India SBI Common Account Opening Form for All Public Sector Banks (Non Individual) 2020-2024 free printable template

Show details

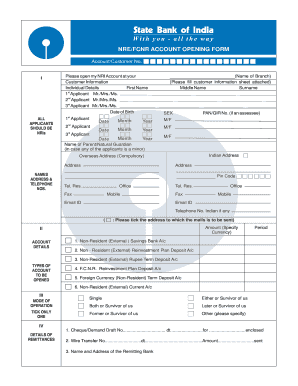

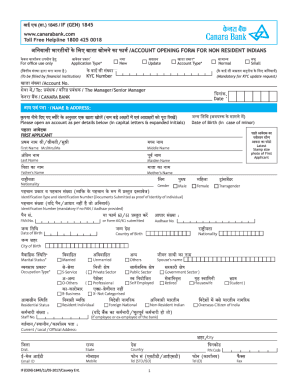

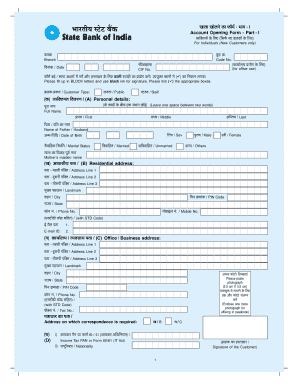

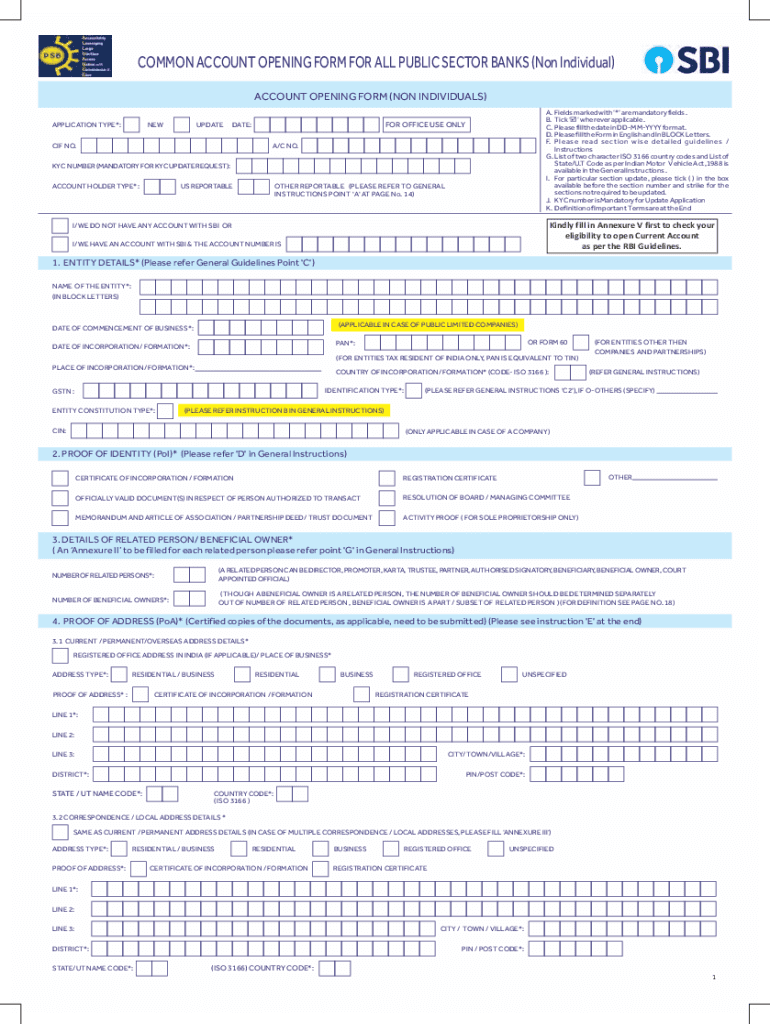

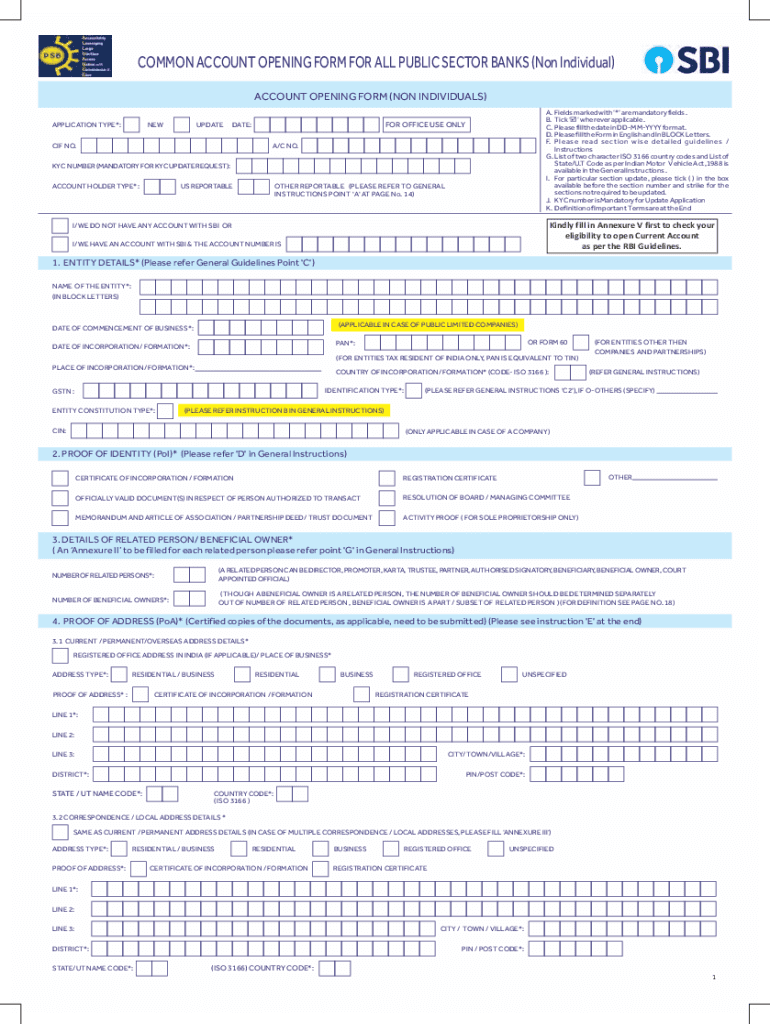

COMMON ACCOUNT OPENING FORM FOR ALL PUBLIC SECTOR BANKS Non Individual ACCOUNT OPENING FORM NON INDIVIDUALS APPLICATION TYPE NEW UPDATE CIF NO. A. Fields marked with are mandatory fields. B. Tick wherever applicable. C. Please fill the date in DD-MM-YYYY format. F* Please read section wise detailed guidelines / Instructions G* List of two character ISO 3166 country codes and List of State/U. T Code as per Indian Motor Vehicle Act 1988 is available in the General Instructions. I. For...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your common account opening form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your common account opening form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing common account opening form for all public sector banks online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit common account opening form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out common account opening form

How to fill out a common account opening form:

01

Gather all necessary documents and information beforehand, such as your identification documents, proof of address, and employment details.

02

Start by filling out your personal information, including your full name, date of birth, and contact details. Ensure accuracy and legibility.

03

Proceed to provide your identification details, such as your passport or driver's license number, along with its expiry date.

04

Specify your current employment status and provide accurate details about your employer or source of income.

05

If applicable, indicate whether you have any joint account holders and provide their information as well.

06

Mention your preferred account type and specify any additional services or features you require.

