Get the free CENTRAL UNITED LIFE INSURANCE COMPANY Claim Form

Show details

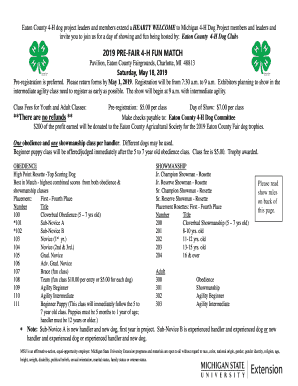

CENTRAL UNITED LIFE INSURANCE COMPANY INVESTORS CONSOLIDATED INSURANCE COMPANY Claim Form CAUTION: Any person who knowingly and with intent to injure, defraud, or deceive any insurance company files

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your central united life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central united life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit central united life insurance online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit central united life insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out central united life insurance

How to Fill Out Central United Life Insurance:

01

Start by gathering all necessary personal information, such as your full name, date of birth, and contact details.

02

Next, provide details about your current health status, including any pre-existing medical conditions or medications you are currently taking.

03

Proceed to disclose any lifestyle habits that may affect your coverage, such as smoking or engaging in high-risk activities.

04

Indicate the type and amount of coverage you are seeking, whether it's term life insurance, whole life insurance, or another option offered by Central United Life Insurance.

05

Review the available policy options to choose the one that best suits your needs and budget. Consider factors such as the premium amount, death benefit, and any additional riders or benefits included in the policy.

06

Once you have made your selections, carefully read and understand the terms and conditions of the policy. If you have any questions or concerns, don't hesitate to reach out to a representative from Central United Life Insurance for clarification.

07

Finally, complete the application form accurately and thoroughly. Double-check all the information provided to ensure it is correct and up to date.

Who needs Central United Life Insurance?

01

Individuals who have dependents, such as a spouse, children, or aging parents, may require life insurance to financially protect their loved ones in the event of their death.

02

People with outstanding debts, such as mortgages, student loans, or credit card debts, may consider Central United Life Insurance to ensure their debts are paid off in case of their passing.

03

Business owners or partners may need life insurance to safeguard their businesses in case of untimely death, ensuring the continuity and financial stability of the company.

04

Individuals who want to leave a legacy or provide an inheritance to their loved ones may opt for Central United Life Insurance as a way to accumulate and pass on wealth.

05

Those who want to cover their funeral expenses and alleviate the financial burden on their family members often choose to have life insurance to address these costs.

Remember, it's crucial to evaluate your specific financial situation and goals before deciding on Central United Life Insurance or any other life insurance policy. When in doubt, consult with a financial advisor or insurance professional to ensure you make an informed decision.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is central united life insurance?

Central United Life Insurance is a type of insurance policy that provides coverage for individuals, typically for a certain period of time.

Who is required to file central united life insurance?

Individuals who have purchased a central united life insurance policy are required to file for it.

How to fill out central united life insurance?

To fill out a central united life insurance form, you will need to provide personal information, policy details, and beneficiary information.

What is the purpose of central united life insurance?

The purpose of central united life insurance is to provide financial protection to the policyholder's beneficiaries in the event of the policyholder's death.

What information must be reported on central united life insurance?

Information such as policyholder's personal details, policy coverage details, beneficiary information must be reported on central united life insurance.

When is the deadline to file central united life insurance in 2023?

The deadline to file central united life insurance in 2023 is typically specified in the policy terms, but it is usually within a certain number of days after the policyholder's death.

What is the penalty for the late filing of central united life insurance?

The penalty for late filing of central united life insurance can vary depending on the insurance provider, but it may result in a delay in processing the claim or denial of the claim altogether.

How do I complete central united life insurance online?

Filling out and eSigning central united life insurance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an eSignature for the central united life insurance in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your central united life insurance directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete central united life insurance on an Android device?

Use the pdfFiller mobile app and complete your central united life insurance and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your central united life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.