Get the free JATASOABGTA.doc. Substitute W-9 Form - helpdesk ws

Show details

Transfer Articulation Using Banner 7 Job Aid: Defining Transfer Institutions Purpose The Transfer Articulation Institution Form (SANTA) is used to capture and maintain information pertaining to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your jatasoabgtadoc substitute w-9 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your jatasoabgtadoc substitute w-9 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing jatasoabgtadoc substitute w-9 form online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit jatasoabgtadoc substitute w-9 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

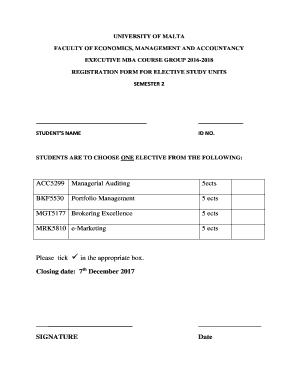

How to fill out jatasoabgtadoc substitute w-9 form

How to fill out the jatasoabgtadoc substitute W-9 form?

01

Start by downloading the jatasoabgtadoc substitute W-9 form from the official website of the Internal Revenue Service (IRS). Ensure that you have the latest version of the form.

02

Begin filling out the form by providing your full legal name. This should be the name associated with your Social Security Number (SSN) or Employer Identification Number (EIN) if you are a business entity.

03

Next, enter your business name (if applicable), which should match the name on your tax return. If you are an individual, you can leave this field blank.

04

Provide your business entity type, such as sole proprietorship, partnership, corporation, or disregarded entity. Choose the appropriate option based on your business structure.

05

Indicate your federal tax classification by checking the appropriate box. Most individuals will select "Individual/sole proprietor or single-member LLC." However, consult a tax professional if you are unsure about which option to choose.

06

Enter your address, including your street address, city, state, and ZIP code in the corresponding fields.

07

Include your account numbers if applicable. This is necessary for certain specified payments, such as real estate transactions or mortgage interest.

08

Sign and date the form to certify that the information provided is accurate. Failure to sign the form may invalidate it.

09

Lastly, submit the completed form to the requester as instructed by them. This could be an employer, financial institution, or another entity requiring your tax information.

Who needs the jatasoabgtadoc substitute W-9 form?

The jatasoabgtadoc substitute W-9 form is typically required by entities that need to obtain the tax identification information of individuals or businesses with which they engage in financial transactions. Some common situations where the form may be necessary include:

01

Independent contractors or freelancers providing services to businesses, who may need to provide their tax information for payment and reporting purposes.

02

Vendors or suppliers who receive payments from businesses, as their tax information is needed for accurate reporting and compliance.

03

Financial institutions, such as banks or brokerage firms, which may require individuals or businesses to provide their tax information to comply with federal reporting regulations.

04

Real estate transactions, where individuals or businesses involved in sales or transfers of property may need to complete a W-9 form for tax reporting purposes.

It is important to note that the specific circumstances and requirements for the jatasoabgtadoc substitute W-9 form may vary. Therefore, it is always advisable to consult the requester or a tax professional if you have any doubts or questions about its completion.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is jatasoabgtadoc substitute w-9 form?

The jatasoabgtadoc substitute W-9 form is a form used by businesses to provide their taxpayer identification number to other businesses.

Who is required to file jatasoabgtadoc substitute w-9 form?

Any business or individual who receives payments for services rendered is required to file a jatasoabgtadoc substitute W-9 form.

How to fill out jatasoabgtadoc substitute w-9 form?

To fill out a jatasoabgtadoc substitute W-9 form, you need to provide your name, address, taxpayer identification number, and certification.

What is the purpose of jatasoabgtadoc substitute w-9 form?

The purpose of the jatasoabgtadoc substitute W-9 form is to obtain the taxpayer identification number of a business or individual for tax reporting purposes.

What information must be reported on jatasoabgtadoc substitute w-9 form?

The jatasoabgtadoc substitute W-9 form must report the name, address, taxpayer identification number, and certification of the business or individual.

When is the deadline to file jatasoabgtadoc substitute w-9 form in 2023?

The deadline to file the jatasoabgtadoc substitute W-9 form in 2023 is typically January 31st.

What is the penalty for the late filing of jatasoabgtadoc substitute w-9 form?

The penalty for late filing of the jatasoabgtadoc substitute W-9 form can vary depending on the situation, but it can range from $50 to $270 per form.

How can I send jatasoabgtadoc substitute w-9 form for eSignature?

Once you are ready to share your jatasoabgtadoc substitute w-9 form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in jatasoabgtadoc substitute w-9 form?

With pdfFiller, the editing process is straightforward. Open your jatasoabgtadoc substitute w-9 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit jatasoabgtadoc substitute w-9 form on an Android device?

You can make any changes to PDF files, such as jatasoabgtadoc substitute w-9 form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your jatasoabgtadoc substitute w-9 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.