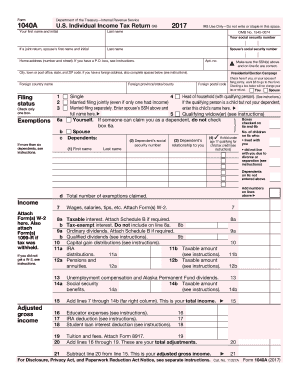

Get the free Form 1040 Instructions - Internal Revenue Service - irs

Show details

The Qualified Dividends and Capital Gain Tax Worksheet in the line 44 instructions reflects this new higher rate. If you do not have to file Schedule D use the Qualified Dividends and Capital Gain Tax Worksheet in the line 44 instructions to figure your tax. Use the Qualified not have to use the Schedule D Tax Worksheet and if any of the following You reported qualified dividends You do not have to file Schedule D and you reported capital gain distributions on Form 1040 line 13. However you...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form 1040 instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1040 instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 1040 instructions online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 1040 instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

How to fill out form 1040 instructions

How to fill out form 1040 instructions:

01

Gather all necessary documents. This includes your W-2 forms, 1099 forms, and any other income or deduction information.

02

Start with your personal information. Fill in your name, address, Social Security number, and filing status.

03

Report your income. Enter the amounts from your W-2 forms and any other income sources on the appropriate lines.

04

Deduct your expenses. If you qualify for any deductions, such as student loan interest or self-employment expenses, enter them on the appropriate lines.

05

Calculate your tax liability. Subtract your deductions from your income to determine your taxable income. Use the tax tables provided in the instructions to find your tax liability.

06

Report any credits. If you qualify for any tax credits, enter them on the appropriate lines.

07

Calculate your final tax due or refund. Subtract your tax credits from your tax liability to determine the amount you owe or the refund you will receive.

08

Complete the payment section. If you owe taxes, include payment information or set up a payment plan. If you are due a refund, indicate how you would like to receive it.

09

Double-check your form for accuracy. Make sure all amounts are entered correctly and all necessary schedules and forms are attached.

10

Sign and date your form. Remember to sign and date your form before mailing or electronically filing it.

Who needs form 1040 instructions:

01

Individuals who are required to file an income tax return with the Internal Revenue Service (IRS) use form 1040 instructions.

02

Form 1040 instructions are needed by taxpayers who have income that cannot be reported on simpler forms like 1040EZ or 1040A.

03

This form is necessary for individuals who have more complex tax situations or have significant deductions or credits that need to be reported on their tax returns.

Fill form : Try Risk Free

People Also Ask about form 1040 instructions

How do I fill out a 1040 for dummies?

What goes in line 16 on 1040?

What is one of the first steps in filling out your 1040?

How do I fill out an internal revenue service check?

How do I fill out a 1040 step by step?

How do I fill out a 1040 IRS form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 1040 instructions?

Form 1040 instructions provide guidance on how to fill out and complete Form 1040, which is the U.S. Individual Income Tax Return form.

Who is required to file form 1040 instructions?

Any individual who earned income in the United States and meets certain filing requirements outlined by the Internal Revenue Service (IRS) is required to file Form 1040 instructions.

How to fill out form 1040 instructions?

To fill out Form 1040 instructions, you need to gather information about your income, deductions, credits, and personal information. Then, follow the instructions provided by the IRS on where to report each item and calculate your tax liability.

What is the purpose of form 1040 instructions?

The purpose of Form 1040 instructions is to facilitate the reporting and calculation of an individual's federal income tax liability. It helps taxpayers accurately report their income, deductions, credits, and taxes owed or refunded.

What information must be reported on form 1040 instructions?

Form 1040 instructions require taxpayers to report various types of income, such as wages, self-employment income, interest, dividends, and capital gains. Additionally, deductions, credits, and personal information, including Social Security numbers and filing status, must be provided.

When is the deadline to file form 1040 instructions in 2023?

The deadline to file Form 1040 instructions in 2023 is typically April 15th, but it may vary slightly based on weekends and holidays. It is recommended to consult the IRS website or a tax professional for the exact deadline.

What is the penalty for the late filing of form 1040 instructions?

The penalty for the late filing of Form 1040 instructions is generally a percentage of the unpaid tax liability. The exact penalty amount can vary depending on the length of the delay and the taxpayer's filing history. It is advisable to consult the IRS guidelines for specific penalty calculations.

Where do I find form 1040 instructions?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific form 1040 instructions and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I make changes in form 1040 instructions?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 1040 instructions and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my form 1040 instructions in Gmail?

Create your eSignature using pdfFiller and then eSign your form 1040 instructions immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your form 1040 instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.