Get the free Small Business and Credit Access - National Federation of ...

Show details

Financing Small Businesses Small Business and Credit Access January 2011 The FIB Research Foundation is a small business-oriented research and information organization affiliated with the National

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your small business and credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small business and credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit small business and credit online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit small business and credit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out small business and credit

How to fill out small business and credit:

01

Start by gathering all necessary financial information related to your small business, including income and expenses, assets and liabilities, and any outstanding loans or credit lines. This will give you a clear picture of your current financial situation.

02

Create a business plan that outlines your goals, objectives, and strategies for your small business. This plan should also include a detailed financial projection for the next few years, taking into account potential revenue growth and expenses.

03

Research and compare different options for small business loans and credit lines. Look for lenders that offer competitive interest rates, flexible repayment terms, and any additional benefits or resources that may be useful for your business.

04

Prepare all necessary documentation required by lenders, such as your business plan, financial statements, tax returns, and any relevant legal documents. Make sure to keep these documents organized and up to date.

05

Apply for small business loans and credit lines that best fit your needs. Follow the application process outlined by each lender, which may include submitting your documentation, completing forms, and providing any additional information.

06

Consider alternative sources of funding for your small business, such as grants, crowdfunding, or angel investors. These options may provide additional financial resources to support your business growth.

Who needs small business and credit:

01

Entrepreneurs and aspiring business owners who want to start their own small businesses and need financial support to fund their startup costs, purchase equipment or inventory, or cover initial operating expenses.

02

Existing small business owners who require additional capital to expand their operations, invest in new technologies, hire staff, or open new locations.

03

Individuals who want to establish business credit separate from their personal credit. This can help protect personal assets and build a strong credit history for the business, making it easier to access financing in the future.

Overall, small business and credit are essential for individuals and businesses looking to start, grow, or sustain their entrepreneurial ventures. It enables them to access the necessary funds and resources needed to succeed in a competitive market.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

