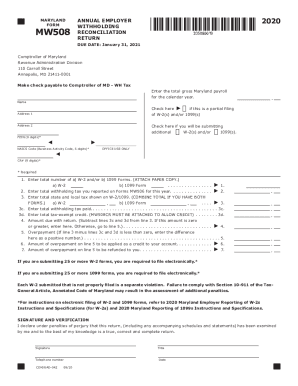

Get the free mw508 form

Show details

STATE OF DELAWARE Division of Revenue Business Audit Bureau 820 N. French Street Wilmington, Delaware 19801 2011 APPLICATION FOR EXEMPTION FROM PUBLIC UTILITY TAX UPON CELL PHONES Reset Print Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

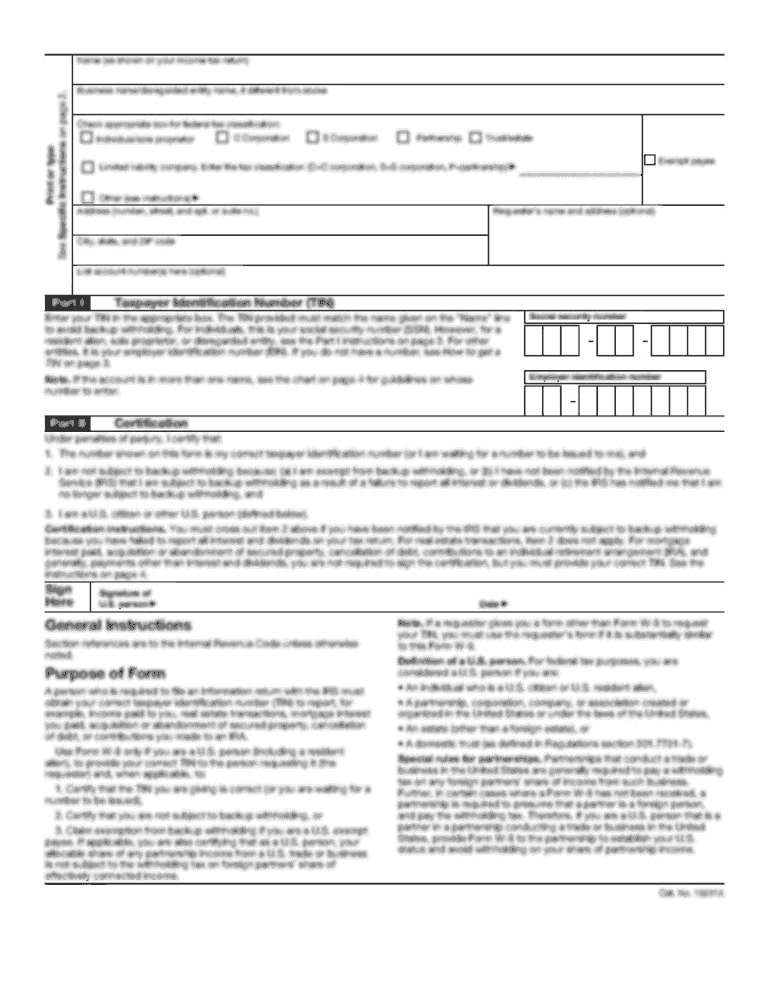

Edit your mw508 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mw508 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mw508 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2020 form mw508. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

How to fill out mw508 form

How to fill out mw508:

01

Obtain the mw508 form from the appropriate source, such as the Department of Revenue or online.

02

Begin by providing your personal information, such as your name, address, and social security number.

03

Fill in your employer's information, including their name, address, and federal identification number.

04

Report your wages and other compensation received during the tax year. Include any tips, bonuses, and commissions.

05

Declare any deductions and exemptions you are entitled to claim. Make sure to follow the instructions on the form regarding specific deductions.

06

Calculate your total tax liability or refundable credits and enter the amount in the appropriate section.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs mw508:

01

Individuals who are employed in Massachusetts and have state income tax withheld from their wages.

02

Employers who are required to report their employees' income and tax withholding to the Massachusetts Department of Revenue.

03

Self-employed individuals who need to report their business income and pay estimated taxes to the state.

Fill mw 508 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mw508?

MW508 is a form used to report income tax withheld by an employer from an employee's wages in the District of Columbia.

Who is required to file mw508?

Employers who have withheld income tax from employee wages in the District of Columbia are required to file mw508.

How to fill out mw508?

To fill out mw508, employers must provide their business information, employee details, and report the amount of income tax withheld from their employees.

What is the purpose of mw508?

The purpose of mw508 is to report and reconcile the income tax withheld by employers in the District of Columbia.

What information must be reported on mw508?

Employers must report their business details, employee information, and the amount of income tax withheld from each employee on mw508.

When is the deadline to file mw508 in 2023?

The deadline to file mw508 in 2023 is April 30, 2024.

What is the penalty for the late filing of mw508?

The penalty for the late filing of mw508 is 5% of the tax due for each month or fraction of a month the return is late, up to a maximum of 25%.

How can I manage my mw508 directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 2020 form mw508 and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out the maryland mw508 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign maryland mw508 form 2020 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit mw508 form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share maryland form mw508 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your mw508 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maryland mw508 is not the form you're looking for?Search for another form here.

Keywords relevant to form mw508

Related to md form mw508

If you believe that this page should be taken down, please follow our DMCA take down process

here

.