Get the free Retirement Savings Plan (RSP) enrolment form - MyStFX St ...

Show details

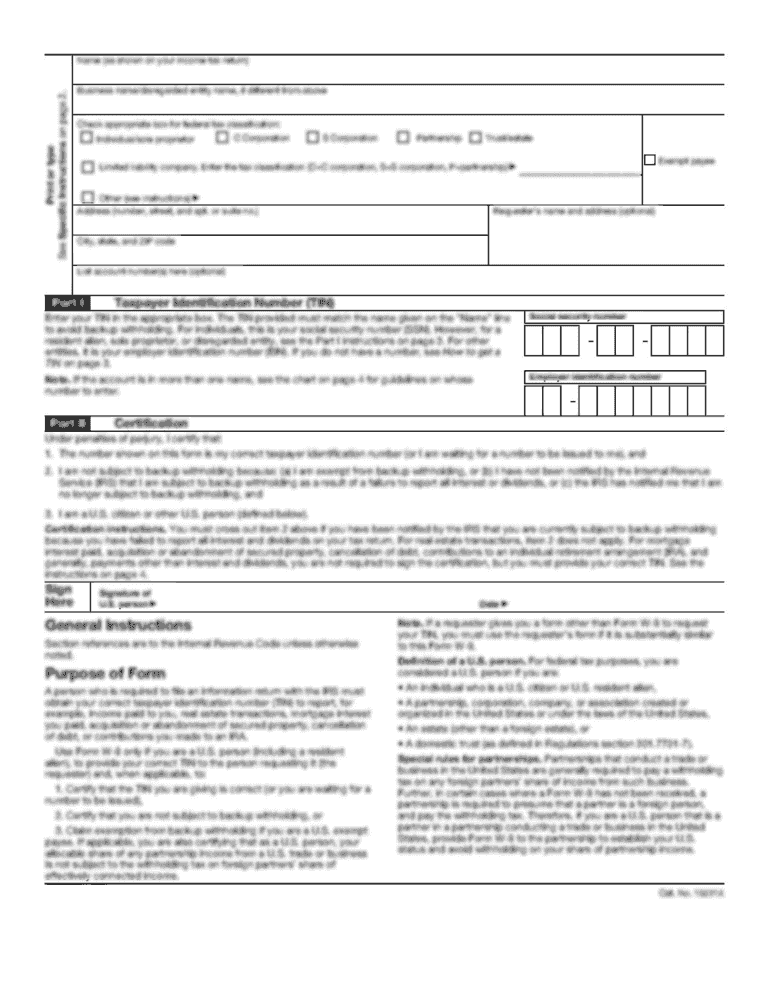

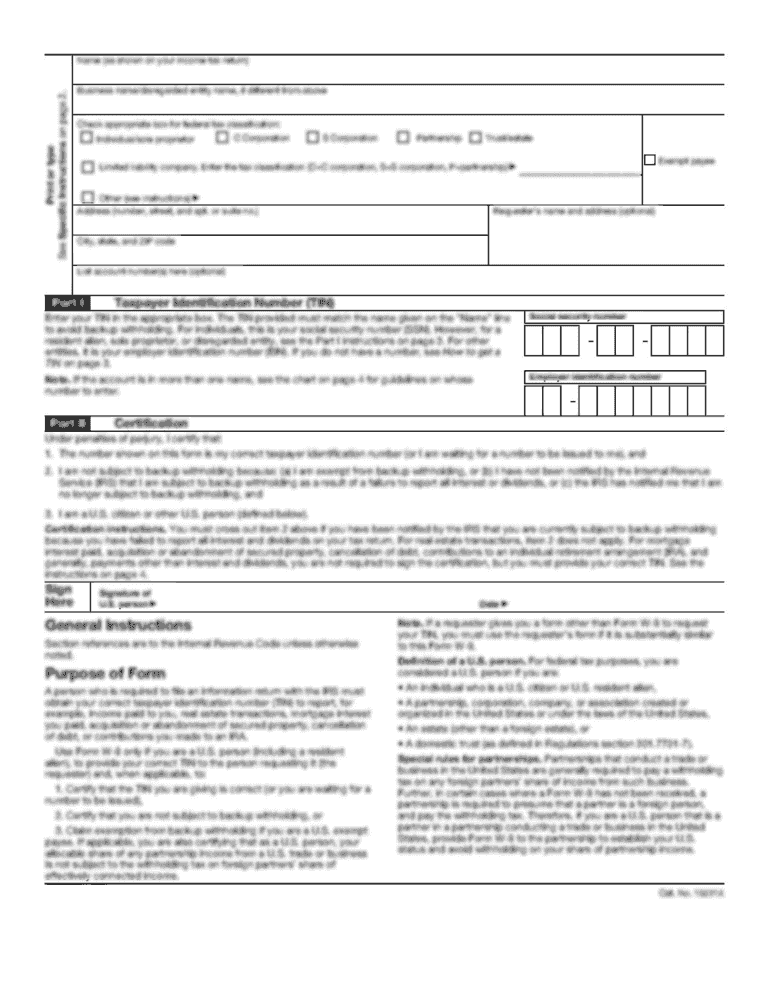

Retirement Savings Plan (RSP) enrollment form Sun Life Financial, Group Retirement Services PO Box 11001 STN CV, Montreal QC H3C 3P3 www.sunlife.ca Please PRINT clearly. Not : La version Fran raise

