Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

The term "IRS J" is not clear, and it is possible that it may refer to different things depending on the context. Without additional information, it is difficult to determine the specific meaning of "IRS J." It is recommended to provide more context or specify the topic related to "IRS J" for a more accurate response.

Who is required to file irs j?

There is no specific IRS form called "IRS J". However, individuals or entities may be required to file various types of forms with the IRS, depending on their particular tax situation. Some common forms include:

1. Form 1040: Individual Income Tax Return - Most individuals must file this form to report their annual income and calculate their tax liability.

2. Form 1065: U.S. Return of Partnership Income - Partnerships are required to file this form to report their income, deductions, profits, and losses.

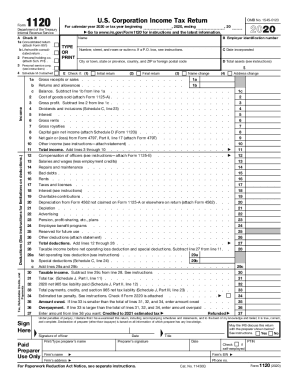

3. Form 1120: U.S. Corporation Income Tax Return - Corporations file this form to report their income, deductions, and tax liability.

4. Form 941: Employer's Quarterly Federal Tax Return - Employers must file this form to report their employment taxes, such as federal income tax withholding and Social Security and Medicare taxes.

