Get the free 2013 INSTRUCTIONS FOR FORM RI-1096PT - Rhode Island ... - tax ri

Show details

Search RI.gov: ... Vendors reproducing Rhode Island state tax forms must register with the Rhode ... except voucher forms, may be submitted as a PDF via email. ... RI-1040 2D version — Draft updated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2013 instructions for form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 instructions for form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 instructions for form online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 instructions for form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

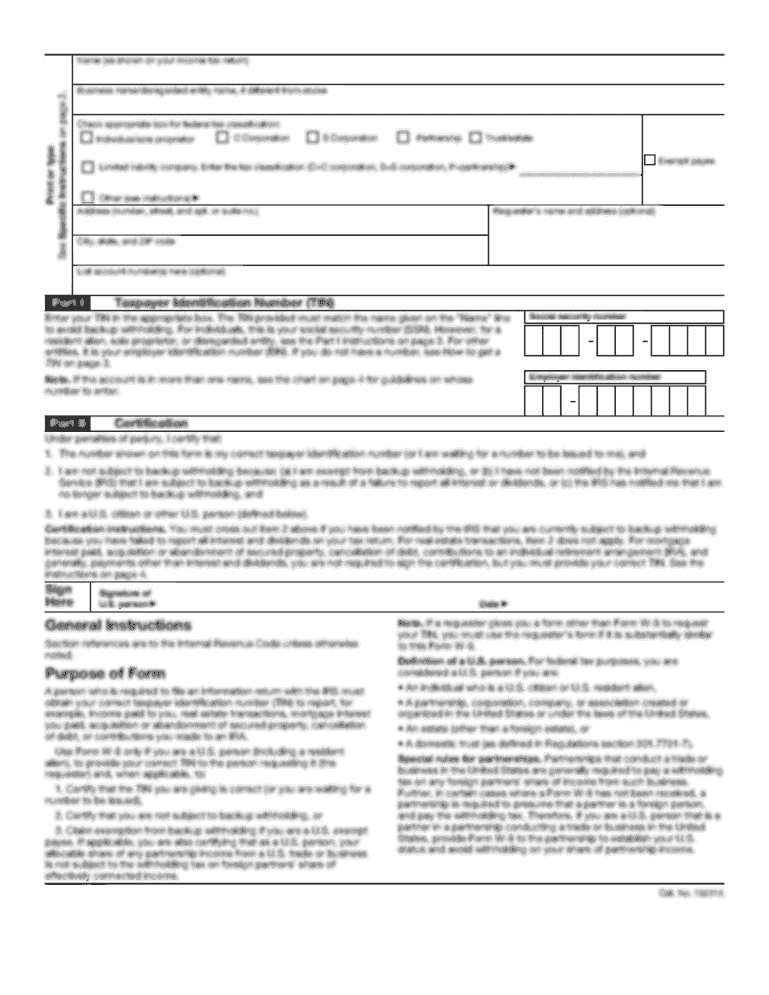

How to fill out 2013 instructions for form

How to fill out 2013 instructions for form:

01

Read the instructions thoroughly: Start by carefully reading through the 2013 instructions for the specific form you are filling out. It is essential to understand the requirements and guidelines mentioned in the instructions before proceeding.

02

Gather all necessary information: Collect all the information and documents required to complete the form. This may include personal details, financial information, or any other specific data relevant to the form.

03

Follow the provided format: Pay close attention to the format and structure mentioned in the 2013 instructions. Fill out the form in the designated spaces, using the instructed font size and style.

04

Double-check for accuracy: Make sure that all the information entered on the form is accurate and error-free. Mistakes or discrepancies in the form may lead to delays or rejection.

05

Provide supporting documents if required: If the 2013 instructions mention any supporting documents that need to be attached, gather and submit them along with the completed form. Ensure that they are relevant and properly organized.

06

Proofread before submission: Before submitting the form, proofread it thoroughly. Look for any spelling errors, missing information, or any other mistakes. It is crucial to ensure the form is complete and correct.

