To view more information on the MA Form, please visit the Federal Bureau of Investigation website at the following address: and you will find a link to the MA Form found on the website. NOTE: THIS FORM IS THE SITE FOR MAINTAINING AN ALERT DETAIL IN CASE OF AN ATTACK. You must include your name and address, complete your contact information, and sign and date the MA Form. If the Federal Bureau of Investigation confirms that there is an actual threat, your name and contact information will be forwarded to the appropriate law enforcement agency. NOTE: IF YOU DO NOT HAVE A PICTURE FILE, YOU MUST EMAIL AND RE-PHOTO THE FBI AT THIS ADDRESS:

WITH YOUR PHOTOS OF YOUR TERRORIST ORGANIZATION. You will be provided a new email address if you have an incorrect or inaccurate photo. After you have notified the FBI, you will be able to download and print out a Form MA. Please print the MA FORM and carry it with you as you travel. This is the only form that you are required to complete and bring with you. Once you complete the form, your contact information will be sent directly to you on the MA Form and will remain available throughout the duration of the alert. You can also download a printed copy of the MA Form and mail a copy to the following address: FBI-CALLBACK-HOSTING.EMAIL.LIVE FBI. Bureau.

Get the free ohio form 524

Show details

*************************** FOR INSTRUCTIONAL USE ONLY *************************** READ BEFORE COMPLETING YOUR MA FORM Forms not conforming to the specifications listed below or not submitted to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ohio form 524 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio form 524 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

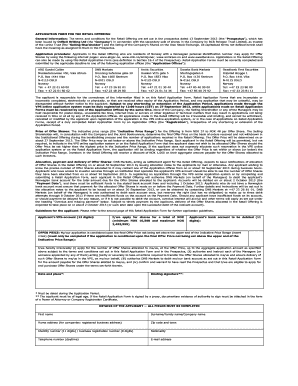

How to edit ohio form 524 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dma 524 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

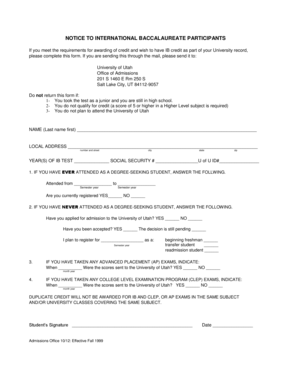

What is ohio form 524?

Ohio form 524 is a tax form used by businesses in Ohio to report their annual income and calculate their tax liability.

Who is required to file ohio form 524?

All businesses in Ohio, including corporations, partnerships, and sole proprietors, are required to file Ohio form 524 if they have taxable income or are subject to the commercial activity tax (CAT).

How to fill out ohio form 524?

To fill out Ohio form 524, businesses need to provide information about their income, deductions, and tax credits. They must also calculate their tax liability based on the applicable tax rate and submit the form by the deadline.

What is the purpose of ohio form 524?

The purpose of Ohio form 524 is to ensure businesses in Ohio accurately report their income and pay the correct amount of taxes owed to the state.

What information must be reported on ohio form 524?

Ohio form 524 requires businesses to report their total income, deductions, tax credits, and calculate their tax liability. They may also need to provide additional supporting documentation or schedules as required.

When is the deadline to file ohio form 524 in 2023?

The deadline to file Ohio form 524 in 2023 is April 17th.

What is the penalty for the late filing of ohio form 524?

The penalty for the late filing of Ohio form 524 is a percentage of the unpaid tax due, based on the number of days the filing is late. The penalty can range from 5% to 15% of the unpaid tax amount.

How do I execute ohio form 524 online?

pdfFiller makes it easy to finish and sign dma 524 form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the dma 524 form form on my smartphone?

Use the pdfFiller mobile app to complete and sign ohio form 524 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete dma 524 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your dma 524 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your ohio form 524 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dma 524 Form is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.