Get the free PART A Recipient Information (Submit a separate form for each eligible site you work...

Show details

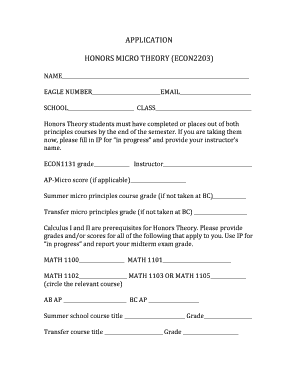

Washington State Health Professional Loan Repayment Program QUARTERLY SERVICE VERIFICATION FORM INSTRUCTIONS PART A: Recipient Information (Submit a separate form for each eligible site you work at.)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your part a recipient information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your part a recipient information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit part a recipient information online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit part a recipient information. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out part a recipient information

To fill out Part A recipient information, follow these steps:

01

Start by entering the recipient's full name in the designated field. This should include their first name, middle name (if applicable), and last name.

02

Next, provide the recipient's complete mailing address. Include the street address, apartment/unit number (if applicable), city, state, and ZIP code. Make sure to double-check the accuracy of the address to ensure proper delivery.

03

Moving on, enter the recipient's contact information. This typically includes their phone number and email address. Providing accurate contact details is essential for efficient communication.

04

If applicable, indicate the recipient's date of birth or age. This information may be necessary for certain transactions or situations.

05

Finally, specify the relationship between the sender and recipient. This can be selected from a predefined list, such as spouse, child, sibling, friend, etc.

Anyone who is required to send or receive mail, packages, important documents, or correspondence may need to fill out Part A recipient information. This includes individuals, businesses, organizations, government agencies, or anyone involved in sending or receiving mail or packages.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

