IRS 1040 - Schedule F 2020 free printable template

Show details

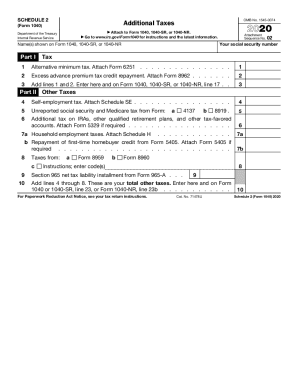

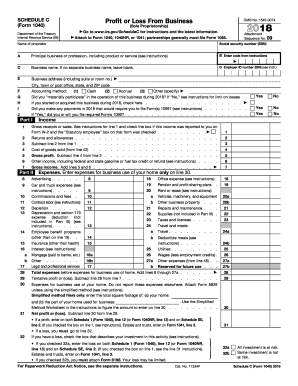

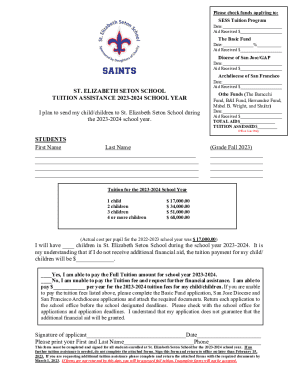

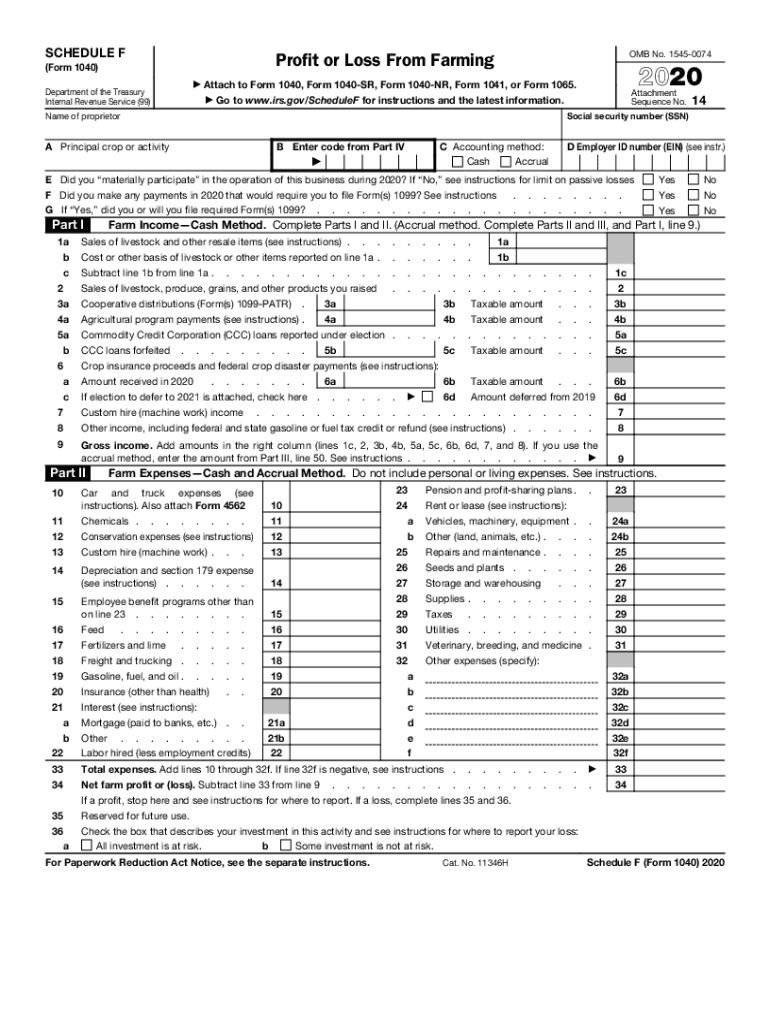

Cat. No. 11346H Schedule F Form 1040 2018 Page 2 Farm Income Accrual Method see instructions. 38a 38b 39a 39b CCC loans reported under election. SCHEDULE F Form 1040 Profit or Loss From Farming Department of the Treasury Internal Revenue Service 99 OMB No. 1545-0074 Attach to Form 1040 Form 1040NR Form 1041 or Form 1065. Enter the result on line 49. Add lines 44 and 49. Enter the total on line 50 and on Part I line 9. Principal Agricultural Activity Codes Do not file Schedule F Form 1040 to...report the following. Go to www.irs.gov/ScheduleF for instructions and the latest information. Attachment Sequence No. B Enter code from Part IV A Principal crop or activity C Accounting method Cash D Employer ID number EIN see instr Accrual E Did you materially participate in the operation of this business during 2018 If No see instructions for limit on passive losses F Did you make any payments in 2018 that would require you to file Form s 1099 see instructions. G If Yes did you or will you...file required Forms 1099. Part I Sales of livestock and other resale items see instructions. Cost or other basis of livestock or other items reported on line 1a. c 3a Subtract line 1b from line 1a. Cooperative distributions Form s 1099-PATR. 4a 5a b Agricultural program payments see instructions. Commodity Credit Corporation CCC loans reported under election. CCC loans forfeited. 5b. 3b Taxable amount 1c 3b 4b 5c Crop insurance proceeds and federal crop disaster payments see instructions Amount...received in 2018 6a If election to defer to 2019 is attached check here 6d Amount deferred from 2017 6b 6d Custom hire machine work income. Other income including federal and state gasoline or fuel tax credit or refund see instructions. Gross income. Add amounts in the right column lines 1c 2 3b 4b 5a 5c 6b 6d 7 and 8. If you use the accrual method enter the amount from Part III line 50. See instructions. Pension and profit-sharing plans Rent or lease see instructions Vehicles machinery...equipment Other land animals etc*. 24a 24b Depreciation and section 179 expense see instructions. Employee benefit programs other than on line 23. Feed Fertilizers and lime Freight and trucking. Gasoline fuel and oil. Insurance other than health Interest see instructions Mortgage paid to banks etc* Other. Labor hired less employment credits Total expenses. Add lines 10 through 32f* If line 32f is negative see instructions. a Farm Expenses Cash and Accrual Method. Do not include personal or...living expenses. See instructions. Car and truck expenses see instructions. Also attach Form 4562 Chemicals. Conservation expenses see instructions No 1a 1b Yes Farm Income Cash Method. Complete Parts I and II Accrual method. Complete Parts II and III and Part I line 9. Social security number SSN Name of proprietor Repairs and maintenance Seeds and plants. Storage and warehousing Supplies Taxes. Utilities. Veterinary breeding and medicine Other expenses specify 32a 21a d 32b 32c 32d 21b e f 32e...32f Net farm profit or loss.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