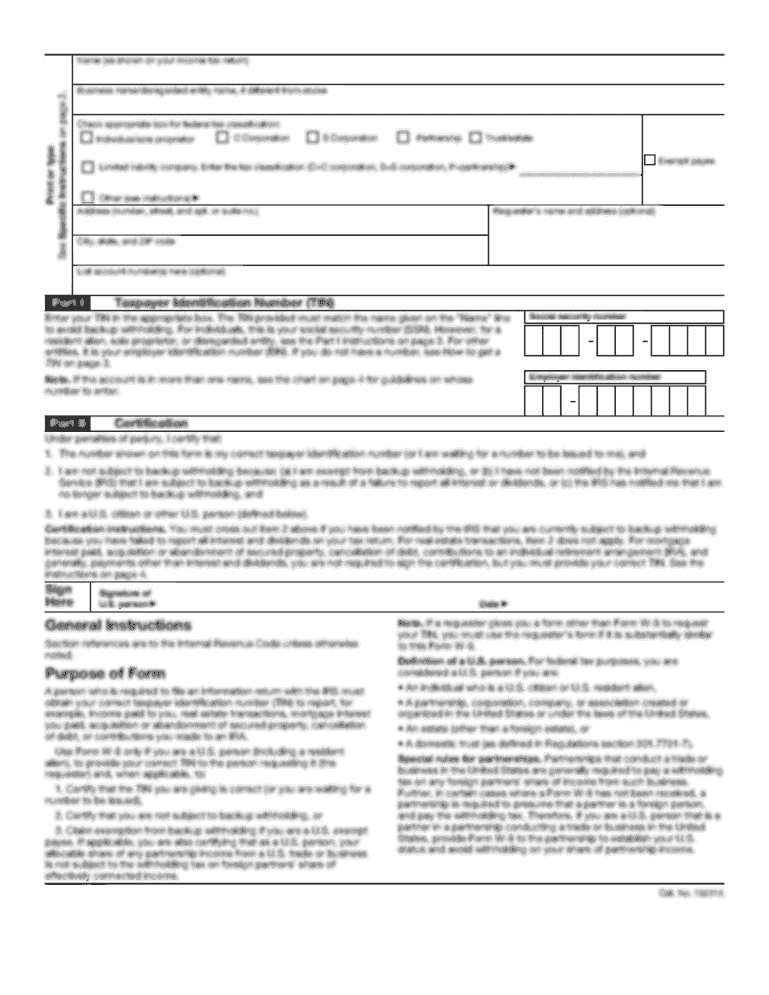

Who needs 2013 instructions for form:

01

Individuals filing taxes: People who need to file their taxes for the year 2013 may require the 2013 instructions for the relevant tax form. The instructions provide guidance on how to accurately fill out the form and report income, deductions, and credits.

02

Employers and employees: If there are any employment-related forms or payroll forms for the year 2013 to be filled out, both employers and employees may need to refer to the 2013 instructions. This helps in correctly reporting wages, deductions, and withholdings.

03

Independent contractors: Independent contractors who need to report their income or expenses for the year 2013 may also require the 2013 instructions specific to their form. These instructions assist in filling out the appropriate sections and understanding the requirements for self-employment tax.

04

Non-profit organizations: Non-profit organizations that need to file tax-exempt forms or other relevant forms for the year 2013 may find the 2013 instructions valuable. These instructions provide guidelines on completing the forms accurately and maintaining compliance with tax laws.

05

Individuals applying for government benefits: For individuals applying for government benefits or assistance programs for the year 2013, the 2013 instructions for the corresponding forms may be necessary. These instructions help in providing the required information and supporting documents to complete the application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

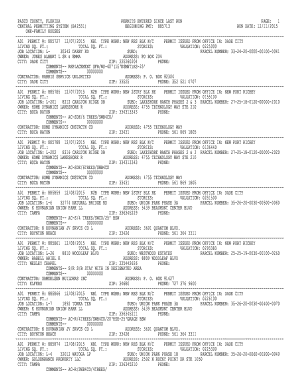

What is instructions for form ri-1096pt?

Instructions for form ri-1096pt provide guidance on how to properly complete and file the form.

Who is required to file instructions for form ri-1096pt?

Anyone who is required to submit form ri-1096pt is also required to file the instructions for the form.

How to fill out instructions for form ri-1096pt?

Instructions for form ri-1096pt should be completed by providing accurate information and following the provided guidelines.

What is the purpose of instructions for form ri-1096pt?

The purpose of instructions for form ri-1096pt is to assist individuals in correctly filing the associated form and to ensure compliance with tax regulations.

What information must be reported on instructions for form ri-1096pt?

Instructions for form ri-1096pt typically include details on how to calculate amounts, where to send the form, and any additional documentation that may be required.

When is the deadline to file instructions for form ri-1096pt in 2023?

The deadline to file instructions for form ri-1096pt in 2023 is typically the same as the deadline for submitting the associated form, which is usually on or before January 31.

What is the penalty for the late filing of instructions for form ri-1096pt?

The penalty for the late filing of instructions for form ri-1096pt may vary depending on the tax regulations in place, but typically includes fines or fees for each day the instructions are late.

How can I send 2013 instructions for form to be eSigned by others?

Once your 2013 instructions for form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an electronic signature for the 2013 instructions for form in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the 2013 instructions for form form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2013 instructions for form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your 2013 instructions for form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.