Get the free APR Vs. Interest Rate: What's The Difference?Bankrate.com

Show details

A Data monitor report UK Mortgages 2003 Reaching New Peaks Published: Dec-03 Product Code: DMFS1580 Providing you with: Extensive coverage of the UK mortgage market and a comparison of it and the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

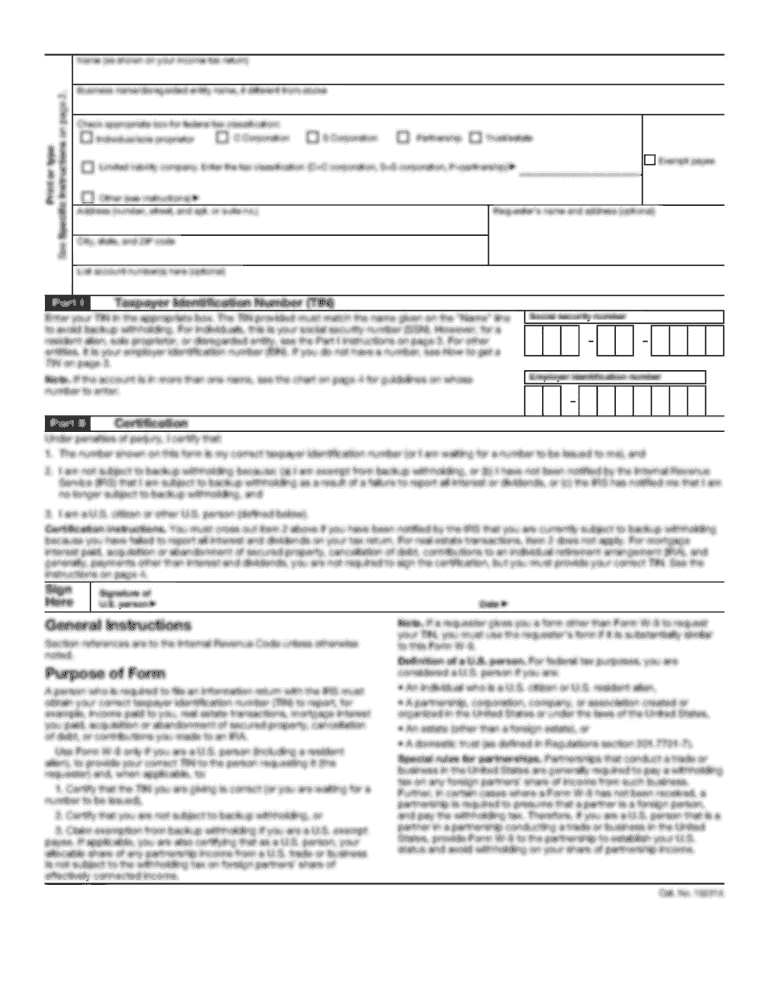

Edit your apr vs interest rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your apr vs interest rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing apr vs interest rate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit apr vs interest rate. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out apr vs interest rate

Understanding the Difference:

To fill out APR vs interest rate, it is important to first comprehend the distinction between the two. The interest rate represents the cost of borrowing money expressed as a percentage, while the annual percentage rate (APR) is a broader measure that includes the interest rate plus any additional fees or costs associated with the loan.

Gather Loan Information:

To accurately compare APRs and interest rates, gather all the necessary information relating to the loan. This includes the loan amount, the term or duration of the loan, any additional fees or charges, and the repayment schedule.

Research and Compare:

It's essential to research and compare different lenders or financial institutions to find the best APR vs interest rate combination that suits your needs. Look for lenders who provide clear and transparent information about their rates and fees.

Use Online Calculators:

Several online calculators are available that can help you calculate the APR of a loan by inputting relevant data. Utilize these tools to determine the true cost of borrowing for different loan options and compare them side by side.

Consider Your Financial Goals:

Think about your financial goals and budget before making a decision. An APR is a useful metric when comparing loan offers, especially if you plan to pay off the loan over a longer period. On the other hand, if you are planning to pay off the loan quickly, the interest rate may hold more significance.

Seek Professional Advice:

If you are still unsure about how to fill out APR vs interest rate forms or how to make a decision, consider seeking advice from a financial advisor or consultant. They can provide personalized guidance based on your specific financial situation and help determine which option is best for you.

Who needs apr vs interest rate?

Potential Borrowers:

Anyone who is looking to borrow money, whether it be for a mortgage, a personal loan, or a credit card, needs to understand the APR vs interest rate. Knowing the difference allows borrowers to make informed decisions and compare loan offers effectively.

Homebuyers:

Homebuyers especially should be familiar with APR vs interest rate as they are likely to take out a mortgage loan. Understanding the true cost of borrowing can help homebuyers budget and assess different mortgage options.

Credit Card Users:

Credit card users should also understand the APR vs interest rate to make informed decisions about their credit card usage. This knowledge can be valuable when choosing a credit card with the most favorable rates and fees.

Individuals Managing Debts:

People managing multiple loans or debts can benefit from understanding the APR vs interest rate. By comparing the APRs of different loans, they can prioritize their repayment strategies and focus on the loans with the highest APRs first.

Financial Analysts:

Financial analysts and professionals who work in the lending industry need to have a deep understanding of APR vs interest rate. Their expertise in this area helps them advise clients, assess loan portfolios, and make informed financial decisions.

In conclusion, filling out APR vs interest rate forms requires an understanding of the key differences between the two concepts, gathering loan information, researching and comparing lenders, using online calculators, considering financial goals, and seeking professional advice if needed. Anyone looking to borrow money or manage their debts can benefit from understanding APR vs interest rate.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is apr vs interest rate?

APR (Annual Percentage Rate) is the total cost of borrowing, including the interest rate and other fees, expressed as a percentage. The interest rate, on the other hand, is simply the cost of borrowing expressed as a percentage without considering other fees.

Who is required to file apr vs interest rate?

Lenders and financial institutions are required to disclose the APR and interest rate to borrowers when offering loans or financial products.

How to fill out apr vs interest rate?

To fill out APR vs interest rate, lenders need to calculate the total cost of borrowing including fees and express it as a percentage for APR. The interest rate is simply the percentage charged for borrowing.

What is the purpose of apr vs interest rate?

The purpose of APR vs interest rate is to provide borrowers with a clear understanding of the total cost of borrowing and allows them to compare different loan offers more easily.

What information must be reported on apr vs interest rate?

APR must include the interest rate, fees, and any other charges associated with borrowing. The interest rate is simply the percentage charged for borrowing.

When is the deadline to file apr vs interest rate in 2023?

The deadline to file APR vs interest rate in 2023 may vary depending on the specific regulations and requirements of the relevant jurisdiction or financial institution.

What is the penalty for the late filing of apr vs interest rate?

The penalty for late filing of APR vs interest rate may include fines, penalties, or other legal consequences depending on the specific regulations and requirements of the relevant jurisdiction or financial institution.

How can I modify apr vs interest rate without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your apr vs interest rate into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find apr vs interest rate?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific apr vs interest rate and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit apr vs interest rate on an Android device?

With the pdfFiller Android app, you can edit, sign, and share apr vs interest rate on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your apr vs interest rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.