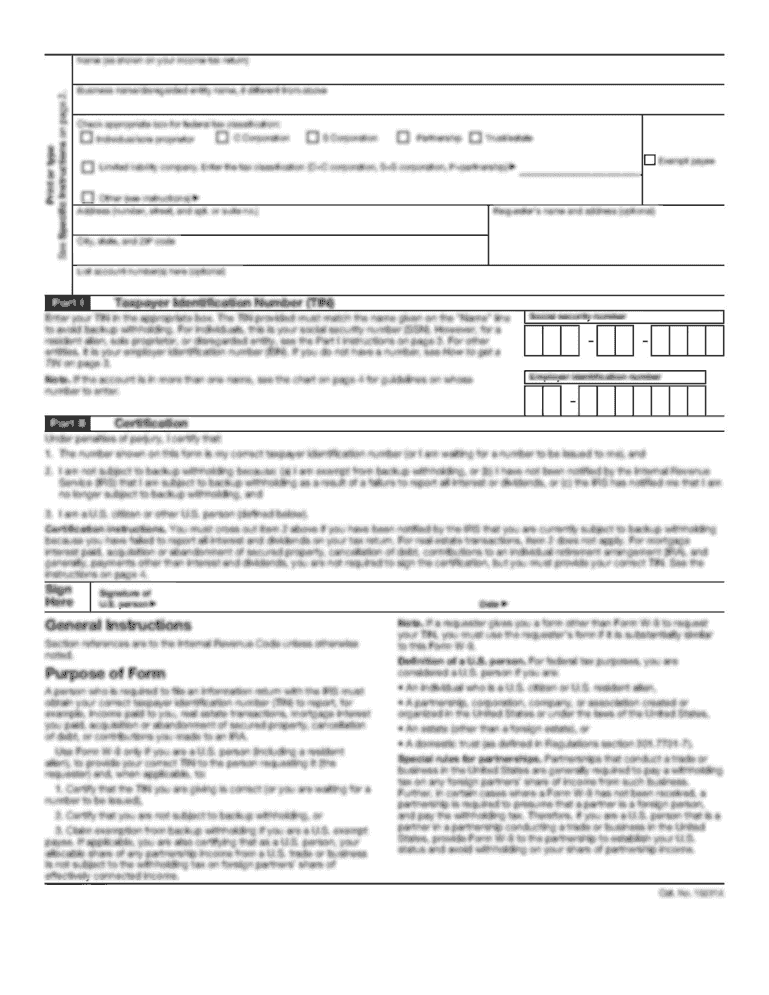

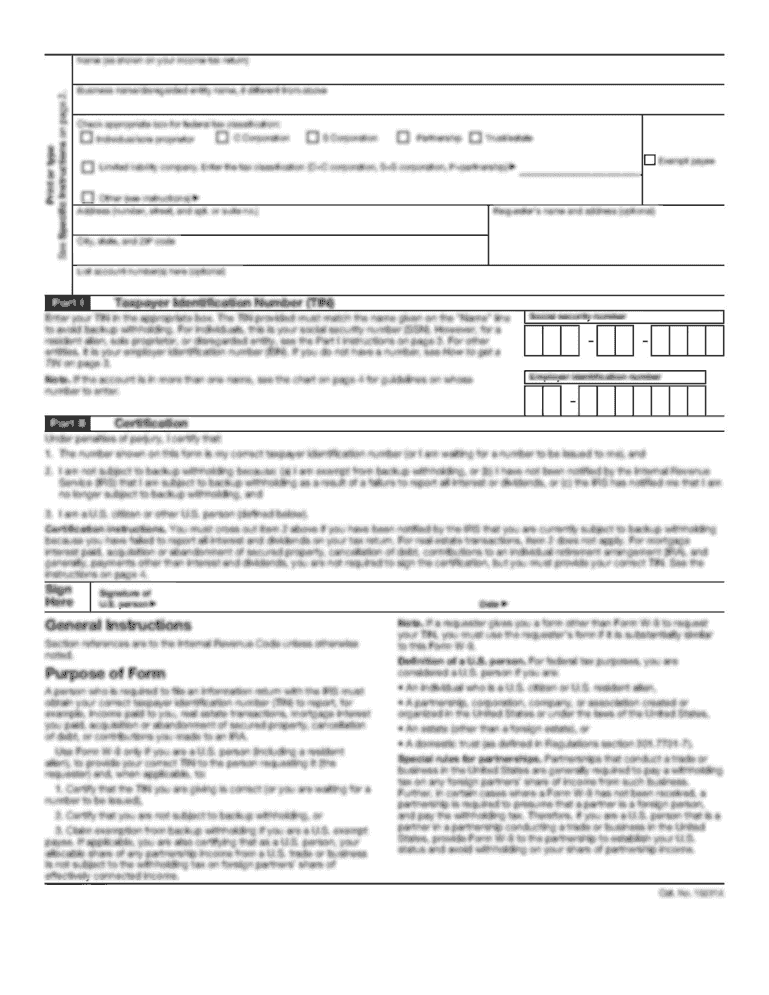

What is small business and credit?

Small business and credit refers to the financial support provided to small businesses by lending institutions in the form of loans or lines of credit.

Who is required to file small business and credit?

Small business owners or managers who have taken out a loan or credit for their business are required to file small business and credit.

How to fill out small business and credit?

Small business and credit can be filled out by providing detailed information about the loan or credit obtained, including the amount, terms, and purpose.

What is the purpose of small business and credit?

The purpose of small business and credit is to help small businesses access the necessary funds to grow and expand their operations.

What information must be reported on small business and credit?

Information such as the name of the lending institution, amount borrowed, interest rate, repayment terms, and the use of funds must be reported on small business and credit.

When is the deadline to file small business and credit in 2023?

The deadline to file small business and credit in 2023 is usually April 15th.

What is the penalty for the late filing of small business and credit?

The penalty for the late filing of small business and credit can vary, but it may include additional fees or fines imposed by the relevant authorities.

How can I get small business and credit?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific small business and credit and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How can I edit small business and credit on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing small business and credit, you can start right away.

How do I complete small business and credit on an Android device?

On an Android device, use the pdfFiller mobile app to finish your small business and credit. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your small business and credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.