Get the free A Close Ended Equity Scheme investing in Eligible Securities as per

Show details

Key Information Memorandum & Application Form Investors must read the Key Information Memorandum and Instructions before completing this Form. HDFC Rajiv Gandhi Equity Savings Scheme Series 2 A Close

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your a close ended equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a close ended equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit a close ended equity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit a close ended equity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

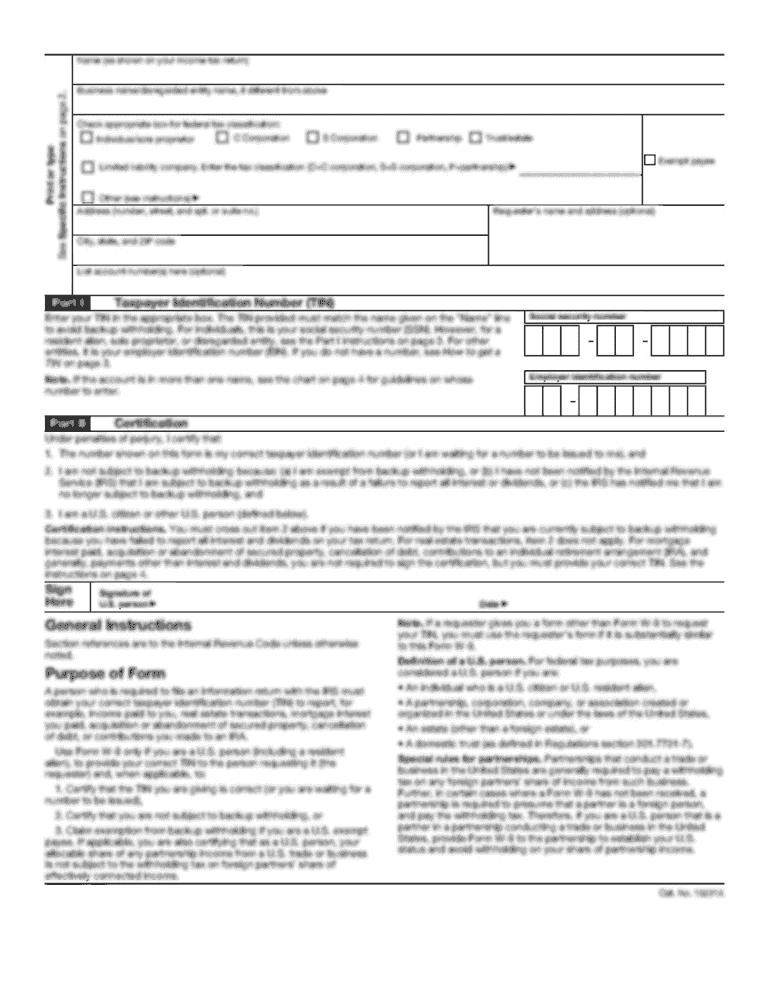

How to fill out a close ended equity

How to fill out a close ended equity:

01

Start by gathering all the necessary information and documents required to fill out the close ended equity form. This may include personal identification, financial statements, and any other relevant paperwork.

02

Carefully read through the instructions provided on the form to ensure you understand the specific requirements and sections that need to be completed.

03

Begin filling out the form by providing your personal details such as your name, address, social security number, and contact information.

04

Follow the prompts on the form to provide the required information about your investment, including the type of equity you are subscribing to and the amount you wish to invest.

05

If applicable, provide any additional details requested in the form, such as previous investment experience or intended use of funds.

06

Double-check all the information you have entered to ensure accuracy and completeness. Make sure to review any sections that require signatures or additional documentation.

07

Once you have completed the form, sign and date it as instructed and submit it to the appropriate party or organization. Keep a copy of the filled-out form for your records.

Who needs a close ended equity:

01

Investors seeking a more stable and long-term investment option may benefit from close ended equities. These investments often provide predictable returns and a fixed investment horizon.

02

Individuals or companies looking to diversify their investment portfolio may consider close ended equities as an option. These investments can provide exposure to different markets and sectors, helping to spread risk.

03

Close ended equities can be suitable for investors who are willing to tie up their funds for a specific period of time. These investments typically have a set duration, after which the investment can be liquidated or sold.

04

Investors who are comfortable with less liquidity in their investments may find close ended equities appealing. Unlike open ended funds, close ended equities are not subject to daily redemptions, providing more stability in uncertain markets.

05

Close ended equities can be attractive to investors who prefer a more professionally managed investment approach. These investments are often overseen by portfolio managers who actively make investment decisions on behalf of investors.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete a close ended equity online?

Filling out and eSigning a close ended equity is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the a close ended equity in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your a close ended equity in seconds.

How do I edit a close ended equity on an Android device?

The pdfFiller app for Android allows you to edit PDF files like a close ended equity. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your a close ended equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.