PH BIR 2550Q 2002 free printable template

Show details

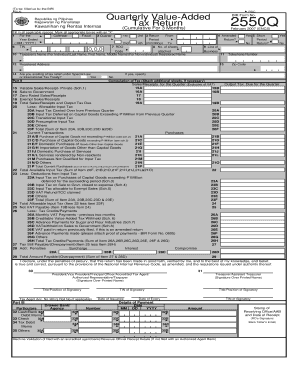

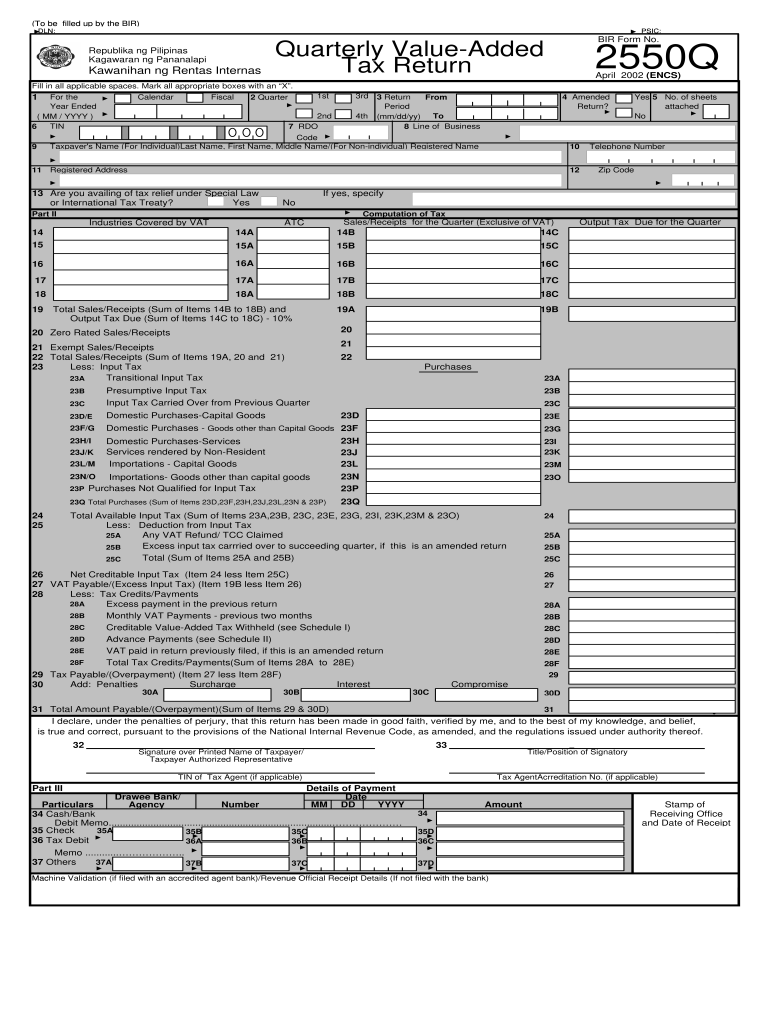

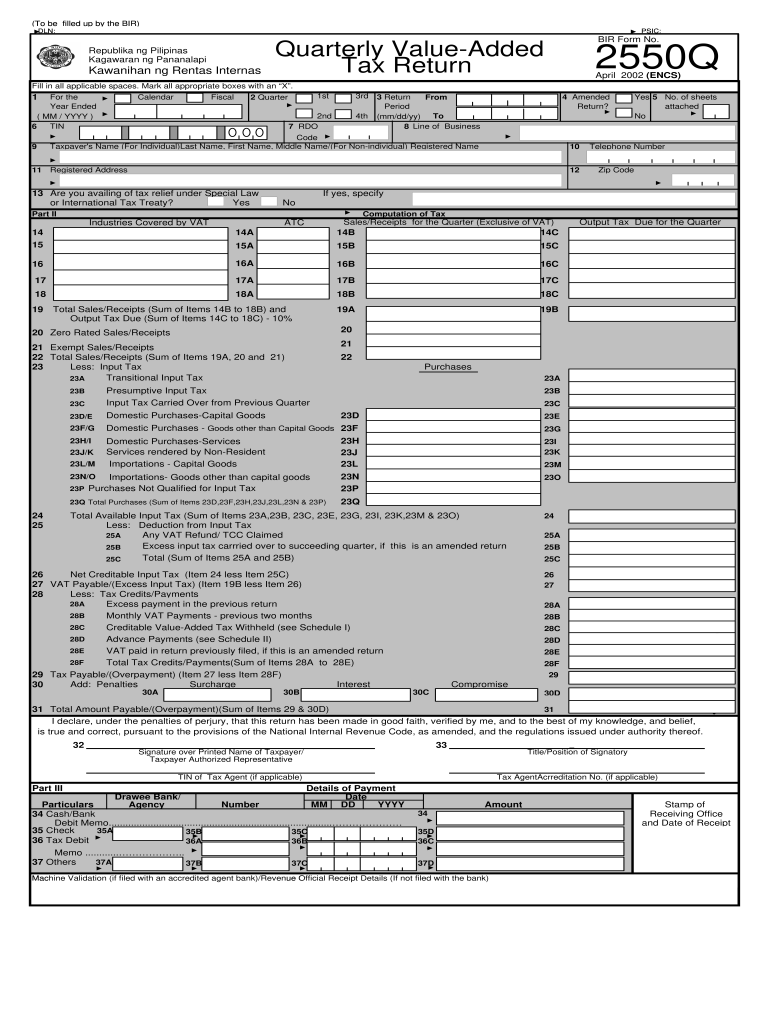

To be filled up by the BIR DLN PSIC Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas BIR Form No. Quarterly Value-Added Tax Return 2550Q April 2002 ENCS Fill in all applicable spaces. 2550Q - Quarterly Value-Added Tax Return Guidelines and Instructions Other Franchise Real Estate Renting Business Activity Sale of Real Property Lease of Real Property Sale/Lease of Intangible Property 10. 35 Check 35A 35B 35C 36 Tax Debit 36A 36B 35D 36C Memo. 37 Others 37A 37B 37D...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bir form 2550q pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 2550q pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 2550q pdf online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2550q form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

PH BIR 2550Q Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir form 2550q pdf

01

The bir form 2550q pdf is used by individuals or businesses in the Philippines who are required to file and pay their quarterly income tax.

02

The first step in filling out the form is to provide your taxpayer identification number (TIN) and registered name in the designated fields.

03

Next, you should indicate the applicable tax period for the form. This would typically be the calendar quarter for which you are filing the income tax return.

04

The form requires you to declare your gross sales or receipts, which can be found in your financial records or sales reports for the specified quarter.

05

You should also provide the amount of taxable sales or receipts, which is the portion of your gross sales that is subject to income tax.

06