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your retirement savings plan rsp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement savings plan rsp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement savings plan rsp online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement savings plan rsp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out retirement savings plan rsp

How to fill out retirement savings plan rsp:

01

Gather all necessary information: Before filling out a retirement savings plan (RSP), gather important information such as your current age, income, expected retirement age, and desired retirement lifestyle. This will help you determine how much you need to save and make informed decisions.

02

Set clear retirement goals: Determine your retirement goals, whether it's to maintain your current lifestyle, travel, or start a small business. Having clear goals will guide your savings plan and motivate you to save regularly.

03

Calculate your retirement savings needs: Use a retirement calculator or consult a financial advisor to estimate how much you should save for retirement. Consider factors such as inflation, investment returns, and projected expenses during retirement.

04

Choose the right retirement savings plan: Research different retirement savings plans available in your country, such as individual retirement accounts (IRAs) or employer-sponsored retirement plans. Consider the contribution limits, tax benefits, and investment options offered by each plan.

05

Understand the contribution rules: Learn about the contribution rules for your chosen retirement savings plan. This includes understanding the maximum allowable contributions, deadlines, and any penalties for over-contributing or withdrawing funds early.

06

Set up automatic contributions: To ensure consistent savings, set up automatic contributions from your paycheck or bank account. This way, you won't have to manually remember to make regular contributions.

07

Select appropriate investment options: If your retirement savings plan offers investment options, research and choose investments that align with your risk tolerance and time horizon. Diversify your investments to mitigate risk and maximize potential returns.

08

Review and adjust your plan regularly: Regularly review your retirement savings plan to ensure it aligns with your changing financial circumstances and goals. Consider adjusting your contributions or investment allocations as necessary.

Who needs retirement savings plan rsp:

01

Individuals planning for retirement: Anyone who wants to save and invest for their retirement should consider a retirement savings plan. It provides a structured approach to accumulating funds over time and can help ensure financial security in retirement.

02

Employees without an employer-sponsored retirement plan: If your employer doesn't provide a retirement plan, a retirement savings plan such as an IRA can be an excellent option. It allows you to take control of your retirement savings and benefit from tax advantages.

03

Self-employed individuals: Self-employed individuals often don't have access to employer-sponsored retirement plans. A retirement savings plan like a solo 401(k) or SEP-IRA can enable self-employed individuals to save for retirement and reduce their taxable income.

04

Individuals seeking tax advantages: Retirement savings plans often offer tax advantages, such as contributions being tax-deductible or tax-free growth. If you want to reduce your current taxable income or enjoy tax-free growth on your investments, a retirement savings plan can be beneficial.

05

Those concerned about social security: Social security benefits may not be sufficient to cover all your expenses during retirement. By having a retirement savings plan, you can supplement your social security income and ensure a comfortable retirement lifestyle.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is retirement savings plan rsp?

Retirement savings plan rsp is a tax-advantaged account designed to help individuals save for retirement.

Who is required to file retirement savings plan rsp?

Employers who offer retirement savings plan rsp to their employees are required to file.

How to fill out retirement savings plan rsp?

To fill out retirement savings plan rsp, employers must provide information on the plan's contribution limits, participant eligibility, investment options, and administrative fees.

What is the purpose of retirement savings plan rsp?

The purpose of retirement savings plan rsp is to help individuals save for retirement and provide tax benefits.

What information must be reported on retirement savings plan rsp?

Information such as employee contributions, employer matching contributions, investment earnings, and plan fees must be reported on retirement savings plan rsp.

When is the deadline to file retirement savings plan rsp in 2023?

The deadline to file retirement savings plan rsp in 2023 is usually April 15th, but it is always recommended to check with the IRS for any updates or changes.

What is the penalty for the late filing of retirement savings plan rsp?

The penalty for the late filing of retirement savings plan rsp can vary, but it can be a percentage of the amount not reported or a flat fee per day of delay.

How can I send retirement savings plan rsp to be eSigned by others?

retirement savings plan rsp is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my retirement savings plan rsp in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your retirement savings plan rsp directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete retirement savings plan rsp on an Android device?

Use the pdfFiller Android app to finish your retirement savings plan rsp and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your retirement savings plan rsp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.