CA PRD-1 2013 free printable template

Show details

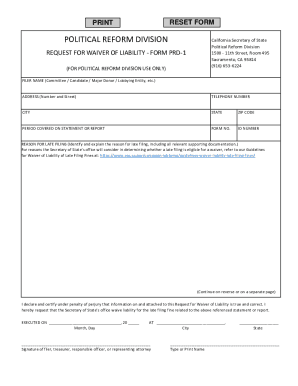

FORM PRD-1 REQUEST FOR WAIVER OF LIABILITY FILER NAME (Committee/Candidate/Lobbying Entity, etc.) Secretary of State Political Reform Division P.O. Box 1467 (95812-1467) 1500 11th Street, Room 495

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your state of california forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of california forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of california forms online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state of california forms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

CA PRD-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out state of california forms

How to fill out state of california forms?

01

Begin by gathering all the necessary information and documentation required to complete the forms. This may include personal information, financial records, and supporting documents.

02

Carefully read and understand the instructions provided with the forms. Familiarize yourself with the specific requirements and any additional documentation that may be needed.

03

Start filling out the forms accurately and legibly. Pay attention to details such as spelling, dates, and signatures.

04

Be sure to answer all the questions on the forms. If a question does not apply to your particular situation, mark it as "N/A" or "not applicable" instead of leaving it blank.

05

Double-check your work and review the completed forms for any errors or omissions. It is crucial to ensure the accuracy of the information provided before submitting the forms.

06

Sign and date the forms as required. Some forms may require multiple signatures from different parties involved, so follow the instructions for signing accordingly.

07

Make copies of all completed forms and supporting documents for your own records. These copies can serve as a reference and be useful in case any issues or inquiries arise later.

08

Submit the completed forms along with any required fees or additional documents to the appropriate state of California agency or office. Follow the submission instructions provided with the forms or visit their official website for specific guidelines.

Who needs state of california forms?

01

Individuals who are residents of California and need to report their income or file taxes with the state.

02

Employers based in California who are required to withhold and report state payroll taxes.

03

Business owners in California who need to register their business, file sales and use tax returns, or report other business-related information.

04

Individuals or organizations involved in legal proceedings in California, such as applying for a marriage license, filing for a divorce, or requesting a court order.

05

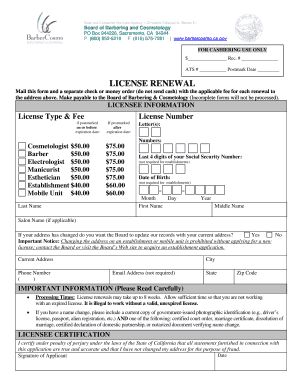

Applicants for various licenses, permits, or certifications in California, such as professional licenses, contractor licenses, or vehicle registrations.

06

Residents or property owners in California who need to apply for state-funded benefits, such as social services, healthcare programs, or housing assistance.

07

Anyone involved in real estate transactions in California, such as buyers, sellers, or agents, who need to complete disclosure forms or property transfer documents.

08

Many other situations exist where state of California forms are needed, depending on the specific legal, financial, or administrative requirements within the state.

Fill form : Try Risk Free

People Also Ask about state of california forms

What are the requirements for a waiver of liability in California?

How do I fill out a liability waiver?

What is a standard waiver of liability?

What is a general release of liability in California?

What is the release of liability clause in California?

What is a general release form of liability?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of california forms?

State of California forms are official documents created and provided by the government of California for various purposes. These forms are used for transactions, record-keeping, and reporting information required by various state agencies and departments. They cover a wide range of topics and situations, including taxes, business registration, vehicle registration, property ownership, employment, healthcare, and many others. These forms are typically available online and can be downloaded and filled out electronically or printed and filled out manually. They are crucial for ensuring compliance with California's laws and regulations and for facilitating communication between individuals, businesses, and the state government.

Who is required to file state of california forms?

Individuals who meet certain criteria are required to file state of California forms. This includes residents of California who have a certain level of income, regardless of whether they earned the income within or outside the state. Non-residents who earned income in California may also be required to file state forms if they meet certain income thresholds or have other California tax obligations.

Additionally, certain business entities operating in California, such as corporations, partnerships, and limited liability companies (LLCs), are required to file state forms to report their income and comply with tax obligations.

It's important for individuals and businesses to consult the California Franchise Tax Board (FTB) or a tax professional to determine their specific filing requirements and obligations.

How to fill out state of california forms?

To fill out state of California forms, follow these steps:

Step 1: Download the form from the appropriate California state agency's website. Most forms are available in PDF format.

Step 2: Open the form using Adobe Acrobat Reader or any other PDF reader software.

Step 3: Read the instructions provided at the beginning of the form. These instructions will guide you through the process of filling out the form correctly.

Step 4: Begin filling out the form using either the typewriter tool or by clicking on the form fields and typing in your information. If the form does not have fillable fields, you will need to print it out and fill it in manually with a pen.

Step 5: Provide accurate and complete information in each section of the form. Double-check your answers before moving on to the next section.

Step 6: If necessary, attach any required supporting documents or additional pages as indicated by the instructions.

Step 7: Review the completed form to ensure all required fields are filled out accurately. Make sure you haven't missed any sections or left any blank spaces.

Step 8: If you are filling out a paper form, make a copy for your records before submitting it.

Step 9: Submit the completed form as instructed in the form's instructions. This may involve mailing it to the appropriate state agency or submitting it online through their website, if available.

Remember to keep copies of all completed forms and any supporting documentation for your records.

What is the purpose of state of california forms?

The purpose of State of California forms varies depending on the specific form. Generally, these forms are used for official documentation and record-keeping purposes within the state. They are designed to collect information, facilitate transactions, and ensure compliance with state laws and regulations. Some common purposes of State of California forms include tax filing, business registration, licensing, voter registration, vehicle registration, health and safety regulations, employment-related documentation, and various legal processes.

What is the penalty for the late filing of state of california forms?

The penalty for late filing of state forms in California can vary depending on the specific form and the circumstances. Generally, late filing penalties may include a monetary fine, interest on unpaid amounts, and potential legal consequences. To determine the specific penalty for a late filing, it is recommended to refer to the instructions and guidelines provided with the specific form or consult with a tax professional or the California government agency responsible for administering the form.

How can I send state of california forms to be eSigned by others?

state of california forms is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for signing my state of california forms in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your state of california forms and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit state of california forms straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing state of california forms, you can start right away.

Fill out your state of california forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.