Get the free insurance policy card form

Show details

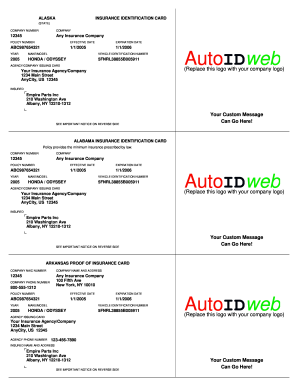

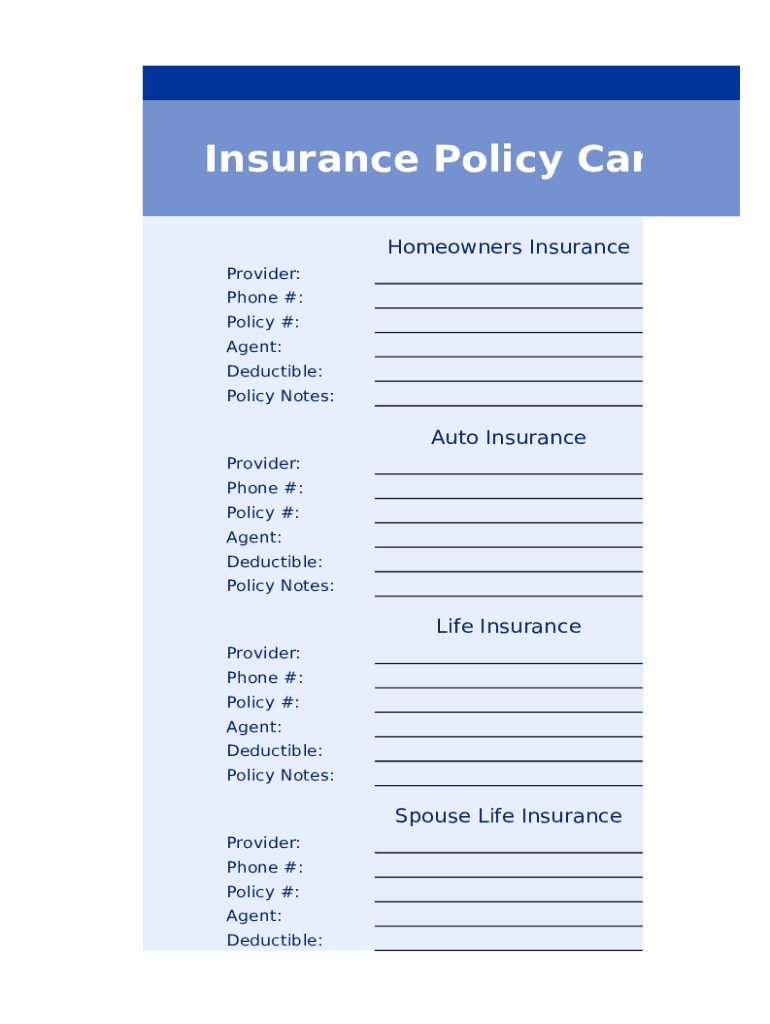

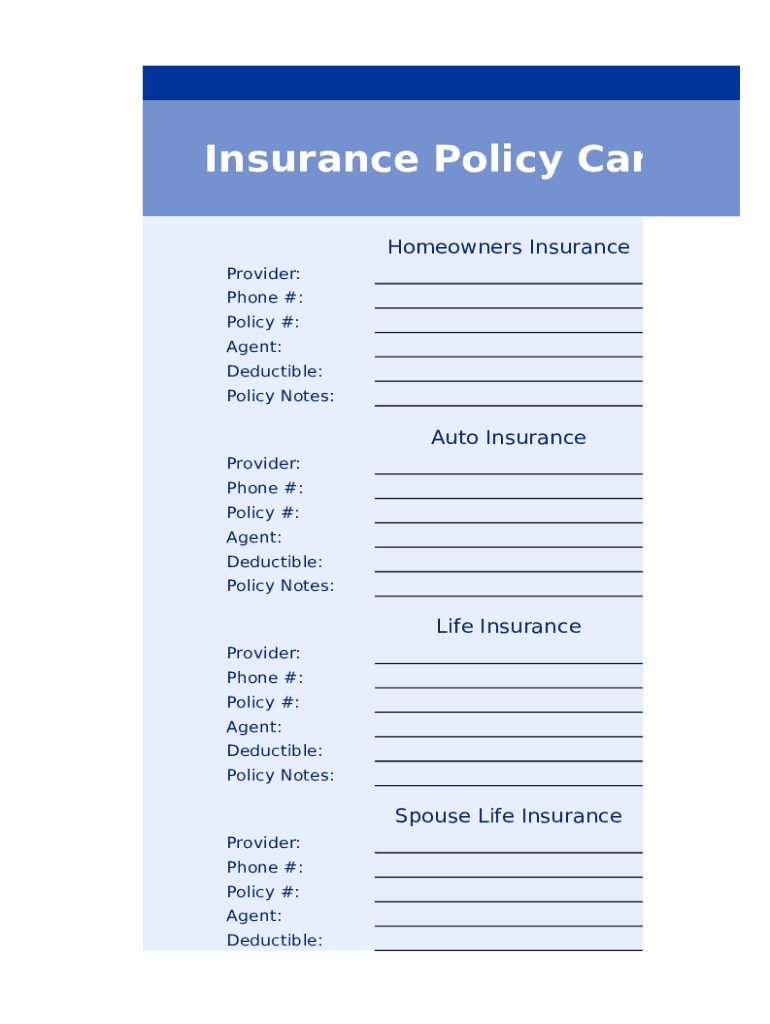

Insurance Policy Card

Homeowners Insurance

Provider:

Phone #:

Policy #:

Agent:

Deductible:

Policy Notes:Auto Insurance

Provider:

Phone #:

Policy #:

Agent:

Deductible:

Policy Notes:Life Insurance

Provider:

Phone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your insurance policy card form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance policy card form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance policy card online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit insurance templates form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out insurance policy card form

How to fill out insurance policy card:

01

Begin by reviewing the policy card carefully, making sure to understand all the sections and information required.

02

Provide personal details such as your full name, address, date of birth, and contact information. This information is crucial for identification purposes.

03

Next, enter the policy number assigned to you by the insurance company. This number helps to associate all the relevant information with your specific policy.

04

Specify the effective date of the policy, which is the date when the coverage begins. Make sure to accurately enter this date to ensure that your policy is valid.

05

Fill in any additional sections that require specific information related to your insurance policy, such as the type of coverage, deductibles, and policy endorsements.

06

Review the completed information thoroughly to ensure its accuracy and make any necessary corrections.

07

Sign and date the insurance policy card to validate and acknowledge that you have provided accurate and truthful information.

08

Keep a copy of the filled-out insurance policy card for your records, as it might be needed for future reference or in case of any claims or disputes.

