Get the free pa last will and testament form

Show details

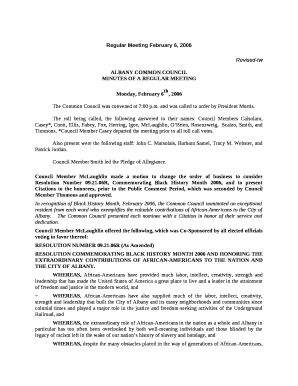

LAST WILL AND TESTAMENT OF 1 BE IT KNOWN THIS DAY THAT, I, 2, of 3 County, Pennsylvania, being of legal age and of sound and disposing mind and memory, and not acting under duress, menace, fraud,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

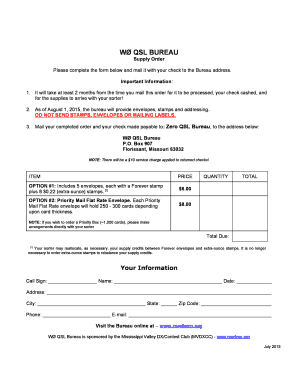

Edit your pa last will and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa last will and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

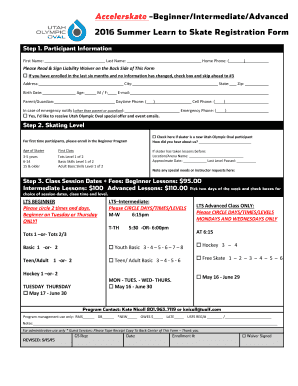

How to edit pa last will and testament online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit last will and testament pa form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out pa last will and

How to fill out PA last will and:

01

Gather all necessary information and documents, such as details of your assets, beneficiaries, and any specific instructions or wishes you have for the distribution of your property.

02

Determine if you want to draft the will yourself or seek professional help from an attorney to ensure it is legally binding and covers all necessary aspects.

03

Start by stating your full legal name, address, and other personal details. Clearly identify the will as your last will and testament.

04

Specify who your executor will be – this is the person responsible for managing your estate after your death.

05

List all your beneficiaries, including their full names and relationship to you. Clearly outline how you want your assets to be distributed among them.

06

Include any specific bequests or gifts you wish to make, such as sentimental items or donations to charity.

07

Consider appointing a guardian for any minor children or dependent adults in your care.

08

Sign and date the will in the presence of at least two witnesses who are not beneficiaries or related to you. Follow the specific legal requirements in Pennsylvania for witnessing and formalities.

09

Store your completed will in a safe place and consider informing your executor and loved ones of its location.

Who needs PA last will and:

01

Individuals who want to have control over how their assets and property are distributed after their death.

02

Parents who want to designate a guardian for their minor children or dependents.

03

Those who have specific wishes for the distribution of their assets or who want to ensure certain beneficiaries receive certain items or amounts.

04

Individuals who have a complicated family structure, such as blended families, and want to clearly outline their intentions for inheritance.

05

Anyone who wants to avoid potential conflicts or disputes among family members and loved ones after their passing.

06

Individuals who want to minimize potential estate taxes and ensure a smooth transfer of their assets.

Fill last will and testament pennsylvania pdf : Try Risk Free

People Also Ask about pa last will and testament

What are the requirements for a will to be valid in PA?

Do Wills in Pennsylvania need to be notarized?

Can you write a will without a lawyer in Pennsylvania?

What makes a valid will in Pennsylvania?

What is required for a will to be valid in PA?

What makes a will invalid in PA?

Can you write your own will in PA?

Can I write my own will in Pennsylvania?

Do wills have to be filed with the court in Pennsylvania?

How do you write a simple will in PA?

What are the requirements for a valid will in Pennsylvania?

What is required for a valid will in PA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file pa last will and?

In Pennsylvania (PA), any person who has personal property within the state is required to file a last will and testament. This includes individuals who are residents of Pennsylvania as well as non-residents who own property within the state. Filing a will helps ensure that the proper administration of the estate takes place after the individual's death.

What is the purpose of pa last will and?

The purpose of a last will and testament is to outline how a person's assets and possessions should be distributed after their death. It also allows individuals to specify a guardian for their minor children, appoint an executor to manage their estate, and even provide instructions for funeral arrangements. A last will and testament can help ensure that a person's final wishes are carried out and can help avoid potential conflicts or disputes among family members.

What information must be reported on pa last will and?

The information that must be reported on a last will and testament varies depending on the jurisdiction in which the will is being executed. However, some common information that is typically included in a last will and testament includes:

1. Testator's Identity: The full legal name and address of the testator (the person making the will) must be included.

2. Appointment of Executor: The will should name an executor, who will be responsible for carrying out the testator's wishes and managing the distribution of assets after their death.

3. Beneficiaries: The will should clearly identify the beneficiaries – individuals or organizations – who will inherit the testator's assets upon their death.

4. Specific Bequests: If the testator wishes to leave specific items or amounts of money to certain people or organizations, those details should be included.

5. Residual Estate: The will should specify how any remaining assets or property, known as the "residual estate," should be distributed after all specific bequests have been made.

6. Guardianship: If the testator has minor children, the will may appoint a guardian to care for them in the event of the testator's death.

7. Witnesses: Most jurisdictions require witnessing of a will. The names and addresses of two witnesses who are not beneficiaries should be included.

8. Date and Signature: The will must be dated and signed by the testator in the presence of the witnesses, as well as signed by the witnesses themselves.

It is important to note that laws relating to wills can vary significantly by jurisdiction, so it is advisable to consult with a legal professional or review specific local laws before creating or updating a last will and testament.

When is the deadline to file pa last will and in 2023?

The specific deadline to file a last will in 2023 may vary depending on various factors, including the jurisdiction and specific circumstances involved. In general, it is advisable to consult with a legal professional or estate planning expert who can provide accurate and up-to-date information based on the state laws of Pennsylvania. They will be able to guide you on the specific deadlines and requirements for filing a last will in 2023.

What is the penalty for the late filing of pa last will and?

It seems like some information is missing in your query. However, assuming you are referring to the late filing of a last will and testament, I can provide you with some general information.

There is typically no penalty for the late filing of a last will and testament since it is not required to be filed with any government agency during the testator's lifetime. The will is only presented for probate at the time of the testator's death. However, there may be specific legal requirements in your jurisdiction regarding the timely submission of the will for probate after the testator's passing.

If you are referring to the late filing of a tax return in Pennsylvania or any jurisdiction, penalties can vary depending on the specific circumstances. Late filing penalties may include monetary fines, interest charges on unpaid taxes, and potentially criminal charges in cases of intentional tax evasion. It is advised to consult with a tax professional or legal advisor, familiar with the specific laws and regulations in your jurisdiction, to receive accurate and up-to-date information regarding penalties for late tax filing.

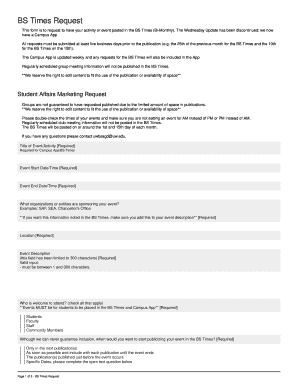

Can I sign the pa last will and testament electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your last will and testament pa form in minutes.

How do I fill out pennsylvania will template using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign last will and testament pennsylvania pdf and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out pa will template on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your last will and testament pa pdf form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your pa last will and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pennsylvania Will Template is not the form you're looking for?Search for another form here.

Keywords relevant to last will and testament pa form

Related to last will and testament pennsylvania pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.