CA FTB 100 2005 free printable template

Show details

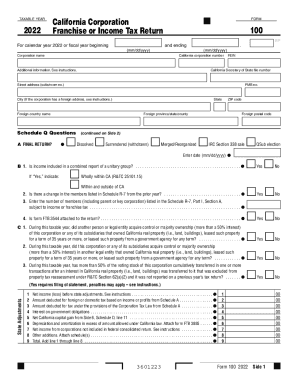

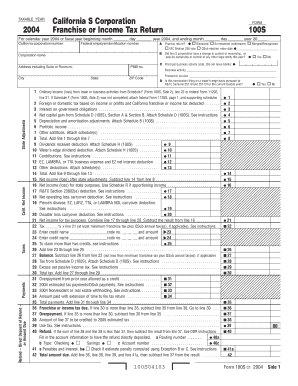

Reset Form Print and Reset Form TAXABLE YEAR 2005 California Corporation Franchise or Income Tax Return FORM 100 For calendar year 2005 or fiscal year beginning month day year 2005, and ending month

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form 100 2005 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 100 2005 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 100 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit california form 100. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

CA FTB 100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 100 2005

How to fill out form 100:

01

Start by downloading form 100 from the official website or obtaining a physical copy from the relevant authority.

02

Read the instructions carefully to understand the purpose and requirements of the form.

03

Gather all the necessary information and documents needed to complete the form. This may include personal details, financial information, or supporting documents.

04

Begin filling out the form by providing accurate and up-to-date information in the designated fields. Double-check all entries for any errors or omissions.

05

Follow any additional instructions given for specific sections or questions on the form. This may include providing explanations, calculations, or attaching additional documents.

06

Review the completed form thoroughly to ensure all information is accurate and complete. Make any necessary corrections or additions.

07

Sign and date the form in the appropriate sections, following any specific instructions for signatures.

08

If required, make a copy of the completed form for your records before submitting it.

09

Submit the form by the specified deadline through the designated method (online submission, mailing, or in-person submission).

10

Keep a record of the submission confirmation or any receipts provided as proof of submission.

Who needs form 100:

01

Individuals or businesses who are required to report specific information or meet certain obligations as per the regulations or requirements of the relevant authority.

02

It may be needed by individuals or businesses for tax purposes, licensing or registration, financial reporting, or other legal and administrative processes.

03

The specific individuals or businesses who need form 100 will vary depending on the country, state, or industry, so it is important to consult the appropriate authorities or seek professional advice to determine the exact requirements.

Fill california corporation franchise tax form 100 : Try Risk Free

People Also Ask about form 100

What is a California form 100?

What is the form 100?

What is a form 100?

What is the penalty for form 100S?

What is California tax form 100?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 100?

Form 100 is the California Corporation Franchise or Income Tax Return. This form must be filed by all corporations registered to do business in California, even if they are not based in California.

What is the purpose of form 100?

Form 100 is used to report the federal income tax liability of individuals and businesses. It is used to calculate the amount of taxes owed and it also includes any credits or deductions that can be claimed to reduce the amount due.

What information must be reported on form 100?

Form 100 is an annual report filed with the California Franchise Tax Board. It includes the following information:

1. The name and address of the entity filing the report.

2. The entity's federal employer identification number (FEIN).

3. The total assets of the entity at the end of the tax year.

4. The total liabilities of the entity at the end of the tax year.

5. The total income of the entity for the tax year.

6. The total expenses of the entity for the tax year.

7. The total net income (or loss) of the entity for the tax year.

8. The total number of shares of stock or other interests outstanding.

9. The total number of shareholders or other interest holders.

10. The name and address of the entity's officers and directors.

11. The name, address, and Social Security number of any person who owns more than 10% of the entity's voting stock or other interests.

When is the deadline to file form 100 in 2023?

The deadline to file California Form 100 for the 2023 tax year is April 15, 2024.

What is form 100?

Form 100 refers to the California Corporation Franchise or Income Tax Return. It is the tax return form filed by corporations that are either incorporated or doing business in California. The form is used to report and calculate the corporation's net income and minimum franchise tax liability for the tax year.

How to fill out form 100?

Form 100 usually refers to different types of forms depending on the specific context. Can you please provide more details or specify the form you are referring to?

What is the penalty for the late filing of form 100?

The penalty for the late filing of Form 100, which is the California Corporation Franchise or Income Tax Return, depends on various factors. Generally, for corporations failing to file on time, the penalty is calculated as a percentage of the unpaid tax due. The penalty is as follows:

- 5% of the unpaid tax if the return is filed 1 to 30 days late.

- An additional 5% of the unpaid tax for each additional month (or fraction thereof) the return is late, up to a maximum of 25%.

- If the corporation fails to file the return within 60 days after the due date, the minimum penalty will be $135 or 100% of the unpaid tax, whichever is lesser.

It's worth noting that these penalties may vary based on the specific circumstances of the corporation's filing and the amount of tax owed. It is always best to consult the official instructions and guidelines provided by the California Franchise Tax Board for accurate and up-to-date penalty information.

How can I get form 100?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the california form 100. Open it immediately and start altering it with sophisticated capabilities.

How do I edit ca form 100 pdf in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing ca 100 form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit ca tax form 100 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing california corporate tax form 100.

Fill out your form 100 2005 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Form 100 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to california franchise tax form 100

Related to tax form 100

If you believe that this page should be taken down, please follow our DMCA take down process

here

.