Get the free uniform residential appraisal report

Show details

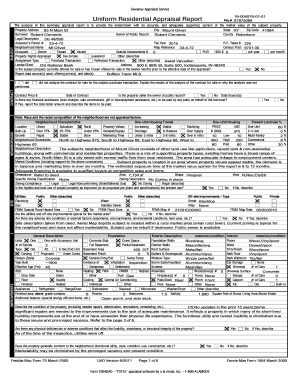

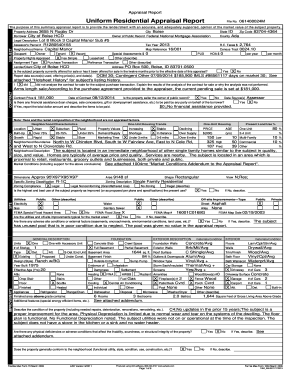

File No. SAMPLE-101a Page 4 a la mode inc. SUBJECT Uniform Residential Appraisal Report File SAMPLE-101a The purpose of this summary appraisal report is to provide the lender/client with an accurate and adequately supported opinion of the market value of the subject property. Property Address 3705 W Memorial Rd City Oklahoma City State OK Zip Code 73134-1512 Borrower Smith Bob Emma Owner of Public Record Jones Frank Sally County OKLAHOMA Legal Description Lot 15 Block 2 - ORANGE GROVE ESTATES...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your uniform residential appraisal report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uniform residential appraisal report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uniform residential appraisal report online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit uniform residential appraisal report. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out uniform residential appraisal report

How to fill out uniform residential appraisal report:

01

Start by gathering all the necessary information about the property being appraised, such as its address, square footage, and any special features.

02

Identify the purpose of the appraisal report, whether it is for a mortgage, refinancing, or legal purposes.

03

Conduct a thorough inspection of the property, taking note of its condition, interior and exterior features, and any repairs or renovations needed.

04

Research recent comparable sales in the area to determine the property's market value.

05

Analyze the local market conditions and trends to understand how they may impact the property's value.

06

Use appropriate appraisal methods and techniques to estimate the property's value, considering factors such as the income approach, cost approach, and sales comparison approach.

07

Document your findings and calculations in the uniform residential appraisal report form, ensuring accurate and detailed information.

08

Include relevant photographs, diagrams, and sketches to support your findings.

09

Review and double-check all the information in the report to ensure its accuracy and completeness.

10

Sign and date the report, and submit it to the appropriate party, such as the lender or client.

Who needs uniform residential appraisal report:

01

Lenders: Banks, mortgage companies, and other financial institutions require a uniform residential appraisal report to determine the property's value for loan and mortgage purposes.

02

Real Estate Agents: Agents may request an appraisal report to assist in pricing a property or negotiating a sale.

03

Homeowners: Homeowners may need an appraisal report to determine their property's value for refinancing, insurance purposes, or legal scenarios such as divorce or estate settlement.

04

Attorneys: Attorneys involved in real estate transactions, property disputes, or legal battles may require a uniform residential appraisal report to support their case.

05

Investors: Real estate investors need appraisal reports to assess the potential profitability of a property before making purchase decisions.

Fill form : Try Risk Free

People Also Ask about uniform residential appraisal report

What is the difference between an appraisal and an appraisal report?

What does appraisal mean in a report?

What is 70D appraisal?

What is appraisal report?

What is the simplest form of appraisal report?

What are the 2 types of appraisals?

What makes a good appraisal report?

What is 1004 form?

What form of appraisal report is the most detailed?

What is a 1004d?

What is appraisal and example?

What are the 3 types of appraisal reports?

Which approach is most commonly used in appraisal?

What are the 3 types of appraisals?

What are examples of appraisal?

Which form is used most frequently for residential appraisals?

Does Uspap require an appraiser to produce an appraisal report that is free of typographical and grammatical errors?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uniform residential appraisal report?

The Uniform Residential Appraisal Report (URAR) is a standardized appraisal report form that is commonly used in the United States for residential property appraisals. It was created by the Appraisal Institute and the Government Sponsored Enterprises (GSEs) including Fannie Mae and Freddie Mac, to establish a consistent and comprehensive method of evaluating residential properties.

The URAR form provides a detailed analysis of the subject property, including its physical characteristics, condition, and market value. It also includes information on comparable sales in the area, as well as an explanation of the appraiser's methodology and rationale for arriving at the appraised value.

The URAR is widely used by appraisers, lenders, and other real estate professionals to assess the value of residential properties for loan origination, refinancing, or other purposes. It helps ensure that appraisals are conducted in a consistent and reliable manner, and provides transparency in the appraisal process.

Who is required to file uniform residential appraisal report?

Lenders who engage in mortgage transactions requiring an appraisal are typically required to file a Uniform Residential Appraisal Report (URAR). This report helps lenders determine the market value of a property before approving a loan. Additionally, government agencies such as the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) may also require URARs for certain mortgage programs they offer.

How to fill out uniform residential appraisal report?

