Get the free EITC FOUNDATION - eitcfoundation

Show details

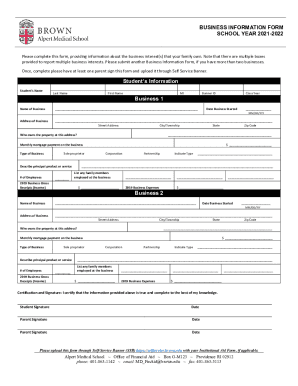

ETC FOUNDATION SCHOLARSHIP INSTRUCTIONS Eastern Idaho Technical College (ETC) Foundation strives to support students who wish to obtain further education and training. Several Scholarships are available

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your eitc foundation - eitcfoundation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eitc foundation - eitcfoundation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eitc foundation - eitcfoundation online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit eitc foundation - eitcfoundation. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out eitc foundation - eitcfoundation

How to fill out eitc foundation:

01

Gather necessary documents: Before starting the process, make sure you have all the required documents such as your Social Security number, income statements, and proof of eligible dependents.

02

Determine eligibility: Check if you meet the income and filing status requirements to qualify for EITC (Earned Income Tax Credit) foundation. This credit is designed to assist low-income individuals and families.

03

Complete the appropriate tax forms: Use the Form 1040, Form 1040A, or Form 1040EZ to fill out your tax return. You may also need to include the Schedule EIC (Earned Income Credit) to claim the EITC foundation.

04

Enter income information: accurately report your earned income, investment income, and any other sources of income on the designated sections of the tax form. Make sure to follow the instructions provided for each line.

05

Determine the eligible dependents: Determine which dependents you can claim for the EITC foundation. Ensure they meet the criteria set by the Internal Revenue Service (IRS), such as relationship or residency requirements.

06

Calculate the credit: Use the EITC table provided by the IRS to calculate your eligible credit amount. This table takes into account your adjusted gross income, filing status, and number of qualified dependents.

07

Claim the credit: Once you have determined the amount of EITC foundation you are eligible for, enter it on the appropriate line of your tax form. Double-check all the information to ensure accuracy.

Who needs eitc foundation?

01

Low-income individuals and families: The EITC foundation is designed to provide financial assistance to individuals and families with low to moderate incomes. It helps alleviate the tax burden and can provide a refund, even if no taxes were owed.

02

Qualified dependents: Individuals who have eligible dependents, such as children, may be eligible for the EITC foundation. This credit aims to support those who are responsible for the care and upbringing of dependents.

03

Earned income earners: The EITC foundation primarily targets individuals with earned income, including wages, salaries, and self-employment income. It is especially beneficial for those with lower incomes.

04

Taxpayers who meet the income and filing status requirements: To be eligible for the EITC foundation, individuals must meet specific income and filing status criteria outlined by the IRS. These requirements ensure that the credit reaches those who need it most.

05

Those seeking financial support during tax season: The EITC foundation can provide significant financial assistance during tax season. By claiming this credit, eligible individuals and families can potentially increase their tax refund or reduce the amount they owe.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eitc foundation?

The EITC Foundation stands for the Earned Income Tax Credit Foundation, which is a non-profit organization dedicated to helping low-income individuals and families access tax credits they are eligible for.

Who is required to file eitc foundation?

Individuals or families who meet the income and eligibility requirements set forth by the IRS are required to file for the EITC Foundation.

How to fill out eitc foundation?

To fill out the EITC Foundation, individuals need to provide information about their income, family size, and other details as required by the IRS.

What is the purpose of eitc foundation?

The purpose of the EITC Foundation is to provide financial assistance to low-income individuals and families by allowing them to claim tax credits on their income tax returns.

What information must be reported on eitc foundation?

Information such as income, family size, and eligibility criteria must be reported on the EITC Foundation form.

When is the deadline to file eitc foundation in 2023?

The deadline to file the EITC Foundation in 2023 is April 15th.

What is the penalty for the late filing of eitc foundation?

The penalty for the late filing of the EITC Foundation is a percentage of the amount of the credit that was not claimed, up to a maximum amount set by the IRS.

How can I edit eitc foundation - eitcfoundation from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your eitc foundation - eitcfoundation into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for signing my eitc foundation - eitcfoundation in Gmail?

Create your eSignature using pdfFiller and then eSign your eitc foundation - eitcfoundation immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit eitc foundation - eitcfoundation on an Android device?

You can make any changes to PDF files, like eitc foundation - eitcfoundation, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your eitc foundation - eitcfoundation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.