If you have any exempt sales or receipts, such as sales to VAT-registered persons or export sales, you need to include those amounts as well.

07

The form also requires you to declare your sales or receipts subject to the expanded withholding tax, which applies to specific business transactions.

08

After completing the sales or receipts section, you need to calculate your income tax payable or refundable based on the tax rates and deductions provided in the form.

09

It is important to review all the information entered on the form for accuracy and completeness before finalizing it.

10

Once you have filled out the form, you can save it as a pdf file and submit it to the Bureau of Internal Revenue (BIR) through their designated channels, such as online or in person.

Anyone who is a taxpayer in the Philippines and is required to pay quarterly income tax should fill out the bir form 2550q pdf. This includes both individuals and businesses, such as self-employed individuals, freelancers, and corporations. It is essential to comply with the tax regulations and file the form on time to avoid penalties or legal consequences.

Video instructions and help with filling out and completing bir form 2550q pdf

Instructions and Help about 2550q form sample

How to generate form 2550 q step 1 from the dashboard go to reports then click form 2550 q then this will appear step 2 select the quarter and year you want to generate in step 3 clicks generate this will appear some part of part 1 will autofill up by the system step 4 click post and the confirmation message will appear click OK

Fill 2550q form fill : Try Risk Free

People Also Ask about bir form 2550q pdf

What is the return period for 2550Q?

What is the purpose of form 2550Q?

How to fill up 2550Q form?

Who needs to file 2550Q?

Who should file 2550Q?

What is BIR 2550Q?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bir form 2550q pdf?

