Get the free 807, 2010 Michigan Composite Individual Income Tax Return - michigan

Show details

Reset Form Michigan Department of Treasury, 807 (Rev. 02-11) 2010 MICHIGAN Composite Individual Income Tax Return Issued under authority of Public Act 281 of 1967. This return is due April 18, 2011.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 807 2010 michigan composite form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 807 2010 michigan composite form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 807 2010 michigan composite online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 807 2010 michigan composite. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out 807 2010 michigan composite

How to fill out 807 2010 Michigan composite:

01

Gather all necessary information and documents for completing the form, such as your personal information, income statements, and any applicable tax documents.

02

Start by carefully reading the instructions provided with the form. Familiarize yourself with the specific requirements and guidelines for completing the 807 2010 Michigan composite form.

03

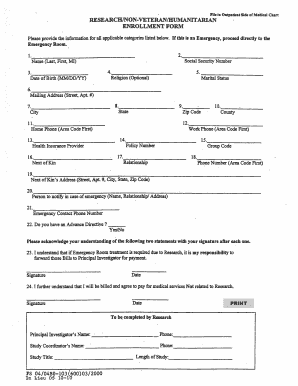

Begin filling out the form by entering your personal information, such as name, address, and Social Security number, in the designated sections.

04

Proceed to the income sections of the form, where you will need to provide details about your sources of income. This may include income from employment, self-employment, rental properties, investments, and any other relevant sources.

05

Ensure that you accurately report your income by referring to your W-2 forms, 1099 forms, and any other income-related documents. Double-check the amounts entered to prevent any errors.

06

When completing the deductions and exemptions sections, carefully document any eligible deductions or exemptions you may have. These could include expenses related to education, healthcare, or business costs. Be sure to follow the specific instructions for calculating and reporting these deductions or exemptions.

07

After completing all the necessary sections, review your form for any mistakes or missing information. Make sure that all required fields are properly filled out and that your calculations are accurate.

08

Sign and date the form as required, certifying that the information provided is true and accurate to the best of your knowledge.

Who needs 807 2010 Michigan composite:

01

Individuals who are required to file a composite income tax return for the state of Michigan may need to use the 807 2010 Michigan composite form. This form is specifically designed for composite filing, which allows certain pass-through entities, such as partnerships or S corporations, to file a single income tax return on behalf of their nonresident individual owners.

02

Pass-through entities in Michigan, such as partnerships or S corporations, who have nonresident individual owners may need to use the 807 2010 Michigan composite form to fulfill their tax obligations. This form helps in aggregating the income and tax liability of the nonresident individual owners, simplifying the tax filing process for both the entity and the owners.

03

It is important to consult with a tax professional or the Michigan Department of Treasury to determine if you meet the requirements for filing a composite return using the 807 2010 Michigan composite form. The form should only be used by those who fit the specific criteria outlined by the state of Michigan for composite filing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 807 michigan composite individual?

The 807 Michigan composite individual is a tax form used by certain nonresident individuals who are part of a composite filing group in Michigan.

Who is required to file 807 michigan composite individual?

Nonresident individuals who are part of a composite filing group in Michigan are required to file the 807 Michigan composite individual form.

How to fill out 807 michigan composite individual?

To fill out the 807 Michigan composite individual form, you need to gather the necessary information regarding your income, deductions, and tax credits. Then, you can follow the instructions provided by the Michigan Department of Treasury to complete the form.

What is the purpose of 807 michigan composite individual?

The purpose of the 807 Michigan composite individual form is to allow nonresident individuals to report their share of income, deductions, and tax credits as part of a composite filing group in Michigan.

What information must be reported on 807 michigan composite individual?

On the 807 Michigan composite individual form, you must report your share of income, deductions, and tax credits. This includes details about your income sources, allowable deductions, and any applicable tax credits.

When is the deadline to file 807 michigan composite individual in 2023?

The deadline to file the 807 Michigan composite individual in 2023 is typically April 17th, unless it falls on a weekend or holiday. It is important to check the specific deadline for the tax year in question.

What is the penalty for the late filing of 807 michigan composite individual?

For the late filing of the 807 Michigan composite individual form, penalties may be imposed by the Michigan Department of Treasury. The specific penalty amount and details can be found in the Michigan tax laws and regulations.

How do I edit 807 2010 michigan composite straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 807 2010 michigan composite, you can start right away.

How can I fill out 807 2010 michigan composite on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your 807 2010 michigan composite. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I fill out 807 2010 michigan composite on an Android device?

On an Android device, use the pdfFiller mobile app to finish your 807 2010 michigan composite. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your 807 2010 michigan composite online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.