Get the free united prairie llc form

Show details

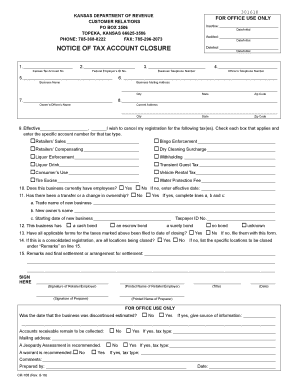

Cooperator Josh Ponder Address R E Q U I R E D I N F O United Prairie Dealer United Prairie Rep City, State, Zip Eric Beckett Hammond, IL Phone Selling Price: County Pitt Drying Charge: Plot Type

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your united prairie llc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united prairie llc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit united prairie llc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit united prairie llc. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out united prairie llc form

How to fill out united prairie llc:

01

Research the requirements: Before starting the process of filling out the united prairie llc, it is important to thoroughly research the specific requirements and regulations of your state. Each state may have different rules regarding the formation and filing of an llc.

02

Choose a name: Select a unique and available name for your united prairie llc. Make sure to check if the name you want is already in use or reserved by another business entity in your state.

03

File articles of organization: Prepare and file the necessary documents, usually called the articles of organization, with the appropriate state agency responsible for llc filings. These documents typically include information such as the llc's name, address, purpose, and the names of the initial members or managers.

04

Appoint a registered agent: Most states require llcs to have a registered agent who will receive important legal documents and correspondence on behalf of the company. Select a registered agent and provide their name and address in the llc formation documents.

05

Create an operating agreement: Although not always required by all states, it is highly recommended to draft an operating agreement. This document outlines the internal workings and management structure of the llc, including the rights and responsibilities of the members or managers.

06

Obtain necessary permits and licenses: Depending on the nature of your business, you may need to obtain certain permits and licenses at the local, state, or federal level. Research the requirements and ensure you have all the necessary authorizations before commencing operations.

07

Obtain an employer identification number (EIN): In most cases, llcs with employees or multiple members will need to obtain an EIN from the Internal Revenue Service (IRS). This unique identification number is used for tax purposes and is typically required when opening a bank account or filing tax returns.

Who needs united prairie llc?

01

Entrepreneurs and small business owners: Many individuals choose to form an llc to establish a legally separate entity for their business ventures. The llc structure provides liability protection for the owners and can offer various tax advantages.

02

Real estate investors: For those involved in real estate investments, forming an llc can be beneficial for protecting personal assets from potential lawsuits or liabilities associated with property ownership.

03

Professional service providers: Many licensed professionals such as doctors, lawyers, architects, or accountants may choose to form an llc to protect themselves and their personal assets from professional malpractice claims.

04

Partnerships and joint ventures: When two or more individuals or entities collaborate on a business endeavor, forming an llc can provide a flexible and secure structure for their operations.

05

Family businesses: Families who wish to pass down their business to future generations or protect their personal assets may opt to organize their business as an llc.

It is important to consult with a business attorney or other professionals familiar with the legal and financial implications of forming an llc to ensure compliance with all the required procedures and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is united prairie llc?

United Prairie LLC is a limited liability company that offers agricultural services and products.

Who is required to file united prairie llc?

Anyone who is a member or owner of United Prairie LLC is required to file the necessary paperwork for the company.

How to fill out united prairie llc?

To fill out United Prairie LLC paperwork, one must provide information such as the company's name, address, members, and purpose.

What is the purpose of united prairie llc?

The purpose of United Prairie LLC is to provide agricultural services and products to customers.

What information must be reported on united prairie llc?

Information such as financial statements, member names, and addresses must be reported on United Prairie LLC paperwork.

When is the deadline to file united prairie llc in 2023?

The deadline to file United Prairie LLC in 2023 is typically by the end of the fiscal year, which is December 31st.

What is the penalty for the late filing of united prairie llc?

The penalty for the late filing of United Prairie LLC paperwork may include fines or other consequences depending on the state regulations.

How do I edit united prairie llc in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing united prairie llc and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an eSignature for the united prairie llc in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your united prairie llc directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit united prairie llc on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share united prairie llc from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your united prairie llc form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.