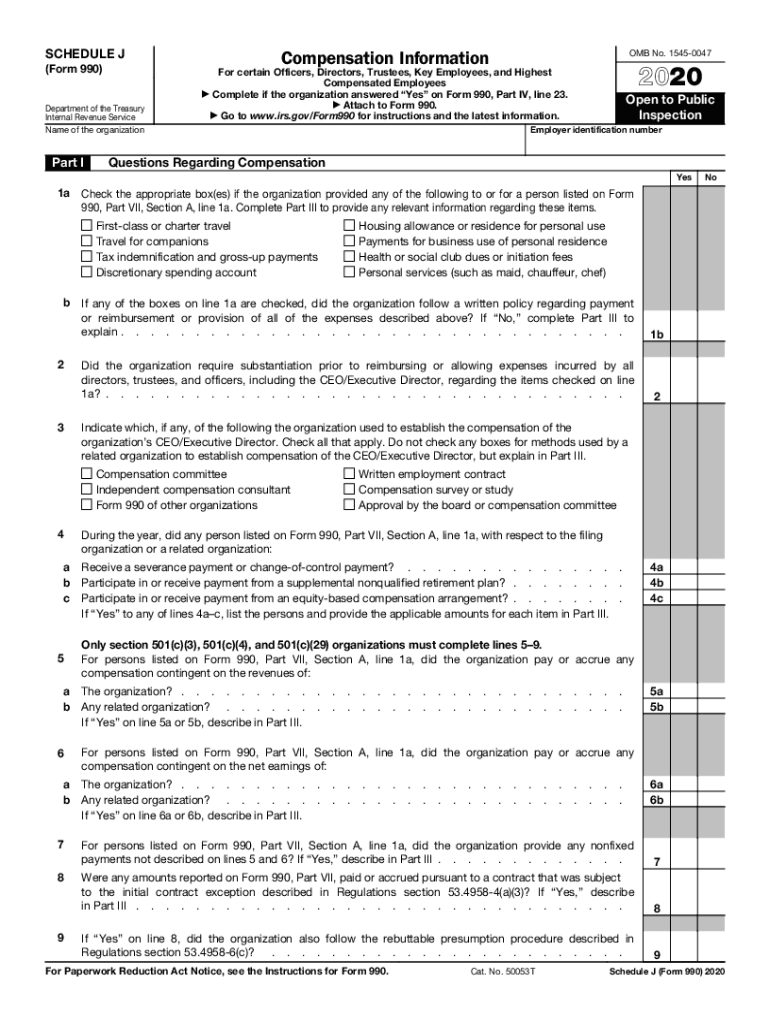

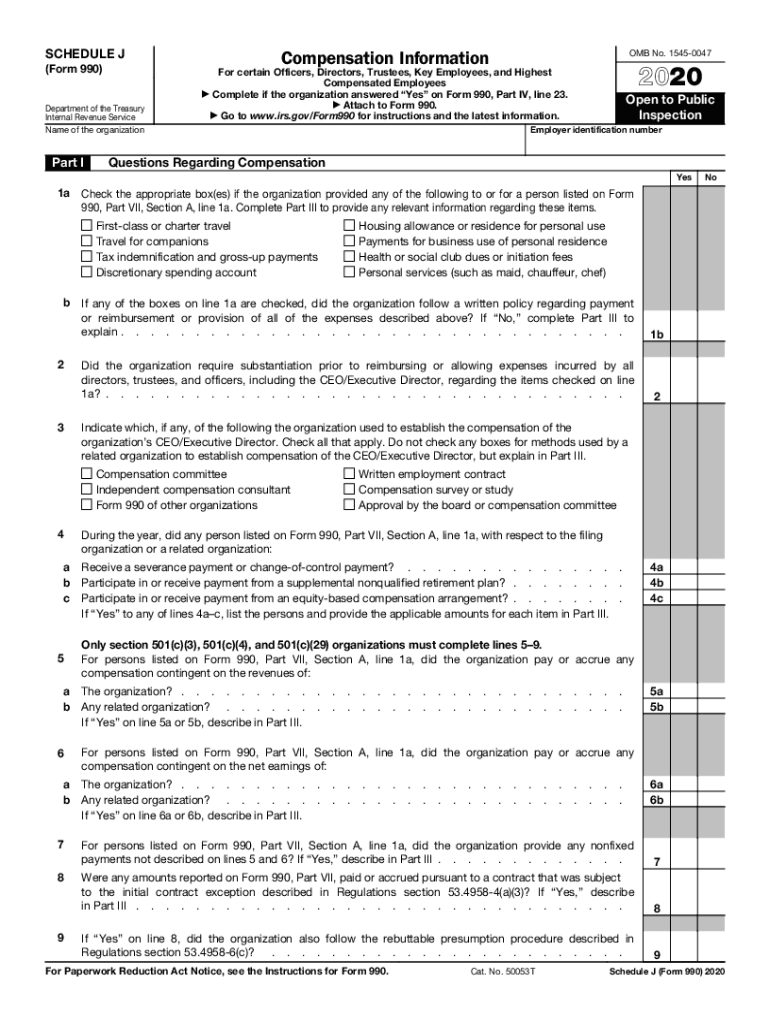

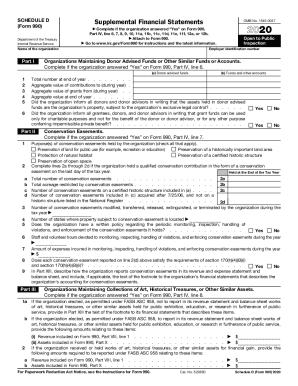

5. Form 990: Return of Organization Exempt from Income Tax - Non-profit organizations are generally required to file this form to report their financial information and maintain tax-exempt status.

It is important to consult the IRS website or a tax professional to determine which specific forms need to be filed based on your individual circumstances.

The term "IRS J" is not widely used or recognized. It is possible that you may be referring to a specific form or document, but without more information, it is difficult to provide detailed guidance on how to fill it out.

If you are referring to a specific IRS form or schedule, please provide the correct form number or a more detailed description of what you are looking for assistance with. This will enable us to provide you with specific instructions on how to fill it out correctly.

What information must be reported on irs j?

IRS Form J is not a specific form used by the Internal Revenue Service (IRS). Therefore, there is no specific information that must be reported on it. It is possible that you might be referring to another form or a specific schedule or attachment to a form.

To provide a more accurate answer, please clarify or provide more details about the form or schedule you are referring to.

What is the penalty for the late filing of irs j?

There is no specific form called "IRS J" in the Internal Revenue Service (IRS) tax forms. However, if you are referring to the late filing of an individual tax return (Form 1040), the penalty can be calculated as follows:

- Failure-to-file penalty: If you do not file your tax return by the due date (usually April 15th), you may incur a penalty of 5% of the unpaid taxes for each month (or part of a month) that the return is late, up to a maximum of 25% of the unpaid taxes.

- Failure-to-pay penalty: If you file your return but fail to pay the taxes owed by the due date, you may face a penalty of 0.5% of the unpaid taxes for each month (or part of a month) that the payment is late, up to a maximum of 25% of the unpaid taxes.

It's important to note that these penalties can be avoided or reduced if you have reasonable cause for the late filing or payment and if you request abatement from the IRS.

If you were referring to a different form or a specific situation, please provide more details for a more accurate response.

How can I manage my irs j directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form 990 schedule j and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete irs j online?

pdfFiller has made filling out and eSigning irs schedule j easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit irs schedule j form in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing schedule j information and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.