Who needs an insurance policy card:

01

Individuals who have purchased an insurance policy for various purposes such as auto, home, health, or life insurance. It serves as proof of coverage and policy details.

02

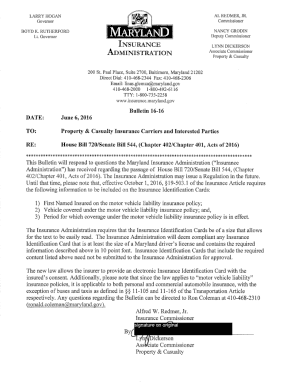

Policyholders, as it is required by law in many jurisdictions to carry a physical copy or have access to an electronic version of the insurance policy card.

03

Third parties, such as healthcare providers or automobile repair shops, who might require the insurance policy card to confirm coverage and process claims or payments.

04

It is important for anyone who possesses an active insurance policy to keep the insurance policy card readily available to provide proof of coverage when needed.

Fill blank texas auto insurance card template : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance policy card?

An insurance policy card is a physical or digital document issued by an insurance company that serves as proof of insurance coverage. It generally includes the policyholder's name, policy number, effective dates of coverage, and contact information for the insurance company. The policy card is typically carried by the policyholder and may be requested as evidence of insurance in various situations, such as when filing a claim or during a traffic stop.

Who is required to file insurance policy card?

Typically, the policyholder or the person covered under the insurance policy is required to file the insurance policy card. This is usually done when obtaining medical services, such as visiting a doctor or hospital, so that the healthcare provider can verify the individual's insurance coverage and bill the insurance company accordingly.

How to fill out insurance policy card?

To properly fill out an insurance policy card, follow these steps:

1. Locate your insurance policy card: Typically, insurance policy cards are provided by your insurance company either by mail or electronically through an online portal.

