Get the free Unrelated Business Income Tax Returns, 2007 - irs

Show details

Domestic Private Foundations Tax Years 2003 2007 by Cynthia Belmonte and Melissa Ludlum T he private foundation segment of the tax-exempt sector experienced modest growth between Tax Years 2003 and 2007. 1 Over this time period the number of private foundations increased 10. 8 percent to 84 613 and the fair market value of total assets held by private foundations increased in real terms by 21. 7 percent. 2 Private foundations provided approximately 163. 7 billion in contributions gifts and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unrelated business income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unrelated business income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing unrelated business income tax online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit unrelated business income tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

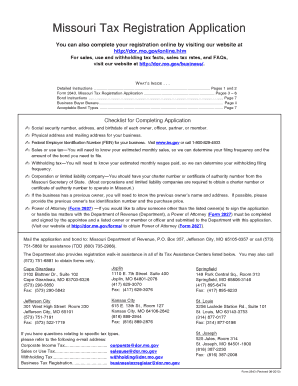

How to fill out unrelated business income tax

How to fill out unrelated business income tax:

01

Begin by gathering all necessary financial documents, such as income statements, expense records, and receipts.

02

Determine if your organization qualifies for tax-exempt status by using IRS Form 1023 or 1024, if applicable.

03

Fill out Form 990-T, which is used to report unrelated business income. Provide all requested information, including the organization's name, address, and Identification Number (EIN).

04

Calculate the total unrelated business income by subtracting allowable deductions from the gross income.

05

Include any applicable estimated tax payments and withholding credits.

06

Complete any additional schedules or forms that may be required based on the organization's activities, such as Schedule A for interest, rent, or royalties.

07

Review the completed form for accuracy and make any necessary corrections before submitting it to the IRS.

08

Sign and date the form, and retain a copy for your records.

Who needs unrelated business income tax:

01

Nonprofit organizations that engage in activities unrelated to their charitable, educational, or public service missions may need to file unrelated business income tax.

02

This includes income generated from trade or business activities that are not substantially related to the organization's exempt purpose.

03

Examples of unrelated business activities can include operating a gift shop in a museum or hosting unrelated fundraising events.

04

It is important to consult with a tax advisor or refer to IRS guidelines to determine if your organization meets the criteria for filing unrelated business income tax.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unrelated business income tax?

Unrelated business income tax (UBIT) is a tax imposed on the income generated by a tax-exempt organization through unrelated business activities that are not substantially related to its exempt purpose.

Who is required to file unrelated business income tax?

Tax-exempt organizations, such as nonprofits, charities, and certain religious organizations, that generate income from unrelated business activities are required to file Form 990-T and pay unrelated business income tax (UBIT).

How to fill out unrelated business income tax?

To fill out unrelated business income tax, tax-exempt organizations must complete Form 990-T, reporting their unrelated business income, deductions, and calculating the tax owed. It is important to review the instructions provided by the IRS and consult with a tax professional if needed.

What is the purpose of unrelated business income tax?

The purpose of unrelated business income tax is to prevent tax-exempt organizations from gaining an unfair advantage over for-profit businesses by engaging in unrelated business activities. It ensures that income generated from unrelated activities is subject to taxation, similar to how taxable businesses are treated.

What information must be reported on unrelated business income tax?

On Form 990-T, tax-exempt organizations must report their gross unrelated business income, allowable deductions, and calculate the taxable income and tax due. Additional information such as organizational details and schedules may also be required.

When is the deadline to file unrelated business income tax in 2023?

The deadline to file unrelated business income tax in 2023 is typically on the 15th day of the 5th month following the end of the organization's tax year. However, it is advisable to check the specific due date for the tax year with the IRS or a tax professional.

What is the penalty for the late filing of unrelated business income tax?

The penalty for the late filing of unrelated business income tax is generally calculated as a percentage of the unpaid tax, accruing on a monthly basis. It is important to timely file the tax return to avoid any potential penalties and interest charges.

Can I create an electronic signature for the unrelated business income tax in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your unrelated business income tax.

How do I edit unrelated business income tax straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing unrelated business income tax.

How do I fill out unrelated business income tax using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign unrelated business income tax and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your unrelated business income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.