Get the free tax rate calculator form

Show details

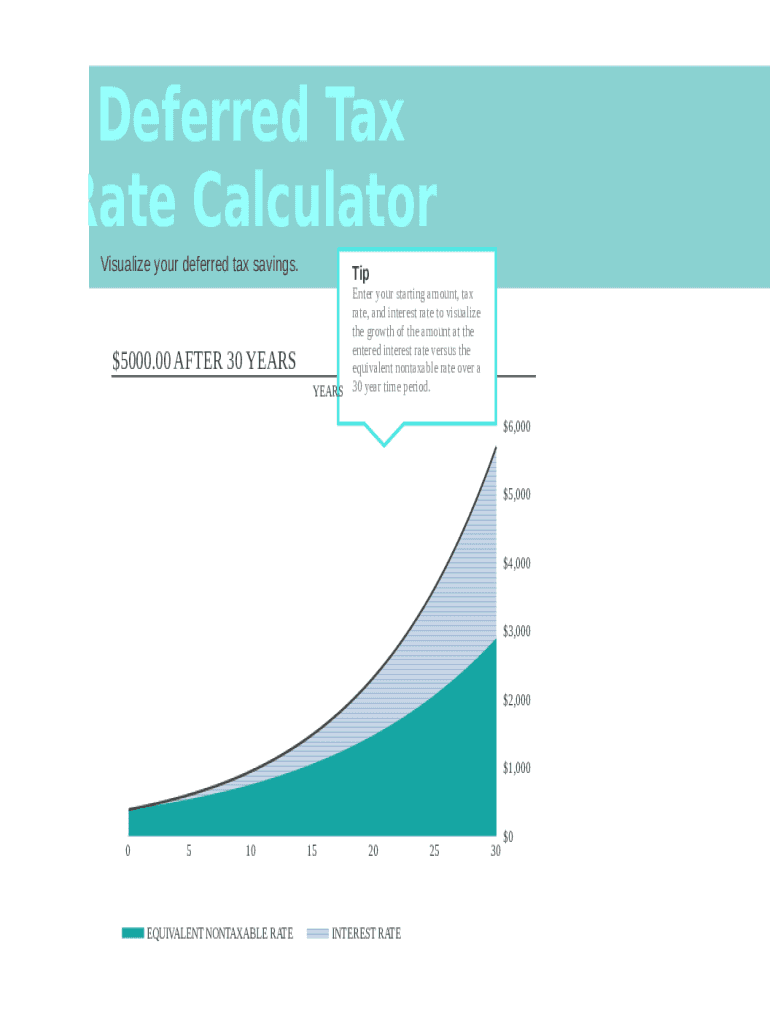

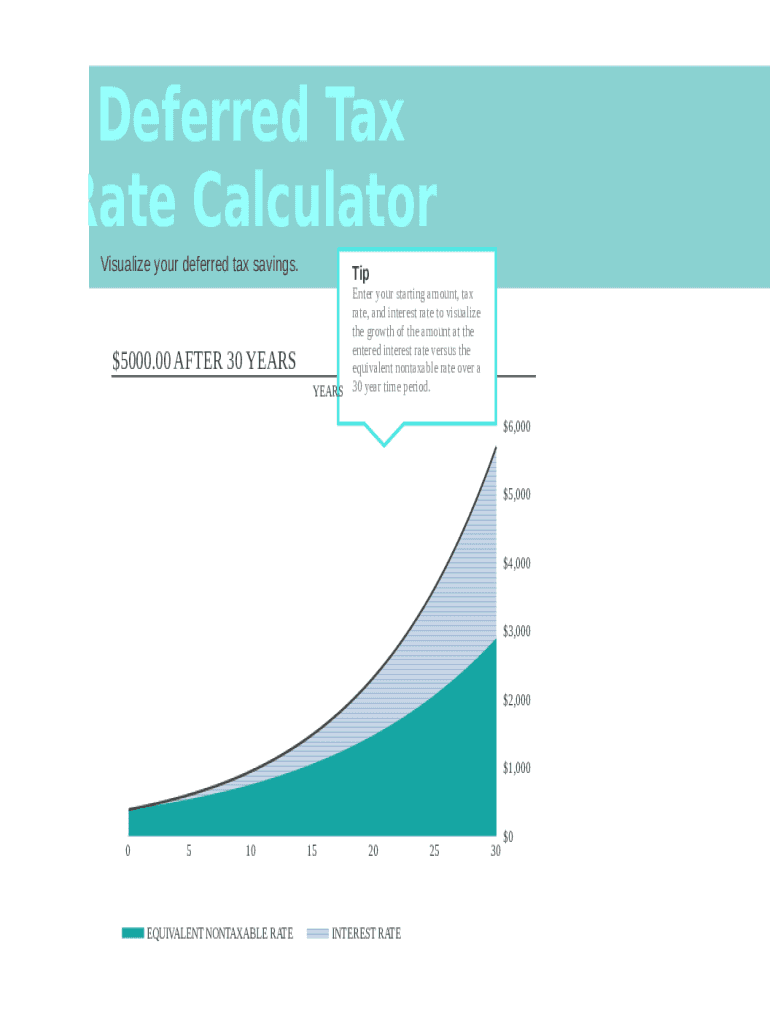

Deferred Tax

Rate Calculator

Visualize your deferred tax savings.$5000.00 AFTER 30 Years

Enter your starting amount, tax

rate, and interest rate to visualize

the growth of the amount at the

entered

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax rate calculator form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax rate calculator form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax rate calculator online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit rate calculator spreadsheet form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out tax rate calculator form

How to fill out tax rate calculator:

01

Gather all relevant income information, such as your salary, additional sources of income, and any deductions or exemptions you may have.

