Get the free Home Affordable Modification Program Hardship Affidavit (Form 1021). Home Affordable...

Show details

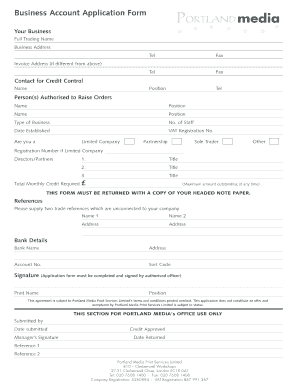

Home Affordable Modification Program Hardship Affidavit Borrower Name: Co-Borrower Name: Property Street Address: Property City, ST, Zip: Service: Loan Number: In order to qualify for s (Service)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your home affordable modification program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home affordable modification program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home affordable modification program online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit home affordable modification program. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out home affordable modification program

How to fill out the Home Affordable Modification Program (HAMP):

01

Gather the necessary documents: You will need to provide financial documents such as pay stubs, tax returns, and bank statements. Additionally, gather any mortgage-related documents like your loan agreement and property information.

02

Contact your mortgage servicer: Reach out to your mortgage servicer, the company that collects your mortgage payments, and inquire about the HAMP. They will provide you with the necessary paperwork and guidance on how to proceed.

03

Complete the Request for Modification and Affidavit (RMA) form: This form is crucial for applying to the HAMP. Fill it out accurately and provide all requested information. Make sure to include your financial details, reasons for requesting the modification, and any other required information.

04

Submit supporting documentation: Along with the RMA form, you will need to submit supporting documents to verify your income, expenses, and financial hardship. This may include pay stubs, bank statements, tax returns, and a hardship letter explaining your financial situation.

05

Wait for a response: After submitting all the required documents, your mortgage servicer will review your application. They will assess whether you meet the eligibility criteria for the HAMP and determine if your request for a loan modification can be granted.

06

Provide any additional information if requested: If your mortgage servicer requires more information or documents, be prompt in providing them. Your cooperation will help expedite the review process.

07

Stay in communication with your mortgage servicer: Throughout the application process, maintain regular contact with your mortgage servicer. Respond to any inquiries or requests promptly to avoid delays.

Who needs the Home Affordable Modification Program?

01

Homeowners facing financial hardship: The HAMP is designed for homeowners who are struggling to make their mortgage payments due to a loss of income, medical expenses, or other financial hardships. It aims to help eligible individuals modify their mortgage terms to make them more affordable and avoid foreclosure.

02

Homeowners with loans backed by Fannie Mae or Freddie Mac: The HAMP is available for homeowners with loans owned or guaranteed by Fannie Mae or Freddie Mac. These two government-sponsored enterprises play a significant role in the mortgage market, and many homeowners have loans backed by them.

03

Homeowners who meet the eligibility criteria: To qualify for the HAMP, homeowners need to meet specific eligibility criteria, such as demonstrating financial hardship, having a mortgage originated before January 1, 2009, and residing in the property as their primary residence, among others. It is important to review the program's guidelines and consult with your mortgage servicer to determine if you meet the requirements.

Fill form : Try Risk Free

People Also Ask about home affordable modification program

How do I write a hardship letter for mortgage assistance?

What is an example of a hardship statement?

What is a hardship letter for a mortgage modification?

What is an example of a good hardship letter?

How do you write a hardship statement?

How do I write a hardship affidavit for loan modification?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is home affordable modification program?

The Home Affordable Modification Program (HAMP) is a federal program designed to help homeowners modify their mortgage loans to make them more affordable.

Who is required to file home affordable modification program?

Homeowners who are struggling to make their mortgage payments may be eligible to apply for the Home Affordable Modification Program.

How to fill out home affordable modification program?

To apply for the Home Affordable Modification Program, homeowners must contact their mortgage servicer and provide detailed financial information.

What is the purpose of home affordable modification program?

The purpose of the Home Affordable Modification Program is to help homeowners avoid foreclosure by making their mortgage payments more affordable.

What information must be reported on home affordable modification program?

Homeowners must provide detailed financial information, including income, expenses, and details about their mortgage loan.

When is the deadline to file home affordable modification program in 2023?

The deadline to file for the Home Affordable Modification Program in 2023 is typically set by the individual mortgage servicer.

What is the penalty for the late filing of home affordable modification program?

There may be penalties or fees associated with late filing of the Home Affordable Modification Program, depending on the terms of the mortgage loan.

How can I send home affordable modification program for eSignature?

When your home affordable modification program is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get home affordable modification program?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific home affordable modification program and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete home affordable modification program on an Android device?

Complete your home affordable modification program and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your home affordable modification program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.