Get the free kentucky new hire reporting form

Show details

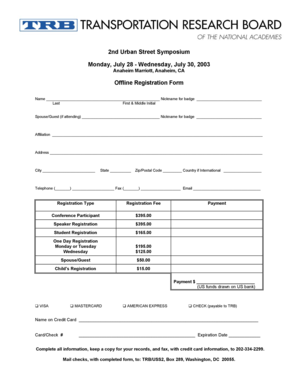

Kentucky New Hire Reporting Form Send Completed Form to P. O. Box 2586 Atlanta GA 30301-2586 Fax form to 1-800-817-0099 For more information 1-800-817-2262 or www. Kynewhire. com EMPLOYER INFORMATION Please Print or Type Federal Employer Identification Number Employer Name Street Address 1 This address is the payroll address for income withholding if it is different than employer s site address City/State/Zip Code Contact Phone/Name Email Address Social Security Number - - Employee Address...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your kentucky new hire reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky new hire reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kentucky new hire reporting form online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit kynewhire form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out kentucky new hire reporting

How to fill out Kentucky New Hire:

01

Obtain the Kentucky New Hire form from the Kentucky Office of Employment and Training or download it from their website.

02

Begin by providing your company's name, address, and federal employer identification number (FEIN).

03

Fill in the employee's personal information, including their full name, address, social security number, and date of birth.

04

Indicate whether the employee is a new hire, rehire, or a returned worker.

05

Specify the employee's start date and the anticipated first date of paid work.

06

Enter the employee's job title or a brief job description.

07

Supply the employee's rate of pay, pay frequency, and the effective date of the pay rate.

08

If applicable, include any additional compensation or benefits the employee will receive.

09

Provide the employee's direct supervisor's name and contact information.

10

Sign and date the form, acknowledging that you, as the employer, understand the requirements of reporting new hires to the state.

11

Submit the completed Kentucky New Hire form to the Kentucky Office of Employment and Training within 20 days of the employee's start date.

Who needs Kentucky New Hire:

01

Employers in Kentucky are required by law to fill out the Kentucky New Hire form for all newly hired employees.

02

This form is necessary for reporting new hires to the Kentucky Office of Employment and Training.

03

Both private and public employers must comply with this requirement, regardless of the size of their company.

Fill kentucky new hire form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kentucky new hire?

Kentucky New Hire is a program implemented by the state of Kentucky in accordance with federal law that requires employers to report new hires and rehires to the Kentucky Office of Employment and Training (OET). The program aims to assist in the enforcement of child support orders and help prevent fraudulent receipt of unemployment and workers' compensation benefits. Employers are required to report new employee information, including their name, address, social security number, and employment start date, to the OET within 20 days of the employee's hire or rehire date.

Who is required to file kentucky new hire?

In Kentucky, employers are required to file Kentucky New Hire reports.

How to fill out kentucky new hire?

To fill out the Kentucky New Hire form, you can follow these steps:

1. Obtain the form: You can download the Kentucky New Hire Reporting Form from the official website of the Kentucky Office of Employment and Training.

2. Provide the employer information: Begin by providing your employer information on the form. This includes the legal business name, employer's Federal Employer Identification Number (FEIN), address, city, state, zip code, and employer's telephone number.

3. Provide the employee information: Fill in the employee information section, including the employee's full name, social security number, address, city, state, and zip code.

4. Provide the employment details: Fill in the date the employee was hired, the first date of work, the employee's occupation, and the anticipated employment frequency (full-time, part-time, seasonal, or temporary).

5. Fill in the employer's contact person information: Provide the name and contact information of the employer's representative to whom inquiries about the reported employees should be directed. This includes the contact person's name, job title, phone number, fax number, and email address.

6. Signed certification: The employer or their authorized representative must sign and date the certification at the bottom of the form, indicating that the provided information is true and correct.

7. Submit the form: Once the form is filled out, you can submit it as instructed on the official website or to the appropriate Kentucky Office of Employment and Training location. Ensure that you keep a copy of the form for your records.

Remember to consult the official instructions and guidelines provided by the Kentucky Office of Employment and Training for any specific requirements or variations in the process.

What is the purpose of kentucky new hire?

Kentucky New Hire is a program implemented by the State of Kentucky to ensure that employers report newly hired employees to the Kentucky New Hire Reporting Center. The purpose of this program is to facilitate the collection of child support payments by locating non-custodial parents who have income from employment. By requiring employers to report new hires, the program helps the state's child support enforcement agency to identify parents who have the ability to pay child support and ensure that these payments are made. It also helps in locating parents who may be delinquent in their child support payments and take appropriate actions to enforce payment.

What information must be reported on kentucky new hire?

When reporting a new hire in Kentucky, the following information must be provided:

1. Employer Information: The name, address, and Federal Employer Identification Number (FEIN) of the employer.

2. Employee Information: The full name, address, and Social Security Number (SSN) of the newly hired employee.

3. Hire Date: The date of the employee's first day of work or the first day for which the employee is paid.

4. Rehire Situation: If the employee has been rehired within 20 days of separation, the rehire date must be reported along with the original hire date.

5. Employer Contact Information: A contact person's name, phone number, and email address should be provided for any additional questions or clarifications.

It is important to ensure the accuracy and timeliness of the information reported on the Kentucky new hire form to comply with state and federal regulations.

What is the penalty for the late filing of kentucky new hire?

The penalty for the late filing of the Kentucky New Hire report depends on the number of days the report is late. Here is the breakdown of penalties:

- 1 to 30 days late: $25 per day, up to a maximum of $500.

- 31 to 60 days late: $500 per month, up to a maximum of $1,000.

- More than 60 days late: $1,000 per month, up to a maximum of $1,000.

It's important to note that these penalties are subject to change, so it's always best to refer to the most up-to-date information from the Kentucky New Hire Reporting Center.

How can I send kentucky new hire reporting form to be eSigned by others?

Once your kynewhire form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit kentucky new hire in Chrome?

kentucky new hire reporting can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete ky new hire reporting form on an Android device?

On Android, use the pdfFiller mobile app to finish your ky new hire form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your kentucky new hire reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kentucky New Hire is not the form you're looking for?Search for another form here.

Keywords relevant to kentucky new hire forms

Related to ky new hire

If you believe that this page should be taken down, please follow our DMCA take down process

here

.