utilize petty cash funds for day-to-day expenses, which may include purchasing office supplies, reimbursing employees for small purchases, or covering minor operational costs. Therefore, individuals responsible for managing these petty cash funds within small businesses would need to process petty cash expense reimbursement requests.

03

Nonprofit Organizations: Nonprofit organizations may have designated employees responsible for managing petty cash funds, particularly for activities like event planning or outreach efforts. These individuals would require petty cash expense reimbursement to account for any authorized expenses incurred during their operations.

Note: The specific individuals or departments requiring petty cash expense reimbursement may vary depending on the organizational structure, policies, and the nature of operations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

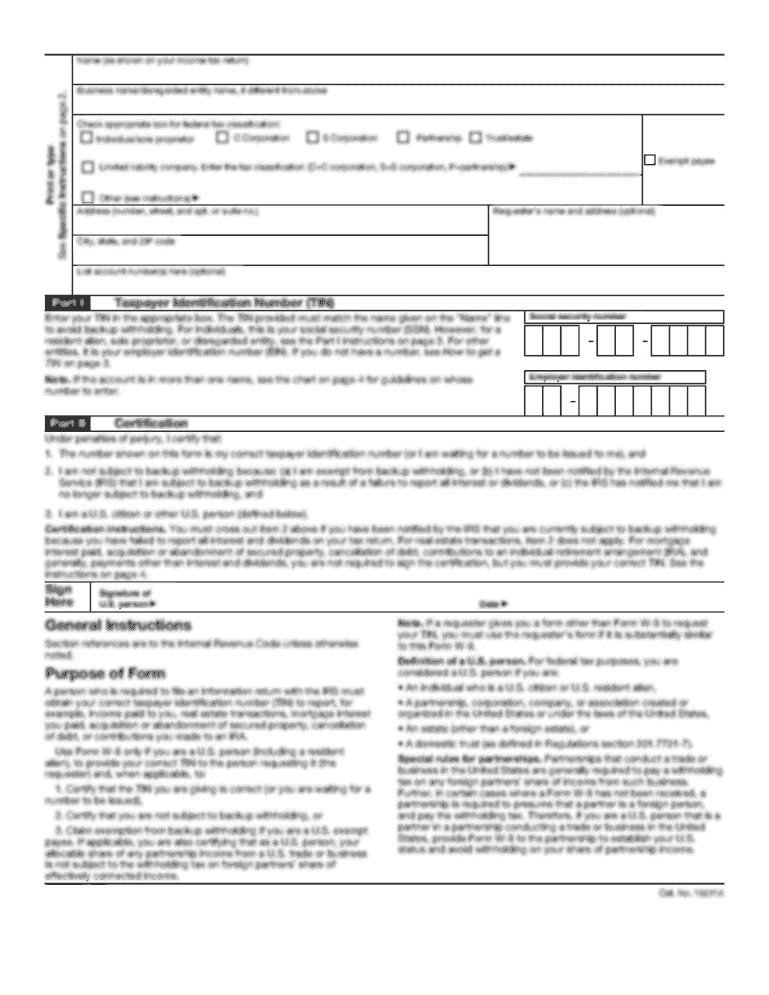

What is petty cash expense reimbursement?

Petty cash expense reimbursement is the process of reimbursing employees for small, out-of-pocket expenses they have incurred on behalf of the company.

Who is required to file petty cash expense reimbursement?

Employees who have incurred small expenses on behalf of the company are required to file petty cash expense reimbursement.

How to fill out petty cash expense reimbursement?

To fill out petty cash expense reimbursement, employees need to prepare a reimbursement form with details of the expense, date, amount, and reason for the expense.

What is the purpose of petty cash expense reimbursement?

The purpose of petty cash expense reimbursement is to ensure that employees are reimbursed for any small expenses they have incurred on behalf of the company in a timely manner.

What information must be reported on petty cash expense reimbursement?

Information reported on petty cash expense reimbursement includes details of the expense, date, amount, reason for the expense, and the employee's name and department.

When is the deadline to file petty cash expense reimbursement in 2023?

The deadline to file petty cash expense reimbursement in 2023 is typically the end of the month following the incurring of the expense.

What is the penalty for the late filing of petty cash expense reimbursement?

The penalty for the late filing of petty cash expense reimbursement may include delays in reimbursement and potential disciplinary action.

How can I edit petty cash expense reimbursement from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your petty cash expense reimbursement into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute petty cash expense reimbursement online?

Easy online petty cash expense reimbursement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out petty cash expense reimbursement on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your petty cash expense reimbursement by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your petty cash expense reimbursement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.