Bir form 2550q pdf is an official document from the Philippines Bureau of Internal Revenue (BIR). It is a quarterly tax return form used by employers and employees to report their income and taxes paid. The form is used to calculate the amount of income taxes and other taxes due for each quarter.

How to fill out bir form 2550q pdf?

Instructions for filling out the BIR Form 2550Q:

1. Enter your name and address in the upper left corner.

2. Enter the date and your taxpayer identification number (TIN) in the lower left corner.

3. Enter the period covered by the return in the "Period Covered" section.

4. Enter the amount of total sales or receipts in the "Total Sales or Receipts" section.

5. Enter the amount of cost of sales in the "Cost of Sales" section.

6. Enter the amount of gross income in the "Gross Income" section.

7. Enter the amount of deductions in the "Deductions" section.

8. Enter the net income in the "Net Income" section.

9. Enter the amount of tax due in the "Tax Due" section.

10. Sign and date the form in the "Signature/Date" section.

11. Submit the form to the Bureau of Internal Revenue.

What information must be reported on bir form 2550q pdf?

The following information must be reported on BIR Form 2550Q:

1. Name and Address of Payor

2. TIN of Payor

3. Name and Address of Payee

4. TIN of Payee

5. Nature of Income Payment

6. Gross Amount of Income

7. Amount of Withholding Tax

8. TIN of Withholding Agent

9. Date of Payment

10. Particulars of Payment

Who is required to file bir form 2550q pdf?

BIR Form 2550Q is a tax form used in the Philippines for reporting and paying quarterly value-added tax (VAT). The individuals or entities that are required to file BIR Form 2550Q are:

1. VAT-registered taxpayers whose annual gross sales or receipts exceed PHP 3,000,000

2. VAT-registered taxpayers who voluntarily opt to be under VAT system even if their annual gross sales or receipts do not exceed PHP 3,000,000 (optional VAT registration)

3. VAT-registered taxpayers with zero-rated or effectively zero-rated sales and positive input VAT

4. VAT-registered taxpayers engaged in exporting of goods or services, including applicants under the fiscal incentive schemes

5. VAT-registered taxpayers engaged in digital transactions, online sales, or e-commerce activities regardless of their annual gross sales or receipts

6. VAT-registered taxpayers who have issued VAT official receipts and/or sales invoices using CRM/POS machine for their actual enhanced VAT compliance with their sources of income/business operations, regardless of their annual gross sales or receipts.

It is recommended to consult with a tax professional or the Bureau of Internal Revenue (BIR) for specific and accurate information regarding the filing requirements.

What is the purpose of bir form 2550q pdf?

BIR Form 2550Q is a tax form used in the Philippines for reporting and paying quarterly value-added tax (VAT) liabilities. The purpose of this form is to provide a systematic and standardized way for businesses to calculate and remit their VAT obligations to the Bureau of Internal Revenue (BIR). This form helps the government track and collect VAT revenues accurately and efficiently.

When is the deadline to file bir form 2550q pdf in 2023?

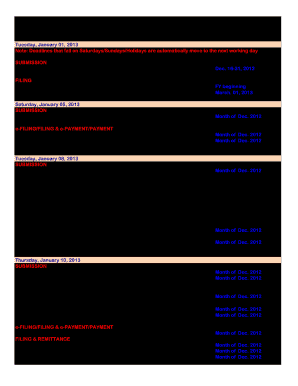

The deadline to file BIR Form 2550Q (Quarterly Value-Added Tax Return) PDF in 2023 is on the 20th day of the month following the end of the quarter.

What is the penalty for the late filing of bir form 2550q pdf?

The penalty for the late filing of BIR Form 2550Q (Quarterly Value-Added Tax Return) is a fine of Php 1,000 for each return that was not filed or filed beyond the due date. This penalty applies regardless of whether there is tax due or not.

How do I complete bir form 2550q pdf online?

Completing and signing 2550q form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the 2550q form download excel form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2550q form download and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit 2550q form pdf on an Android device?

You can edit, sign, and distribute form 2550q on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your bir form 2550q pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2550q Form Download Excel is not the form you're looking for?Search for another form here.

Keywords relevant to form 2550q download

Related to 2550q

If you believe that this page should be taken down, please follow our DMCA take down process

here

.