How to fill out IRS 1040 - Schedule F

Instructions and Help about IRS 1040 - Schedule F

How to edit IRS 1040 - Schedule F

Editing IRS 1040 - Schedule F requires careful attention to the details. Typically, filers will need to download the blank form, make necessary updates, and ensure that all changes are clearly documented. Use tools that allow for highlighting changes or comments if adjustments affect reported income or expense details.

To submit an edited Schedule F, verify that all information aligns with both your overall tax return and financial circumstances. If working with a professional tax preparer, ensure they review the edits to maintain compliance.

How to fill out IRS 1040 - Schedule F

Filling out IRS 1040 - Schedule F involves a series of straightforward steps. Begin by clearly stating your name and Social Security number at the top of the form. Subsequently, list your business's income along with allowable expenses associated with the farming activities. Ensure that you have all necessary documentation, such as invoices and receipts, to support the amounts reported.

After entering the income and expenses, calculate the net profit or loss. This figure will be transferred back to your main tax form (IRS Form 1040), affecting your overall tax liability. Double-check entries for accuracy to minimize potential errors.

About IRS 1040 - Schedule F 2020 previous version

What is IRS 1040 - Schedule F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule F 2020 previous version

What is IRS 1040 - Schedule F?

IRS 1040 - Schedule F is a tax form used to report income or losses from farming operations. It's specifically for individuals who earn income through farming and want to report it as part of their annual tax return. By using this form, filers can detail their earnings, costs, and any other deductions allowable for their agricultural business.

What is the purpose of this form?

The purpose of IRS 1040 - Schedule F is to allow farmers to declare their income and expenses pertaining to farming activities. This includes summarizing gross income received from sales of farm products along with related expenses to determine the net profit or loss for the tax year. Accurate reporting is necessary for tax compliance and to take advantage of potential deductions.

Who needs the form?

Individuals engaged in farming operations who receive income need to file IRS 1040 - Schedule F. This includes sole proprietors who are self-employed in agriculture, as well as individuals involved in partnerships or LLCs where farming income is attributed. It's essential for those who qualify to report their earnings accurately to ensure compliance with IRS regulations.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule F if you do not engage in farming activities or if your farming operations do not generate sufficient income. Additionally, if your only farming income comes from passive sources, such as rental income from property, you may not need to file this form. However, it's always advisable to consult with a tax professional to confirm your tax obligations.

Components of the form

The main components of IRS 1040 - Schedule F include sections for reporting income, expenses, and net profit or loss. Income sections require filers to detail gross sales, cooperative distributions, and other significant farm income sources. Expense sections allow for deductions related to cost of goods sold, depreciation, and other operational expenses related to farming activities.

What payments and purchases are reported?

On IRS 1040 - Schedule F, you report payments for expenses that directly relate to your farming business. This includes costs associated with purchasing livestock, feed, seed, fertilizers, and farming equipment. Additionally, any payments related to farm labor and repairs can be reported as well, ensuring you maximize your allowable deductions.

What are the penalties for not issuing the form?

Failing to file IRS 1040 - Schedule F, when required, can lead to significant penalties. The IRS may impose fines for late filings or inaccurate reporting, which can add up quickly. Additionally, there may be issues with interest accruing on any unpaid taxes resulting from unreported income, further complicating your tax situation.

What information do you need when you file the form?

When filing IRS 1040 - Schedule F, you need comprehensive financial records pertaining to your farming operations. This includes documentation for income generated from sales, expense invoices, and evidence of any loans or lease agreements related to the farm. Having organized records helps in accurately filling out the form and substantiating your entries in the event of an audit.

Is the form accompanied by other forms?

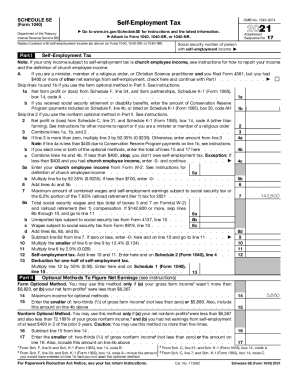

IRS 1040 - Schedule F often accompanies IRS Form 1040, which is the main individual income tax return. Additionally, other forms may be necessary if you have specific deductions or credit claims, such as depreciation schedules or forms for reporting self-employment tax. Always verify requirements to ensure comprehensive filing.

Where do I send the form?

Where to send your IRS 1040 - Schedule F depends on your filing method and where you reside. If filing by mail, you should send the completed form along with your IRS Form 1040 to the specified address for your state, as indicated in the IRS instructions for filing. For electronic submissions, follow the e-filing procedures outlined by the IRS.

See what our users say