Get the free NRN Form - Preservation Alliance of Greater Philadelphia

Show details

HTTP://www.philadelphiabuildings.org/pab/app/ar display.cfm/22293. Accessed on July 12, 2010. Caldwell, E. Dig by. Philadelphia Gentlemen: The Making of a ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your nrn form - preservation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nrn form - preservation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nrn form - preservation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nrn form - preservation. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

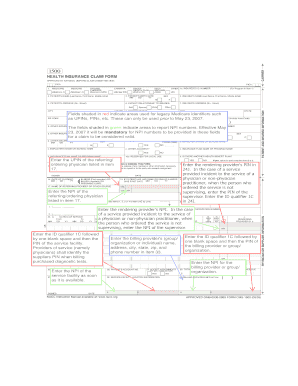

How to fill out nrn form - preservation

How to fill out nrn form - preservation:

01

Start by obtaining the nrn form - preservation from the relevant authority or organization.

02

Carefully read through the instructions and guidelines provided on the form.

03

Fill in all the required personal information accurately, including your full name, contact details, and any other information requested.

04

Provide the necessary details regarding the item or items that you wish to preserve, such as its description, location, and any identifying marks or numbers.

05

If applicable, provide any additional information that may be required, such as the value or importance of the item being preserved.

06

Double-check all the information you have entered to ensure its accuracy and legibility.

07

Sign and date the form as required.

08

Submit the completed form to the designated authority or organization, following any specific submission instructions provided.

Who needs nrn form - preservation?

01

Individuals who want to protect and preserve valuable or significant items.

02

Collectors of antiques, artworks, or other valuable assets.

03

Institutions or organizations that manage and preserve cultural, historical, or scientific collections.

04

Insurance companies or appraisers who require documentation of items for preservation purposes.

05

Government agencies or authorities responsible for the protection and preservation of important objects or artifacts.

06

Any individual or entity looking to safeguard and maintain the condition of a specific item or collection.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nrn form - preservation?

NRN form - preservation refers to the process of documenting and maintaining the records of non-resident taxpayers to preserve their tax information.

Who is required to file nrn form - preservation?

Non-resident taxpayers who have financial or economic activities in a particular jurisdiction are required to file NRN form - preservation.

How to fill out nrn form - preservation?

NRN form - preservation can be filled out by providing specific details about the non-resident taxpayer, their financial activities, and the relevant tax information.

What is the purpose of nrn form - preservation?

The purpose of NRN form - preservation is to ensure proper documentation and record-keeping for non-resident taxpayers, allowing tax authorities to verify and assess their tax obligations accurately.

What information must be reported on nrn form - preservation?

NRN form - preservation typically requires reporting of the non-resident taxpayer's personal information, financial activities, income sources, and tax liability details.

When is the deadline to file nrn form - preservation in 2023?

The deadline to file NRN form - preservation in 2023 is usually determined by the tax authorities of the specific jurisdiction and may vary. It is recommended to consult the local tax regulations or authorities for the exact deadline.

What is the penalty for the late filing of nrn form - preservation?

The penalty for the late filing of NRN form - preservation can also vary depending on the jurisdiction and local tax regulations. It is advisable to consult the respective tax authorities or seek professional tax advice to understand the specific penalties and consequences of late filing.

How do I execute nrn form - preservation online?

pdfFiller has made filling out and eSigning nrn form - preservation easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the nrn form - preservation in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your nrn form - preservation right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I fill out nrn form - preservation on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your nrn form - preservation. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your nrn form - preservation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.