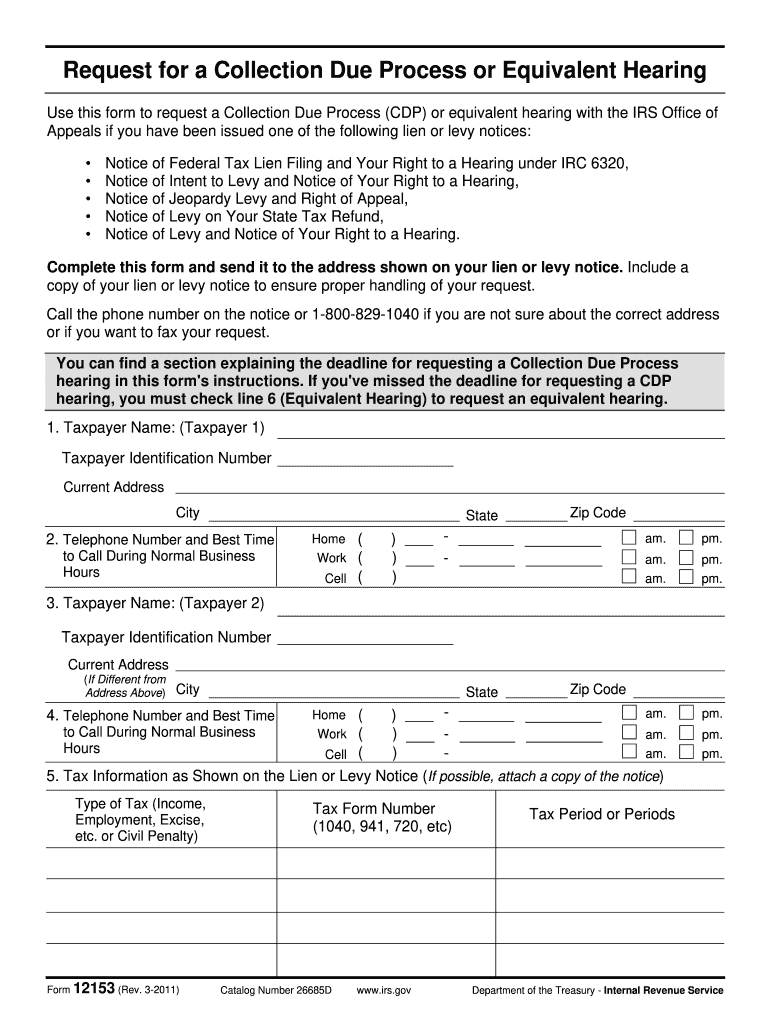

Who needs an IRS form 12153?

This is a form for those who receive a notice of lien or a notice of levy and want to request a Collection Due Process (CDP), or an equivalent hearing. It is issued by IRS Office of Appeals for taxpayers across America.

What is form 12153 for?

This form gives a chance to avoid levy and offer another way to repay the debt. If a taxpayer receives a notice of lien and files this form in a timely manner, the IRS official would not probably issue a notice of levy. However, if you missed the deadline for a CDP request, you can file this form to apply for an equivalent hearing.

Is it accompanied by other forms?

It should not be accompanied by other forms.

When is form 12153 due?

The Notice of Federal Tax Lien you received must contain the due date for filing a form 12153. CDP hearing about a levy must be requested no longer than 30 days after the date of the notice of levy.

How do I fill out an IRS form 12153?

Provide the information about yourself and write specific reasons why you need a CDP hearing. These may include inability to pay taxes caused by an illness or reasons connected to your current financial situation (for applicants who receive public benefits for living), a suggestion of a different way to pay the debt, or current reasonable expenses that exceed applicant’s income.

Where do I send it?

Please do not send this request to the IRS Office of Appeals. It will not be processed on time, and you will not get the response you hope for. Instead, send it to the address written on the notice of lien or levy.