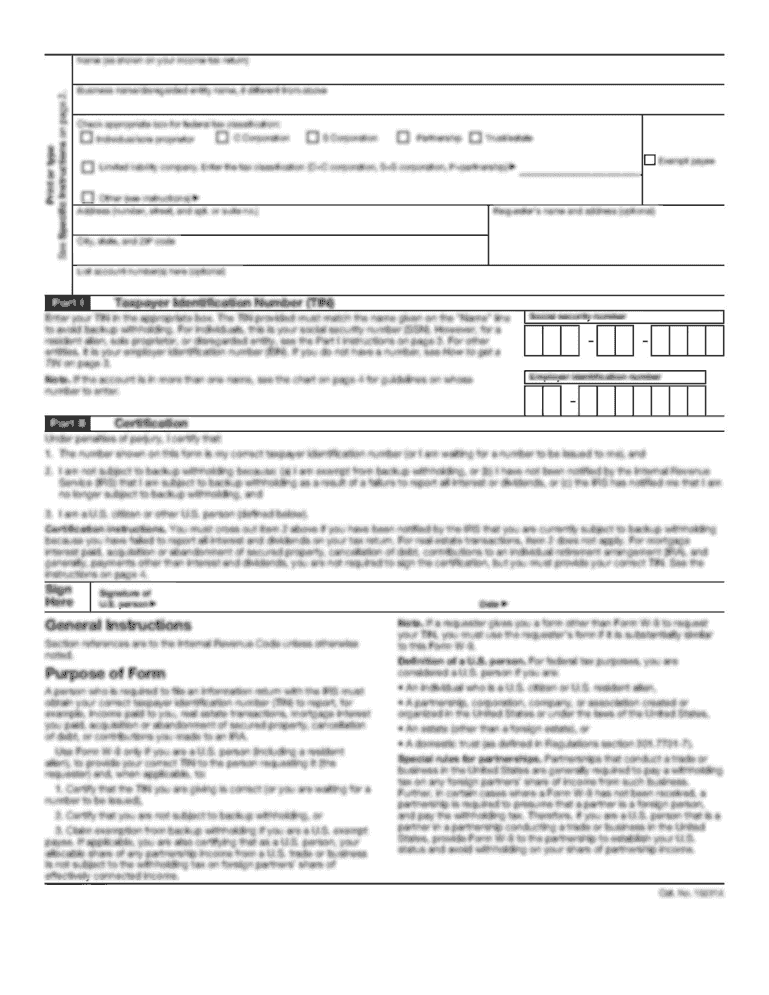

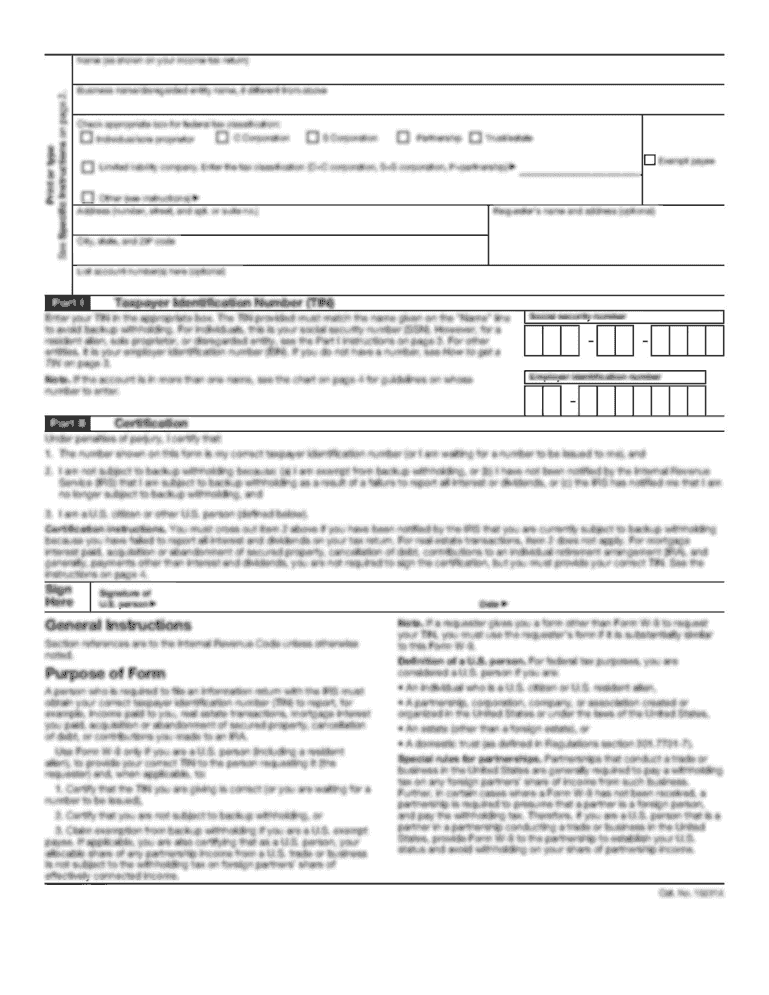

What is part a recipient information?

Part A recipient information includes details about the recipient of a payment, such as name, address, and taxpayer identification number.

Who is required to file part a recipient information?

Part A recipient information must be filed by the payer of income, usually a business or employer.

How to fill out part a recipient information?

Part A recipient information can be filled out electronically or on paper forms provided by the IRS.

What is the purpose of part a recipient information?

The purpose of part A recipient information is to report payments made to individuals or entities for tax purposes.

What information must be reported on part a recipient information?

Part A recipient information must include details of the payment amount, type of income, and any taxes withheld.

When is the deadline to file part a recipient information in 2023?

The deadline to file part A recipient information in 2023 is typically January 31st.

What is the penalty for the late filing of part a recipient information?

The penalty for late filing of part A recipient information can vary depending on the circumstances, but it is typically a specified amount per form.

How can I send part a recipient information for eSignature?

When your part a recipient information is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I sign the part a recipient information electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your part a recipient information in seconds.

How do I complete part a recipient information on an Android device?

Use the pdfFiller app for Android to finish your part a recipient information. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your part a recipient information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.