02

Enter the income information into the appropriate fields of the tax rate calculator, ensuring accuracy and completeness.

03

Provide information about your filing status, such as whether you are single, married filing jointly, or head of household.

04

Input details regarding any tax credits or deductions that you might qualify for, such as child tax credits or mortgage interest deductions.

05

Double-check all the entered information to ensure accuracy before proceeding.

06

Click on the calculate button or similar option to let the tax rate calculator process the provided data.

07

Review the calculated results, which may include your taxable income, total tax liability, and effective tax rate.

08

Use the results from the tax rate calculator to make informed decisions about tax planning, withholding adjustments, or estimated tax payments.

Who needs tax rate calculator:

01

Individuals who want to estimate their tax liability before filing their tax returns.

02

Taxpayers who anticipate changes in their financial situation and wish to plan ahead for potential tax consequences.

03

Small business owners or self-employed individuals who need to calculate their estimated quarterly taxes.

04

Professionals who provide tax advice or assistance to clients and require a tool for accurate tax rate calculations.

05

Individuals who want to compare the tax rates and liabilities of different filing statuses or scenarios.

06

Anyone who wants to gain a better understanding of how specific factors, deductions, or credits affect their overall tax rate.

Fill tax template editing fillable : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax rate calculator?

A tax rate calculator is a tool used to determine the percentage of tax that needs to be paid on a specific income or transaction. It takes into account various factors such as income level, filing status, and applicable deductions or credits to calculate the accurate tax rate. This allows individuals or businesses to estimate their tax liability and plan their finances accordingly.

Who is required to file tax rate calculator?

Taxpayers are required to file tax rate calculators.

How to fill out tax rate calculator?

To fill out a tax rate calculator, follow these steps:

1. Gather all necessary information: Collect all your income and expense information, including your annual salary, deductions, credits, and other sources of income.

2. Determine your filing status: You need to know whether you are filing as single, married filing jointly, married filing separately, or head of household.

3. Enter your income: Input your taxable wages, salaries, or any other income you receive. This includes income from self-employment, rental properties, investments, and any other sources.

4. Enter deductions: If you have any deductions, such as student loan interest, mortgage interest, or medical expenses, enter these values into the calculator. Make sure to have accurate documentation and receipts to support your deductions.

5. Include credits: If you qualify for any tax credits, such as the Child Tax Credit or the Earned Income Tax Credit, enter these amounts into the calculator.

6. Calculate deductions, credits, and exemptions: The calculator may prompt you to enter any exemptions or additional deductions that you may have.

7. Determine the tax rate: After entering all the necessary information, the calculator will compute your tax liability. It will provide you with the total amount of tax you owe based on your income, deductions, and credits.

8. Review and verify: Double-check all the information you provided to ensure accuracy. Ensure that you have considered all applicable factors that may affect your tax rate.

9. Apply the calculated rate: Finally, use the computed tax rate to accurately complete your tax return or to estimate your tax liability for planning purposes.

What is the purpose of tax rate calculator?

The purpose of a tax rate calculator is to determine the amount of taxes an individual or business is required to pay based on their income or other relevant factors. It uses the applicable tax rates and formulas to calculate the tax liability. This calculator helps individuals and businesses plan their finances, estimate tax payments, and ensure compliance with tax regulations. It can also provide insights into how different factors or changes in income can affect the tax amount.

What information must be reported on tax rate calculator?

The information that must be reported on a tax rate calculator typically includes:

1. Filing status: This refers to whether you are single, married filing jointly, married filing separately, head of household, or a qualifying widow(er). Different filing statuses have different tax rates.

2. Taxable income: This is the total amount of income that is subject to taxation after deductions and exemptions have been applied.

3. Deductions: Relevant deductions might include student loan interest, mortgage interest, state and local taxes, medical expenses, etc. These deductions help reduce your taxable income.

4. Exemptions: This refers to the number of dependents you have, such as children or other dependents, that may reduce your taxable income.

5. State or local taxes: Some tax calculators may also require you to input your state and/or local tax rates if applicable, as it varies from state to state.

6. Other relevant factors: Some tax calculators may include additional sections where you can enter other variables like retirement contributions, self-employment income, capital gains, and other tax credits or deductions that apply to your specific situation.

The tax rate calculator uses this information to estimate your tax liability and determine the appropriate tax rate based on your income and filing status.

What is the penalty for the late filing of tax rate calculator?

There is no specific penalty for the late filing of a tax rate calculator, as it is not a tax filing document. However, if you are referring to late filing of tax returns, the penalty varies depending on the jurisdiction and the amount of tax owed. Generally, penalties can include late filing fees, interest charges on unpaid taxes, and potential audits or investigations by tax authorities. It is advisable to consult with a tax professional or review the specific tax regulations in your jurisdiction for accurate and detailed information regarding late filing penalties.

How can I manage my tax rate calculator directly from Gmail?

rate calculator spreadsheet form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send tax template form for eSignature?

When you're ready to share your deferred income tax liability calculation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete deferred tax calculator excel on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your deferred tax sheet form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your tax rate calculator form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Template Form is not the form you're looking for?Search for another form here.

Keywords relevant to tax template editing fillable form

Related to tax template editing fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.