Filling out a Uniform Residential Appraisal Report (URAR) requires attention to detail and accurate information. Here are the steps to follow when filling out the URAR:

1. Gather necessary information: Collect all relevant information about the property, including its address, legal description, and details about the subject property's interior and exterior features. Additionally, gather information about recent sales of comparable properties in the area.

2. Complete the identification page: Start by filling out the identification page, which includes information about the appraiser, client, intended use of the appraisal report, and property identification. Provide accurate and complete information in all the required fields.

3. Describe the subject property: Provide a detailed description of the subject property, including its size, number and types of rooms, and any special features.

4. Include photographs: Take clear and well-lit photographs of the subject property's exterior and interior. Include enough photos to provide an accurate representation of the property's condition and characteristics.

5. Provide details about the neighborhood: Describe the neighborhood in which the subject property is located. Include information about the quality of schools, proximity to amenities, and any recent development or changes that may impact property values.

6. Analyze the market: Research and analyze recent sales of comparable properties in the area. Include a summary of this analysis, including the sale prices, dates, and relevant characteristics of the comparables.

7. Determine the appropriate valuation: Use the sales data and market analysis to determine an appropriate valuation for the subject property. Consider factors such as location, condition, size, and recent sales in the area.

8. Complete the certification and signature section: Review the completed report and ensure that all required information is accurately provided. Sign and date the report and include any necessary certifications.

It's important to note that the process of filling out a URAR may vary depending on the specific guidelines and requirements set by the appraisal industry and regulatory bodies in your jurisdiction. Always refer to the relevant guidelines and regulations when completing a URAR.

What is the purpose of uniform residential appraisal report?

The purpose of the Uniform Residential Appraisal Report (URAR) is to provide a standardized format for appraisers to report their findings and conclusions when valuing residential properties. It is commonly used in mortgage lending, as lenders require an appraisal to determine the value of a property before approving a loan.

The URAR includes essential information about the property being appraised, such as its location, size, condition, and characteristics. The appraiser also assesses comparable sales in the area to determine the property's market value. The report provides an objective and unbiased evaluation of the property's worth, allowing lenders to make informed decisions about financing.

Additionally, the URAR aims to ensure consistency in the appraisal process by adhering to guidelines established by the Appraisal Standards Board of the Appraisal Foundation. By providing a standard format, it helps to facilitate communication and understanding between appraisers, lenders, and other parties involved in the real estate transaction.

What information must be reported on uniform residential appraisal report?

The Uniform Residential Appraisal Report (URAR) is a standardized appraisal form used by appraisers to report their findings on residential properties. It includes a comprehensive analysis of the property being appraised and its market value. The information that must be reported on the URAR includes:

1. Subject property details: This includes the property's address, legal description, and any relevant information about the property, such as zoning designation and whether it is in a flood zone.

2. Neighborhood characteristics: A description of the neighborhood where the subject property is located, including its physical and economic characteristics, as well as any significant developments or changes that may impact property value.

3. Comparable sales: The appraiser must include details about comparable properties (comps) that have recently sold in the area. This includes the property address, sale price, date of sale, and any differences or similarities between the comps and the subject property.

4. Subject property features: The appraiser provides details about the subject property's size, layout, design, construction materials, and condition. Any improvements or additions made to the property, as well as any defects or issues, should also be noted.

5. Market conditions: The appraiser must analyze the current market conditions and trends in the area. This includes factors such as supply and demand, median sales prices, and the time properties are spending on the market.

6. Appraisal methodology: The appraiser must describe the methodology used to determine the property's value. This typically involves analyzing comparable sales, making adjustments for any differences, and applying appropriate valuation methods, such as the sales comparison approach or the income approach.

7. Value conclusion: The appraiser provides their professional opinion of the property's market value, which is typically expressed as a specific dollar amount. This conclusion is based on their analysis of the subject property and the comparable sales.

8. Certification and signature: The URAR must be signed by the appraiser, certifying that their findings and conclusions are true and accurate to the best of their knowledge.

It's important to note that the specific requirements and information needed on the URAR may vary depending on the purpose of the appraisal (e.g., for a mortgage loan, tax assessment, or legal purposes) and the guidelines set forth by the appraisal organization or regulatory body.

What is the penalty for the late filing of uniform residential appraisal report?

The penalty for the late filing of the Uniform Residential Appraisal Report may vary depending on the specific rules and regulations of the governing body or organization that requires the report. In some cases, there may be a monetary fine imposed for the late filing, while in other cases, there may be other consequences such as suspension or revocation of the appraiser's license. It is advisable to check with the relevant regulatory authority or professional organization to determine the specific penalty for late filing.

How do I execute uniform residential appraisal report online?

Filling out and eSigning uniform residential appraisal report is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in uniform residential appraisal report?

With pdfFiller, the editing process is straightforward. Open your uniform residential appraisal report in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit uniform residential appraisal report on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing uniform residential appraisal report.

Fill out your uniform residential appraisal report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.