Get the free (1)Stamp duties charged by Articles 23, 33

Show details

() ()

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 1stamp duties charged by form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1stamp duties charged by form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 1stamp duties charged by online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 1stamp duties charged by. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out 1stamp duties charged by

How to Fill Out Stamp Duties Charged By:

01

Gather all necessary documents: Before filling out stamp duties, make sure you have all the required documents, such as the agreement or contract that requires stamping, any supporting documents, and identification proof.

02

Determine the stamp duty rate: Each jurisdiction has its own stamp duty rates, so it's important to identify the applicable rate for your specific situation. This can usually be found on the government website or by consulting with a legal professional.

03

Calculate the stamp duty amount: Once you've determined the applicable rate, calculate the stamp duty amount based on the value or consideration mentioned in the agreement. This could be a fixed fee or a percentage of the transaction value.

04

Prepare the stamp duty payment: To fill out the stamp duties, you'll need to prepare the payment in the form of cash, check, or any other acceptable method. Some jurisdictions may also allow online payments.

05

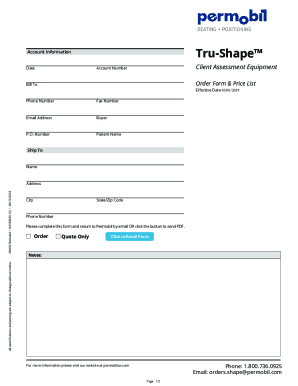

Fill out the stamp duty form: Obtain the appropriate stamp duty form from the relevant government authority or website. Ensure that the form is filled out accurately and completely, providing all the required information such as personal details, transaction details, and any supporting documentation.

06

Submit the stamp duty form and payment: Once the form is filled out correctly, submit the form along with the stamp duty payment to the designated government office or authority. Ensure that all documentation is properly attached and follow any additional instructions provided.

Who needs Stamp Duties charged by?

01

Individuals purchasing or selling property: Stamp duties are commonly charged on real estate transactions, including the purchase or sale of residential or commercial property.

02

Businesses entering into contracts: Companies engaging in various business transactions, such as leases, loan agreements, or partnership agreements, may be required to pay stamp duties on these contracts.

03

Financial institutions and lenders: Financial institutions and lenders involved in mortgage or loan transactions often need to pay stamp duties on the relevant agreements.

04

Shareholders and companies issuing shares: Stamp duties may also be applicable when issuing or transferring shares in a company, affecting both the shareholders and the company itself.

05

Governments and public institutions: Some government entities and public institutions may also need to pay stamp duties in certain circumstances, such as when entering into contracts or engaging in property transactions.

Overall, the need for stamp duties charged by varies depending on the jurisdiction and the specific transactions or agreements involved. It is important to consult with legal professionals or relevant government authorities to understand the specific requirements applicable to your situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1stamp duties charged by?

1stamp duties are charged by the government on certain transactions like property sales or legal documents.

Who is required to file 1stamp duties charged by?

The parties involved in the transaction are usually required to file 1stamp duties.

How to fill out 1stamp duties charged by?

To fill out 1stamp duties, you typically need to provide details about the transaction and pay the required fee.

What is the purpose of 1stamp duties charged by?

The purpose of 1stamp duties is to generate revenue for the government and to deter tax evasion.

What information must be reported on 1stamp duties charged by?

Information such as the parties involved, the nature of the transaction, and the amount paid must be reported on 1stamp duties.

When is the deadline to file 1stamp duties charged by in 2023?

The deadline to file 1stamp duties in 2023 is typically determined by the date of the transaction.

What is the penalty for the late filing of 1stamp duties charged by?

The penalty for late filing of 1stamp duties can vary but may include additional fees or fines.

How can I modify 1stamp duties charged by without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your 1stamp duties charged by into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit 1stamp duties charged by straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing 1stamp duties charged by, you can start right away.

Can I edit 1stamp duties charged by on an iOS device?

Create, edit, and share 1stamp duties charged by from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your 1stamp duties charged by online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.