07

Review the form thoroughly before submitting to ensure all the information provided is accurate and complete.

08

Sign the form at the designated place, verifying that all the information provided is true and accurate to the best of your knowledge.

Who needs a common account opening form?

01

Individuals or businesses who wish to open a new bank account.

02

Clients who want to establish a relationship with a financial institution and benefit from their services.

03

Any person who intends to deposit, withdraw, or manage funds through a formal banking account.

Fill common account opening form for all public sector banks non individual indian bank : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is common account opening form?

A common account opening form is a document used by financial institutions to collect information from customers in order to open a new account. It typically includes personal information such as name, address, and contact information, as well as financial information such as income and net worth. The form also includes a signature line for the customer to sign, acknowledging that they are aware of the institution's terms and conditions.

How to fill out common account opening form?

1. Personal Information: Provide your full name, date of birth, address, phone number, and email address.

2. Account Type: Select the type of account that you'd like to open, such as a savings or checking account.

3. Identification: Provide your social security number, driver's license or state-issued ID, and any other documents that may be required, such as a passport or proof of residency.

4. Funding: Specify how you'll be funding the account, such as a bank transfer, debit card, or check.

5. Signatures: Read the account opening agreement and sign at the indicated spots.

What is the purpose of common account opening form?

The purpose of a common account opening form is to collect the necessary information needed to open a financial account. The form is used to collect information including personal contact information, identification documents, financial information, and other details that may be required by the institution. This information is used to verify the identity of the applicant and ensure the institution is compliant with all money laundering and anti-fraud regulations.

When is the deadline to file common account opening form in 2023?

The deadline to file common account opening form in 2023 has not yet been announced.

What is the penalty for the late filing of common account opening form?

Penalty for the late filing of common account opening form may vary depending on the financial institution. Generally, the penalty is a fee imposed for the late filing. This fee may be a flat fee or an amount based on the amount of time the form is late.

Who is required to file common account opening form?

Common account opening forms are typically required to be filed by individuals or entities who wish to open a new bank, financial, or investment account. This includes both individuals and corporate entities such as businesses, partnerships, trusts, or non-profit organizations. The specific requirements may vary depending on the jurisdiction and the type of account being opened.

What information must be reported on common account opening form?

The specific information that must be reported on a common account opening form may vary depending on the financial institution and regulatory requirements. However, some common information typically required includes:

1. Personal details: Full name, date of birth, residential address, email address, phone number, and occupation.

2. Identification information: Social Security number or other national identification number, passport number (for non-residents), and driver's license or state ID number.

3. Citizenship: Country of citizenship and tax residency status.

4. Employment details: Current employer, job title, and annual income.

5. Financial information: Expected deposit or investment amount, source of funds, and existing banking relationship.

6. Risk assessment: Questions related to investment experience, financial goals, and risk tolerance.

7. Financial suitability: Declarations regarding legal and financial history, such as bankruptcies, liens, or criminal records.

8. Account preferences: Type of account desired (e.g., checking, savings, investment), account ownership (individual, joint, or business), and any additional services required.

9. Beneficiary information: If applicable, details of beneficiaries or authorized signatories.

It is important to note that these are general guidelines, and the specific information required may vary depending on factors such as country-specific regulations, account type, and the nature of the financial institution. It is recommended to consult with the specific institution's guidelines or speak with a representative for accurate information.

How can I send common account opening form for all public sector banks to be eSigned by others?

Once you are ready to share your common account opening form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I fill out common account opening form for all public sector banks non individual iob on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your sbi common account opening form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out common account opening form for all public sector banks non individual on an Android device?

Use the pdfFiller mobile app and complete your common account opening form sbi and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

Fill out your common account opening form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Common Account Opening Form For All Public Sector Banks Non Individual Iob is not the form you're looking for?Search for another form here.

Keywords relevant to how to fill common account opening form for all public sector banks non individual

Related to common account opening form for all public sector banks pdf download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.