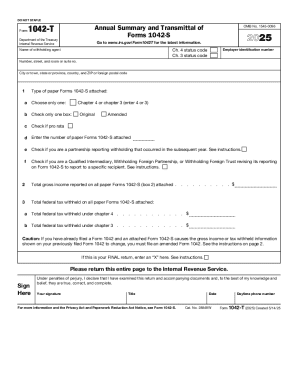

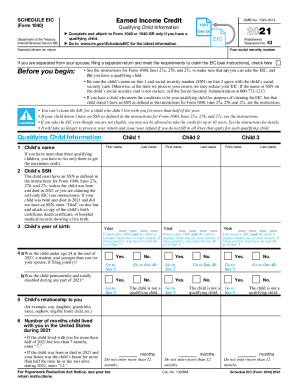

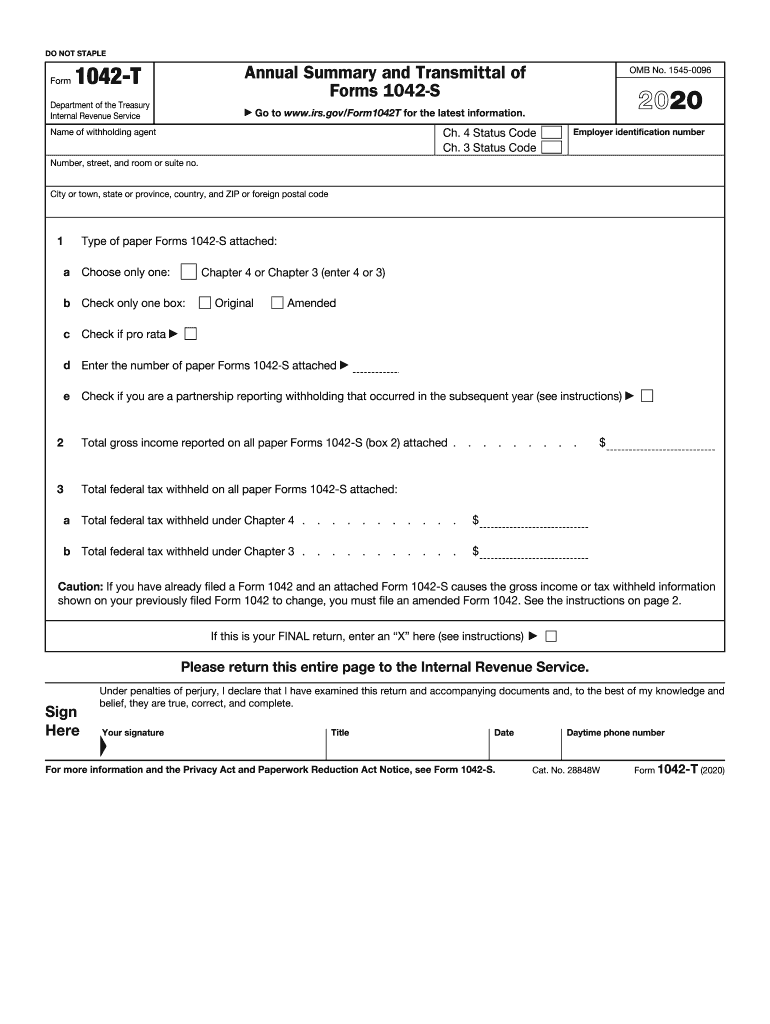

IRS 1042-T 2020 free printable template

Instructions and Help about IRS 1042-T

How to edit IRS 1042-T

How to fill out IRS 1042-T

About IRS 1042-T 2020 previous version

What is IRS 1042-T?

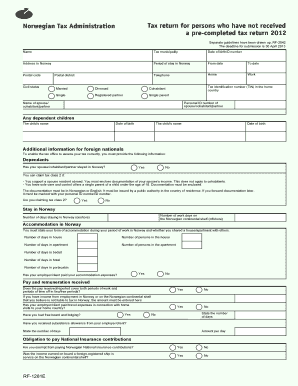

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1042-T

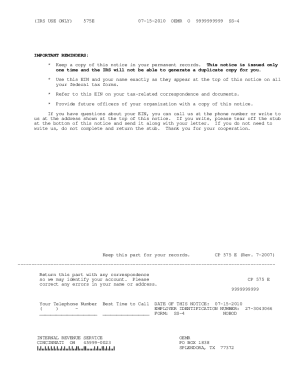

What should I do if I realize I've made a mistake on my form 1042 t after submission?

If you find an error after submitting your form 1042 t, you will need to file a corrected form. Ensure that you mark the box for 'Amended' on the new form to indicate it is a correction. It's essential to submit this as soon as possible to avoid potential penalties.

How can I verify the status of my submitted form 1042 t?

To check the status of your form 1042 t, you can reach out to the IRS directly through their helpline. Have your details ready and note that common e-file rejection codes include issues like incorrect taxpayer identification numbers and filing dates. Resolving these issues promptly is crucial for smooth processing.

What legal considerations should I keep in mind when filing form 1042 t electronically?

When e-filing form 1042 t, it's crucial to ensure your e-signature is acceptable as per IRS standards. Maintain data security by using secure platforms and be aware of the required record retention period, which is typically three years from the filing date. This helps you stay compliant with IRS regulations.

What common mistakes should I avoid when filing form 1042 t?

Some frequent errors when filing form 1042 t include providing incorrect payment amounts and failing to include all necessary payee information. To prevent these mistakes, double-check the figures and ensure all relevant data about foreign payees is accurately filled out before submission.