Get the Get the free tax exempt illinois form - pdfFiller

Show details

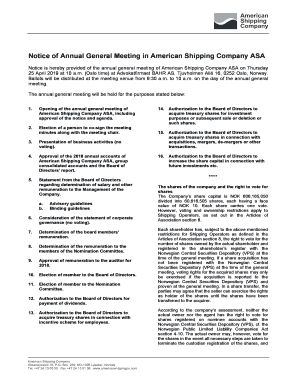

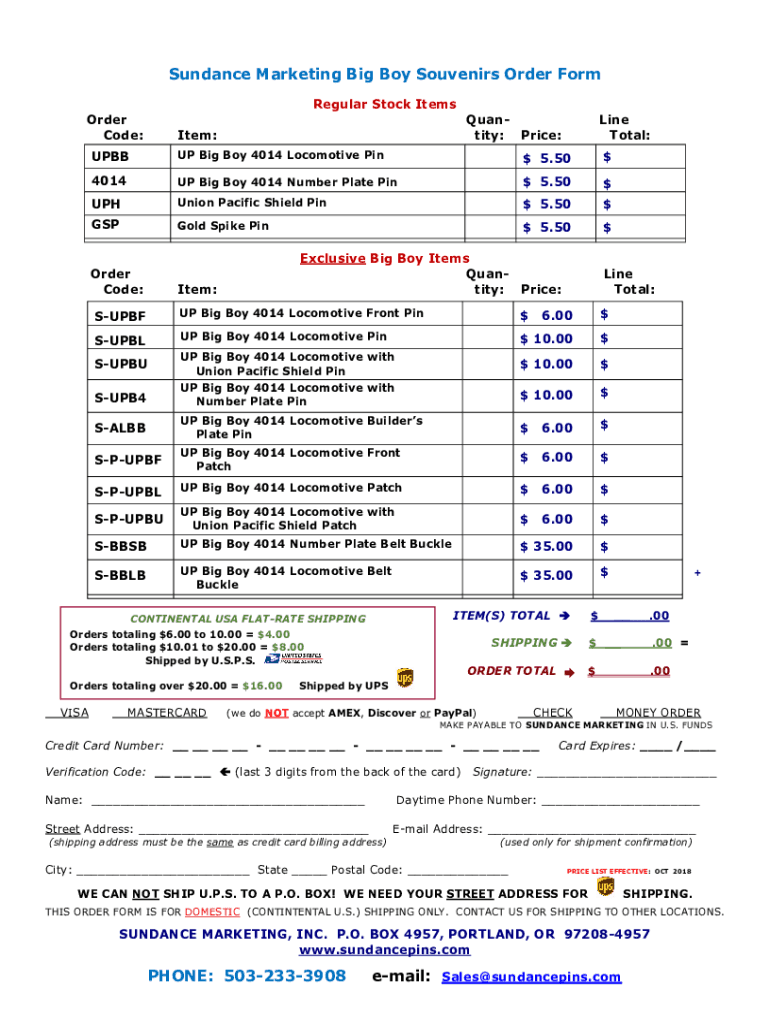

Sun dance Marketing Big Boy Souvenirs Order Form

Regular Stock Items

Order

Code:Quantity: Price:Item:UPB BUP Big Boy 4014 Locomotive Pin4014UP Big Boy 4014 Number Plate Pin$UPHUnion Pacific Shield

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax exempt illinois form

Edit your tax exempt illinois form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax exempt illinois form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exempt illinois form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax exempt illinois form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax exempt illinois form

How to fill out tax exempt illinois form

01

To fill out the tax exempt Illinois form, follow these steps:

02

Download the tax exempt form from the official Illinois Department of Revenue website or obtain a physical copy from the department.

03

Start by providing your basic information such as your name, address, and contact details in the designated fields.

04

Indicate the purpose of the tax exemption by selecting the appropriate option from the provided choices. For example, if you are an eligible nonprofit organization, select the option that applies to your status.

05

Provide any necessary supporting documentation or attachments that may be required by the form. This could include certificates of exemption or other supporting documentation to verify your eligibility for the tax exemption.

06

Calculate and enter the specific goods or services for which the tax exemption is being claimed. Provide accurate details such as quantities, descriptions, and any applicable identification numbers.

07

Double-check all the information provided to ensure accuracy and completeness. Make any necessary corrections or additions before submitting the form.

08

Sign and date the form where indicated to certify the accuracy of the information provided.

09

Submit the completed tax exempt form to the Illinois Department of Revenue either through mail or electronically, depending on the specified instructions.

10

Keep a copy of the filled-out form, along with any supporting documentation, for your records. It may be helpful to maintain organized files to easily access this information in the future.

11

Note: It is recommended to consult with a tax professional or refer to the specific instructions provided with the tax exempt form for detailed guidance.

Who needs tax exempt illinois form?

01

Various individuals and organizations may require the tax exempt Illinois form, including:

02

- Nonprofit organizations recognized by the Internal Revenue Service (IRS) as tax-exempt under section 501(c)(3) or other applicable sections of the Internal Revenue Code.

03

- Government entities and agencies that qualify for tax exemption on certain transactions or purchases.

04

- Certain educational institutions, religious organizations, and charitable organizations as defined by the Illinois Department of Revenue.

05

- Qualified individuals or businesses engaged in specific activities or industries that are eligible for tax exemption as per Illinois tax laws and regulations.

06

It is important to review the specific eligibility criteria and guidelines provided by the Illinois Department of Revenue or consult a tax professional to determine if you or your organization needs the tax exempt Illinois form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax exempt illinois form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax exempt illinois form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I complete tax exempt illinois form online?

Completing and signing tax exempt illinois form online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit tax exempt illinois form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as tax exempt illinois form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is tax exempt Illinois form?

The tax exempt Illinois form is a document used by organizations that qualify for tax-exempt status under Illinois law to apply for and maintain their exemption from state sales and use taxes.

Who is required to file tax exempt Illinois form?

Organizations that qualify for tax-exempt status, such as non-profits, charities, and certain educational institutions, are required to file the tax exempt Illinois form.

How to fill out tax exempt Illinois form?

To fill out the tax exempt Illinois form, gather necessary documentation, complete all required fields on the form accurately, provide a detailed description of your organization's activities, and submit it to the appropriate Illinois tax authority.

What is the purpose of tax exempt Illinois form?

The purpose of the tax exempt Illinois form is to allow qualifying organizations to establish their eligibility for tax-exempt status, enabling them to avoid paying sales and use taxes on qualifying purchases.

What information must be reported on tax exempt Illinois form?

Information that must be reported includes the organization's name, address, type of organization, federal tax identification number, and the nature of the organization’s activities.

Fill out your tax exempt illinois form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Illinois Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.