2. Personal Information: Fill in your personal information, including your full name, address, and contact details. Ensure that the information provided matches the details on your insurance policy and identification documents.

3. Policy/Member ID: Enter your policy or member identification number. This number is unique to your insurance policy and helps the insurance company identify you as a policyholder.

4. Effective Dates: Indicate the start and end dates of your insurance policy coverage. This information should be mentioned on your policy document or can be obtained by contacting your insurance company directly.

5. Insurance Company Information: Enter the name and contact details of your insurance company. This information can usually be found on your policy document, insurance card, or by visiting the insurance company's website.

6. Primary Care Physician: If your insurance policy requires you to designate a primary care physician (PCP), include the name, address, and contact details of your chosen PCP.

7. Emergency Contact Information: Provide emergency contact information, such as a trusted friend or family member's name and contact number. This information can be used by medical professionals in case of emergencies.

8. Additional Required Information: Some insurance policy cards may require additional information specific to your policy, such as a group identification number, prescription drug coverage information, or specific in-network provider details. Fill in these fields if applicable.

9. Signature: If necessary, sign the insurance policy card to certify the accuracy of the information provided.

10. Submitting the Card: Once you have completed filling out the policy card, follow any instructions provided by your insurance company on submitting the card. This may include mailing it back, uploading it through an online portal, or providing it to your human resources department if provided by your employer.

Remember to keep a copy of the completed insurance policy card for your records. If you have any doubts or questions regarding the process, reach out to your insurance company's customer service for assistance.

What is the purpose of insurance policy card?

The purpose of an insurance policy card is to provide proof of insurance coverage to the policyholder. It serves as documentation that the policyholder has an active insurance policy and can be presented to various entities, such as healthcare providers or law enforcement, as evidence of insurance coverage. The insurance policy card typically contains important information such as the policyholder's name, policy number, effective dates of coverage, and contact information for the insurance company.

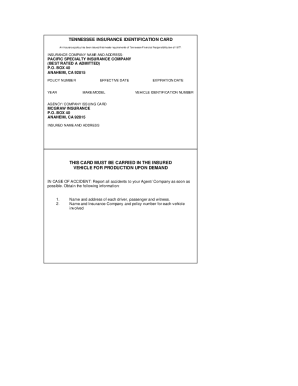

What information must be reported on insurance policy card?

The information that must be reported on an insurance policy card can vary depending on the type of insurance. However, generally, the following information is typically included:

1. Policyholder's Name: The name of the individual or entity that owns the insurance policy.

2. Policy Number: A unique identifier that helps identify the specific insurance policy.

3. Effective Date: The date on which the insurance policy coverage begins.

4. Expiration Date: The date on which the insurance policy coverage ends, unless renewed.

5. Insurance Company Name: The name of the insurance company providing the coverage.

6. Insurance Company Contact Information: Contact details such as phone number, mailing address, and website of the insurance company.

7. Type of Coverage: A brief description of the type of insurance coverage provided, such as health, auto, home, etc.

8. Insured Individual(s): Names and potentially other relevant information about the individuals covered by the insurance policy.

9. Insurance Agent Information: Contact details, including name, phone number, and address, of the insurance agent or agency who sold the policy.

10. Emergency Contact Information: In some cases, emergency contact information may be included for situations requiring immediate assistance.

Keep in mind that specific policies may have additional or different information included on the insurance policy card. It is always important to review the card and read the policy documentation thoroughly to understand the full extent of coverage and any conditions or exclusions.

What is the penalty for the late filing of insurance policy card?

The penalty for the late filing of an insurance policy card can vary depending on the insurance provider and the specific policy terms. Typically, if you fail to file the policy card within the allotted timeframe specified by the insurance provider, there may be consequences such as a lapse in coverage or a delay in processing claims. In some cases, there may also be a penalty fee imposed by the insurance company for the late filing. It is important to review the terms and conditions of your insurance policy or contact your insurance provider directly to understand the specific penalties in your situation.

How can I modify insurance policy card without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including insurance templates form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in insurance templates editable form?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your insurance templates editable and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How can I edit insurance policy template on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing insurance policy fillable form.

Fill out your insurance policy card form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Templates Editable Form is not the form you're looking for?Search for another form here.

Keywords relevant to insurance templates type template form

Related to insurance templates fillable

If you believe that this page should be taken down, please follow our DMCA take down process

here

.